Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions 1. Compute the following for each project The net present value. Use a rate of 10 and the present value of an annuity table

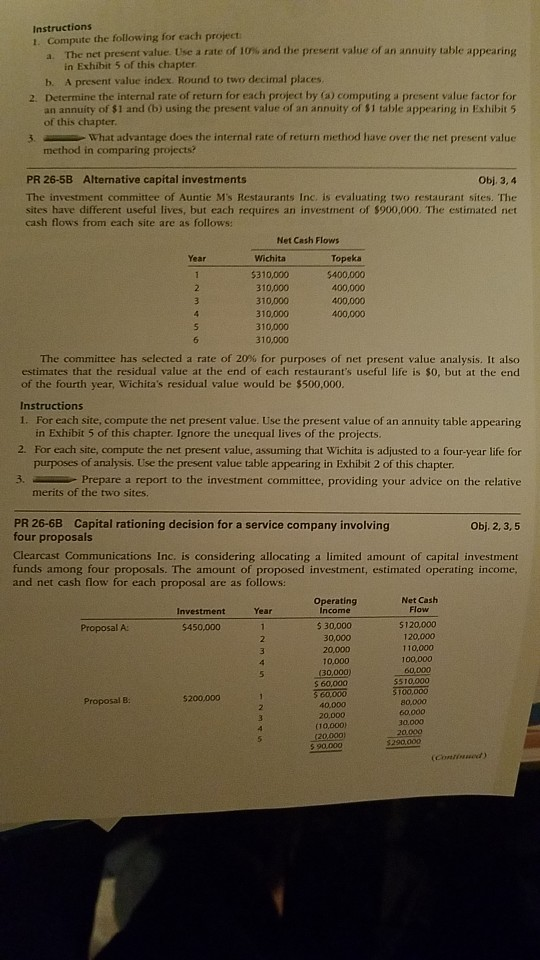

Instructions 1. Compute the following for each project The net present value. Use a rate of 10 and the present value of an annuity table appearing in Exhibit 5 of this chapter b. A present value index. Round to two decimal places 2. Determine the Internal rate of return for each project by (a) computing a present value factor for an annuity of $1 and (b) using the present value of an annuity of stable appearing in Exhibit 5 of this chapter What advantage does the internal rate of return method have over the net present value method in comparing projects? PR 26-5B Alternative capital investments Obj. 3,4 The investment committee of Auntie M's Restaurants Inc. is evaluating two restaurant sites. The sites have different useful lives, but each requires an investment of $900,000. The estimated net cash flows from each site are as follows: Net Cash Flows Year Wichita Topeka $310,000 $400,000 310,000 400,000 310,000 400,000 310,000 400,000 310,000 310,000 The committee has selected a rate of 20% for purposes of net present value analysis. It also estimates that the residual value at the end of each restaurant's useful life is $0, but at the end of the fourth year, Wichita's residual value would be $500,000. Instructions 1. For each site, compute the net present value. Use the present value of an annuity table appearing in Exhibit 5 of this chapter. Ignore the unequal lives of the projects. 2. For each site, compute the net present value, assuming that Wichita is adjusted to a four-year life for purposes of analysis. Use the present value table appearing in Exhibit 2 of this chapter. Prepare a report to the investment committee, providing your advice on the relative merits of the two sites, PR 26-6B Capital rationing decision for a service company involving four proposals Obj. 2,3,5 Clearcast Communications Inc. is considering allocating a limited amount of capital investment funds among four proposals. The amount of proposed investment, estimated operating income, and net cash flow for each proposal are as follows: Operating Net Cash Investment Year Income Flow Proposal A: $450,000 $ 30,000 5120,000 30,000 120,000 20.000 110,000 10,000 100,000 (30,000) 60.000 $ 60,000 5510.000 560,000 $200.000 $100,000 Proposal B: 40.000 80.000 20.000 60.000 (10,000) 30.000 (20.000 20.000 590.000 $ 290,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started