Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: 1. Prepare and title the T accounts show in the chart of accounts. Record a plus (+) or a minus () on the debit

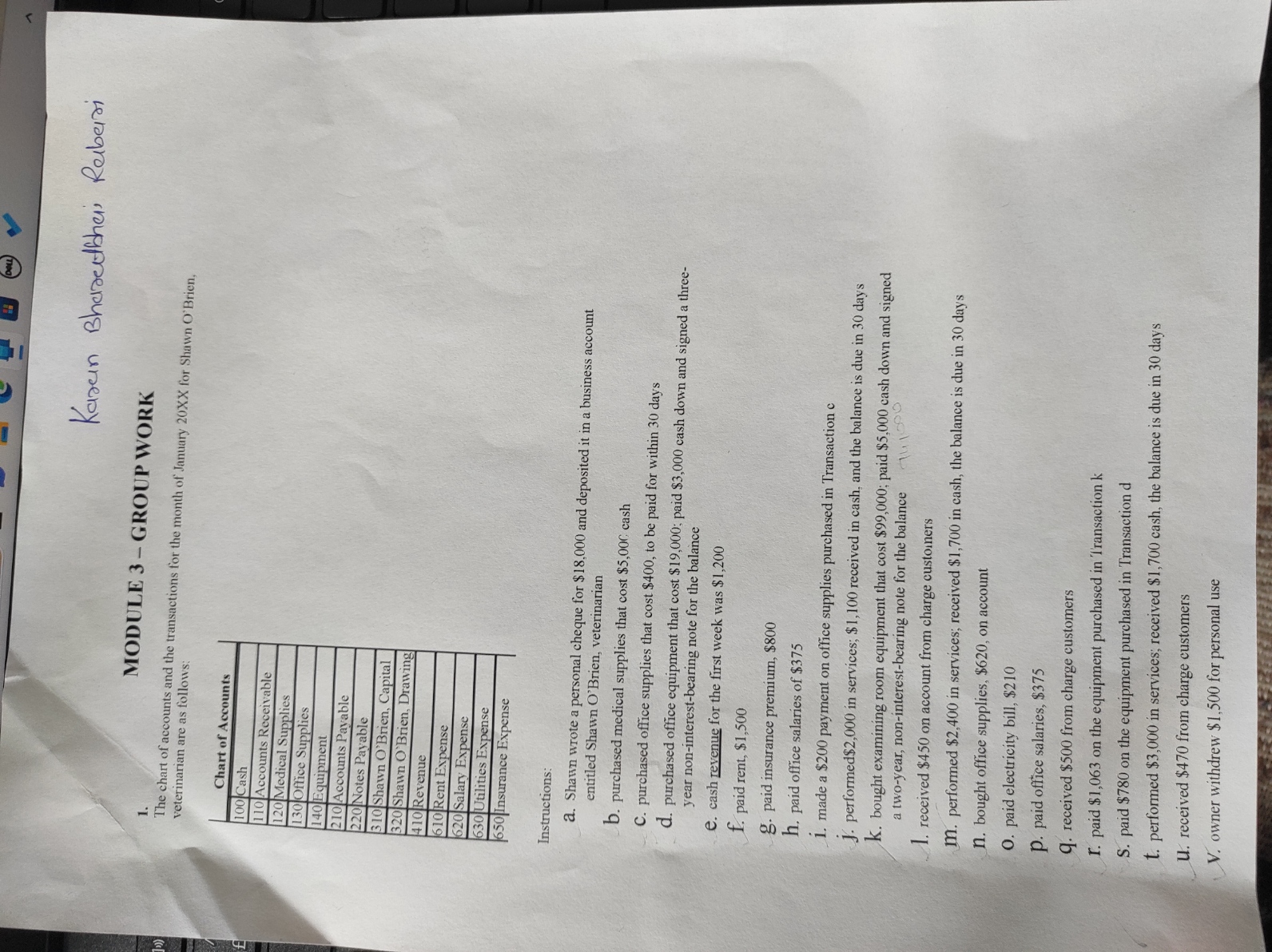

Instructions: 1. Prepare and title the T accounts show in the chart of accounts. Record a plus (+) or a minus () on the debit and credit side of each T account to indic te where the increases and decreases will be recorded. 2. Record the transactions in the T accounts, identifying each by letter. 3. Determine the balance for each account. 4. Pre,are a trial balance as of January 31,20XX. MODULE 3-GROUP WORK The chart of accounts and the transactions for the month of January 20XX for Shawn O'Brien, veterinarian are as follows: Instructions: a. Shawn wrote a personal cheque for $18,000 and deposited it in a business account entitled Shawn O'Brien, veterinarian b. purchased medical supplies that cost $5,00r cash C. purchased office supplies that cost $400, to be paid for within 30 days d. purchased office equipment that cost $19,000; paid $3,000 cash down and signed a threeyear non-interest-bearing note for the balance e. cash revenue for the first week was $1,200 f. paid rent, $1,500 g. paid insurance premium, $800 h. paid office salaries of $375 1. made a $200 payment on office supplies purchased in Transaction c j. performed $2,000 in services; $1,100 received in cash, and the balance is due in 30 days K. bought examining room equipment that cost $99,000; paid $5,000 cash down and signed a two-year, non-interest-bearing note for the balance 1. received $450 on account from charge customers m. performed $2,400 in services; received $1,700 in cash, the balance is due in 30 days n. bought office supplies, $620, on account O. paid electricity bill, $210 p. paid office salaries, $375 q. received $500 from charge customers r. paid $1,063 on the equipment purchased in I ransaction k S. paid $780 on the equipment purchased in Transaction d t. performed $3,000 in services; received $1,700 cash, the balance is due in 30 days U. received $470 from charge customers V. owner withdrew $1,500 for personal use Instructions: 1. Prepare and title the T accounts show in the chart of accounts. Record a plus (+) or a minus () on the debit and credit side of each T account to indic te where the increases and decreases will be recorded. 2. Record the transactions in the T accounts, identifying each by letter. 3. Determine the balance for each account. 4. Pre,are a trial balance as of January 31,20XX. MODULE 3-GROUP WORK The chart of accounts and the transactions for the month of January 20XX for Shawn O'Brien, veterinarian are as follows: Instructions: a. Shawn wrote a personal cheque for $18,000 and deposited it in a business account entitled Shawn O'Brien, veterinarian b. purchased medical supplies that cost $5,00r cash C. purchased office supplies that cost $400, to be paid for within 30 days d. purchased office equipment that cost $19,000; paid $3,000 cash down and signed a threeyear non-interest-bearing note for the balance e. cash revenue for the first week was $1,200 f. paid rent, $1,500 g. paid insurance premium, $800 h. paid office salaries of $375 1. made a $200 payment on office supplies purchased in Transaction c j. performed $2,000 in services; $1,100 received in cash, and the balance is due in 30 days K. bought examining room equipment that cost $99,000; paid $5,000 cash down and signed a two-year, non-interest-bearing note for the balance 1. received $450 on account from charge customers m. performed $2,400 in services; received $1,700 in cash, the balance is due in 30 days n. bought office supplies, $620, on account O. paid electricity bill, $210 p. paid office salaries, $375 q. received $500 from charge customers r. paid $1,063 on the equipment purchased in I ransaction k S. paid $780 on the equipment purchased in Transaction d t. performed $3,000 in services; received $1,700 cash, the balance is due in 30 days U. received $470 from charge customers V. owner withdrew $1,500 for personal use

