Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instruction: Write TRUE if the statement is correct or FALSE if the statement is not correct. true 1 A sale is a transfer of merchandise

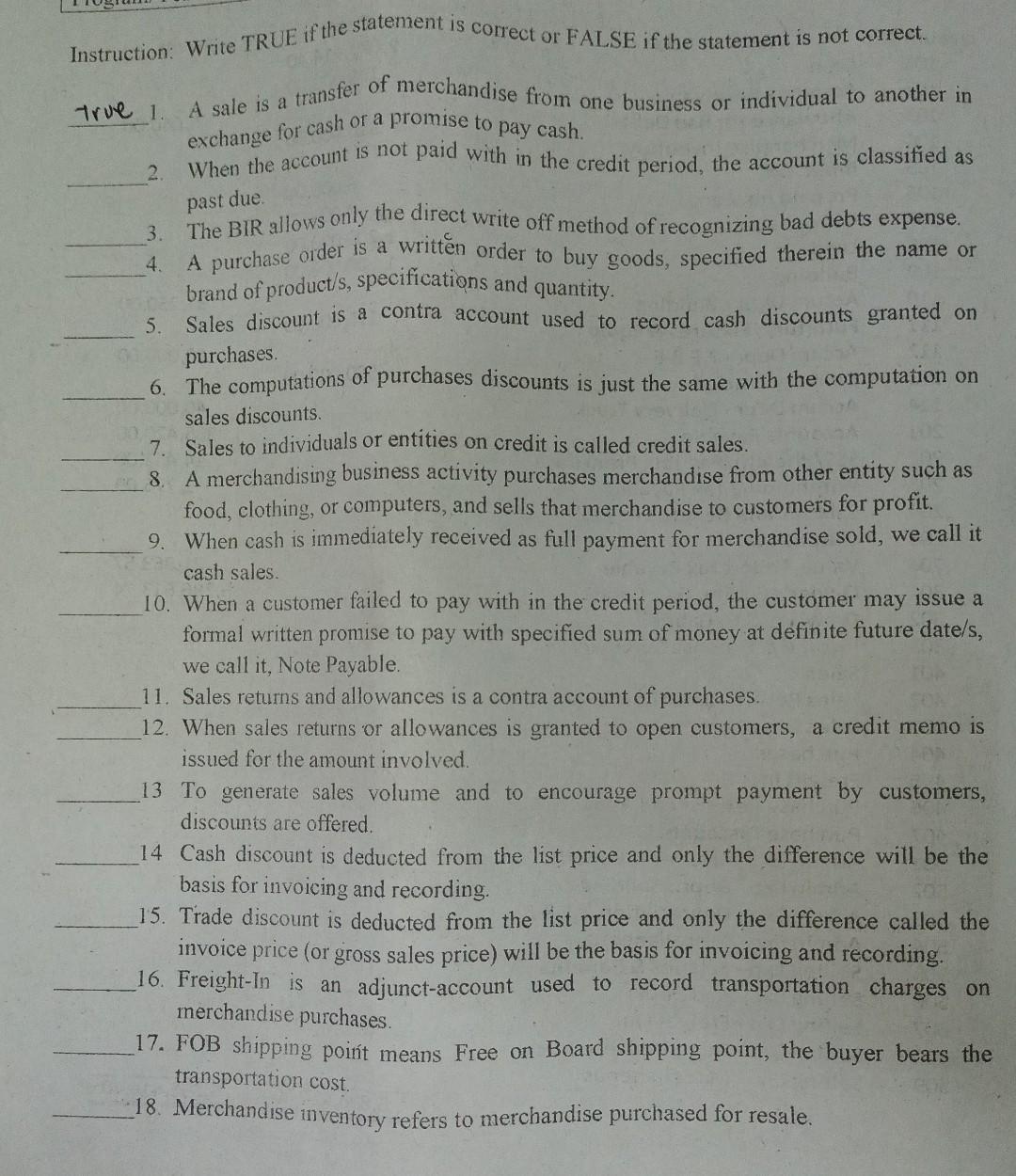

Instruction: Write TRUE if the statement is correct or FALSE if the statement is not correct. true 1 A sale is a transfer of merchandise from one business or individual to another in exchange for cash or a promise to pay cash. 2 When the account is not paid with in the credit period, the account is classified as past due The BIR allows only the direct write off method of recognizing bad debts expense. A purchase order is a writtn order to buy goods, specified therein the name or brand of product/s, specifications and quantity. Sales discount is a contra account used to record cash discounts granted on LLLLLL purchases. 6. The computations of purchases discounts is just the same with the computation on sales discounts. 7. Sales to individuals or entities on credit is called credit sales. 8 A merchandising business activity purchases merchandise from other entity such as food, clothing, or computers, and sells that merchandise to customers for profit. 9. When cash is immediately received as full payment for merchandise sold, we call it cash sales. 10. When a customer failed to pay with in the credit period, the customer may issue a formal written promise to pay with specified sum of money at definite future date/s, we call it, Note Payable. 11. Sales returns and allowances is a contra account of purchases. 12. When sales returns or allowances is granted to open customers, a credit memo is issued for the amount involved. 13 To generate sales volume and to encourage prompt payment by customers, discounts are offered. 14 Cash discount is deducted from the list price and only the difference will be the basis for invoicing and recording. 15. Trade discount is deducted from the list price and only the difference called the invoice price (or gross sales price) will be the basis for invoicing and recording. 16. Freight-In is an adjunct-account used to record transportation charges on merchandise purchases. 17. FOB shipping point means Free on Board shipping point, the buyer bears the transportation cost. 18. Merchandise inventory refers to merchandise purchased for resale

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started