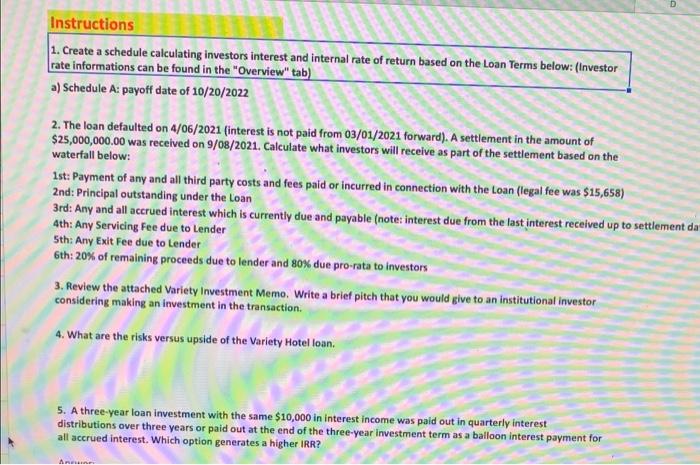

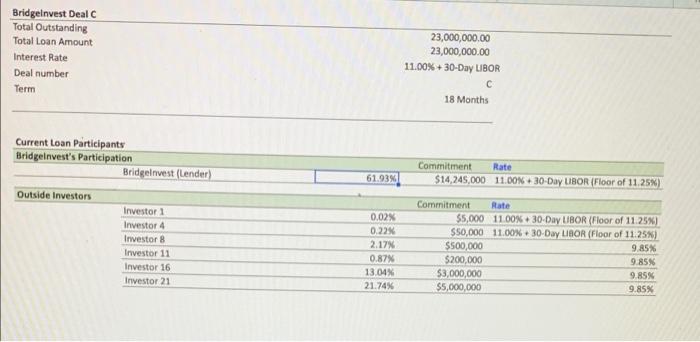

Instructions 1. Create a schedule calculating investors interest and internal rate of return based on the Loan Terms below: (Investor rate informations can be found in the "Overview" tab) a) Schedule A: payoff date of 10/20/2022 2. The loan defaulted on 4/06/2021 (interest is not paid from 03/01/2021 forward). A settlement in the amount of $25,000,000.00 was received on 9/08/2021. Calculate what investors will receive as part of the settlement based on the waterfall below: 1st: Payment of any and all third party costs and fees paid or incurred in connection with the Loan (legal fee was $15,658) 2nd: Principal outstanding under the Loan 3rd: Any and all accrued interest which is currently due and payable (note: interest due from the last interest received up to settlement da 4th: Any Servicing Fee due to Lender Sth: Any Exit Fee due to Lender 6th: 20% of remaining proceeds due to lender and 80% due pro-rata to investors 3. Review the attached Variety Investment Memo. Write a brief pitch that you would give to an institutional investor considering making an investment in the transaction. 4. What are the risks versus upside of the Variety Hotel loan. 5. A three-year loan investment with the same $10,000 in interest income was paid out in quarterly interest distributions over three years or paid out at the end of the three-year investment term as a balloon interest payment for all accrued interest. Which option generates a higher IRR? AR Bridgeinvest Deal Total Outstanding Total Loan Amount Interest Rate Deal number Term 23,000,000.00 23,000,000.00 11.00% + 30-Day LIBOR 18 Months 61.93% Commitment Rate $14,245,000 11.00% + 30-Day LIBOR (Floor of 11.25%) Current Loan Participants Bridgelnvest's Participation Bridgelnvest (Lender) Outside Investors Investor 1 Investor 4 Investor Investor 11 Investor 16 Investor 21 0.02% 0.22% 2.17% 0.87% 13 04 21.74% Commitment Rate $5,000 11.00% + 30-Day LIBOR (Floor of 11.25%) $50,000 11.00% 30-Day LIBOR (Floor of 11.25) $500,000 9.85% $200,000 9.85% $3,000,000 9.85% $5,000,000 9.85% Instructions 1. Create a schedule calculating investors interest and internal rate of return based on the Loan Terms below: (Investor rate informations can be found in the "Overview" tab) a) Schedule A: payoff date of 10/20/2022 2. The loan defaulted on 4/06/2021 (interest is not paid from 03/01/2021 forward). A settlement in the amount of $25,000,000.00 was received on 9/08/2021. Calculate what investors will receive as part of the settlement based on the waterfall below: 1st: Payment of any and all third party costs and fees paid or incurred in connection with the Loan (legal fee was $15,658) 2nd: Principal outstanding under the Loan 3rd: Any and all accrued interest which is currently due and payable (note: interest due from the last interest received up to settlement da 4th: Any Servicing Fee due to Lender Sth: Any Exit Fee due to Lender 6th: 20% of remaining proceeds due to lender and 80% due pro-rata to investors 3. Review the attached Variety Investment Memo. Write a brief pitch that you would give to an institutional investor considering making an investment in the transaction. 4. What are the risks versus upside of the Variety Hotel loan. 5. A three-year loan investment with the same $10,000 in interest income was paid out in quarterly interest distributions over three years or paid out at the end of the three-year investment term as a balloon interest payment for all accrued interest. Which option generates a higher IRR? AR Bridgeinvest Deal Total Outstanding Total Loan Amount Interest Rate Deal number Term 23,000,000.00 23,000,000.00 11.00% + 30-Day LIBOR 18 Months 61.93% Commitment Rate $14,245,000 11.00% + 30-Day LIBOR (Floor of 11.25%) Current Loan Participants Bridgelnvest's Participation Bridgelnvest (Lender) Outside Investors Investor 1 Investor 4 Investor Investor 11 Investor 16 Investor 21 0.02% 0.22% 2.17% 0.87% 13 04 21.74% Commitment Rate $5,000 11.00% + 30-Day LIBOR (Floor of 11.25%) $50,000 11.00% 30-Day LIBOR (Floor of 11.25) $500,000 9.85% $200,000 9.85% $3,000,000 9.85% $5,000,000 9.85%