Instructions: 1. Prepare and title the T accounts show in the chart of accounts. Record a plus (+) or a minus () on the debit and credit side of each T account to indic te where the increases and decreases will be recorded. 2. Record the transactions in the T accounts, identifying each by letter. 3. Determine the balance for each account. 4. Pre,are a trial balance as of January 31,20XX. MODULE 3-GROUP WORK The chart of accounts and the transactions for the month of January 20XX for Shawn O'Brien, veterinarian are as follows: Instructions: a. Shawn wrote a personal cheque for $18,000 and deposited it in a business account entitled Shawn O'Brien, veterinarian b. purchased medical supplies that cost $5,00r cash C. purchased office supplies that cost $400, to be paid for within 30 days d. purchased office equipment that cost $19,000; paid $3,000 cash down and signed a threeyear non-interest-bearing note for the balance e. cash revenue for the first week was $1,200 f. paid rent, $1,500 g. paid insurance premium, $800 h. paid office salaries of $375 1. made a $200 payment on office supplies purchased in Transaction c j. performed $2,000 in services; $1,100 received in cash, and the balance is due in 30 days K. bought examining room equipment that cost $99,000; paid $5,000 cash down and signed a two-year, non-interest-bearing note for the balance 1. received $450 on account from charge customers m. performed $2,400 in services; received $1,700 in cash, the balance is due in 30 days n. bought office supplies, $620, on account O. paid electricity bill, $210 p. paid office salaries, $375 q. received $500 from charge customers r. paid $1,063 on the equipment purchased in I ransaction k S. paid $780 on the equipment purchased in Transaction d t. performed $3,000 in services; received $1,700 cash, the balance is due in 30 days U. received $470 from charge customers V. owner withdrew $1,500 for personal use Instructions: 1. Prepare and title the T accounts show in the chart of accounts. Record a plus (+) or a minus () on the debit and credit side of each T account to indic te where the increases and decreases will be recorded. 2. Record the transactions in the T accounts, identifying each by letter. 3. Determine the balance for each account. 4. Pre,are a trial balance as of January 31,20XX. MODULE 3-GROUP WORK The chart of accounts and the transactions for the month of January 20XX for Shawn O'Brien, veterinarian are as follows: Instructions: a. Shawn wrote a personal cheque for $18,000 and deposited it in a business account entitled Shawn O'Brien, veterinarian b. purchased medical supplies that cost $5,00r cash C. purchased office supplies that cost $400, to be paid for within 30 days d. purchased office equipment that cost $19,000; paid $3,000 cash down and signed a threeyear non-interest-bearing note for the balance e. cash revenue for the first week was $1,200 f. paid rent, $1,500 g. paid insurance premium, $800 h. paid office salaries of $375 1. made a $200 payment on office supplies purchased in Transaction c j. performed $2,000 in services; $1,100 received in cash, and the balance is due in 30 days K. bought examining room equipment that cost $99,000; paid $5,000 cash down and signed a two-year, non-interest-bearing note for the balance 1. received $450 on account from charge customers m. performed $2,400 in services; received $1,700 in cash, the balance is due in 30 days n. bought office supplies, $620, on account O. paid electricity bill, $210 p. paid office salaries, $375 q. received $500 from charge customers r. paid $1,063 on the equipment purchased in I ransaction k S. paid $780 on the equipment purchased in Transaction d t. performed $3,000 in services; received $1,700 cash, the balance is due in 30 days U. received $470 from charge customers V. owner withdrew $1,500 for personal use Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started