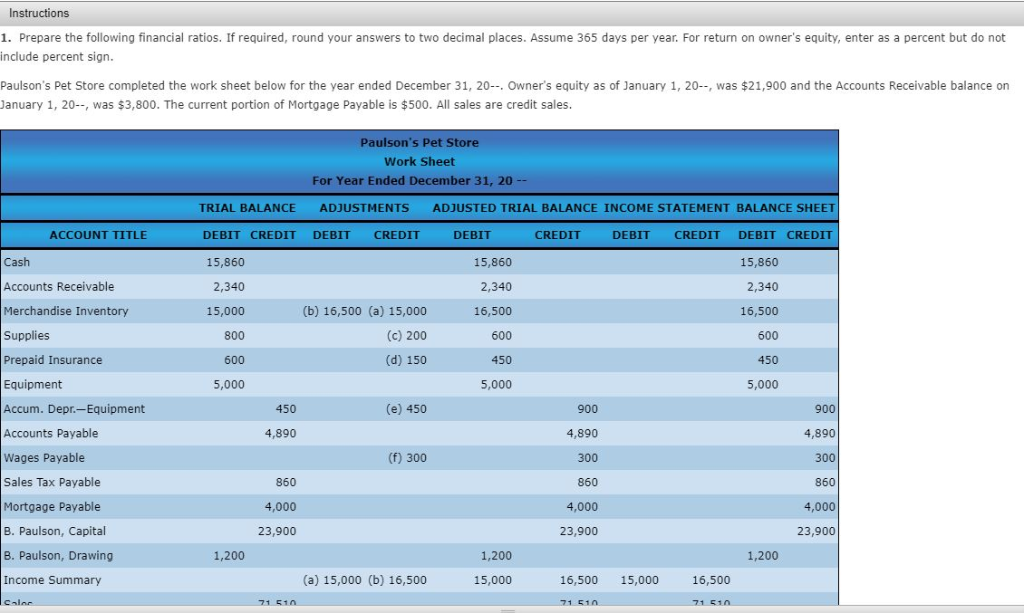

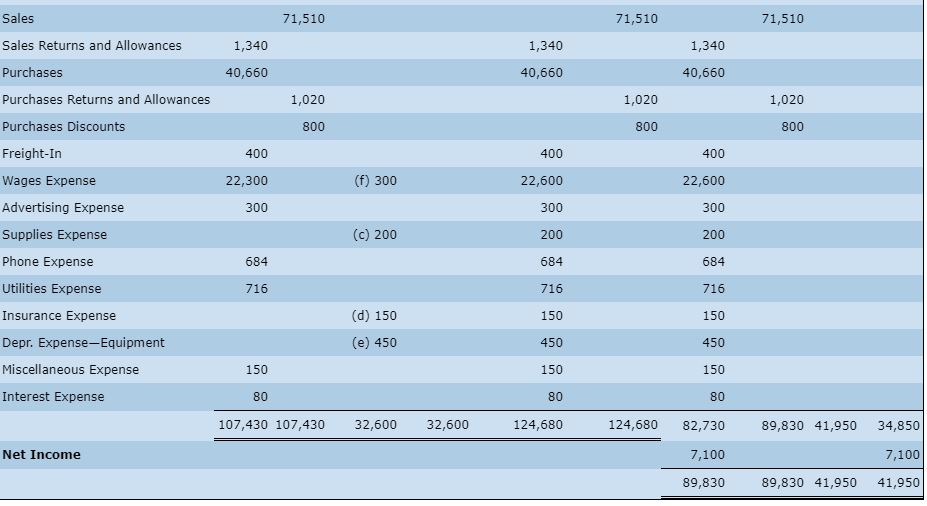

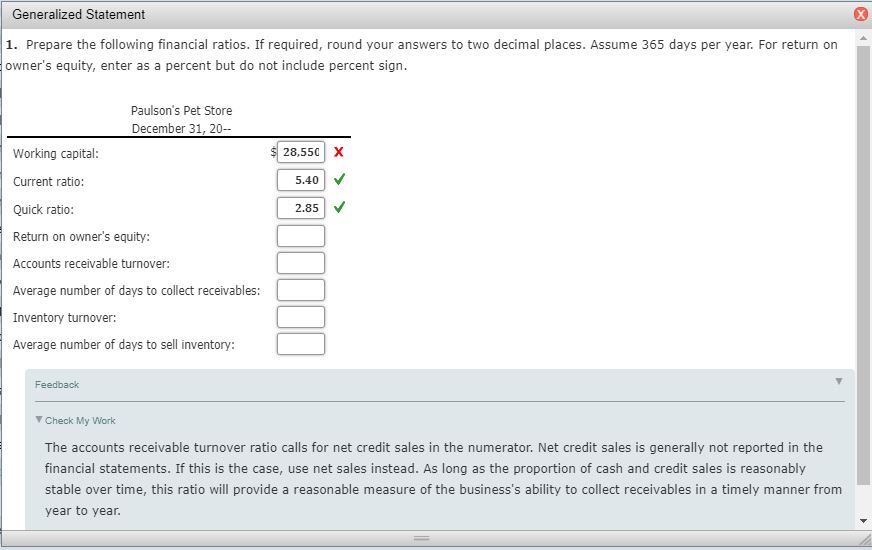

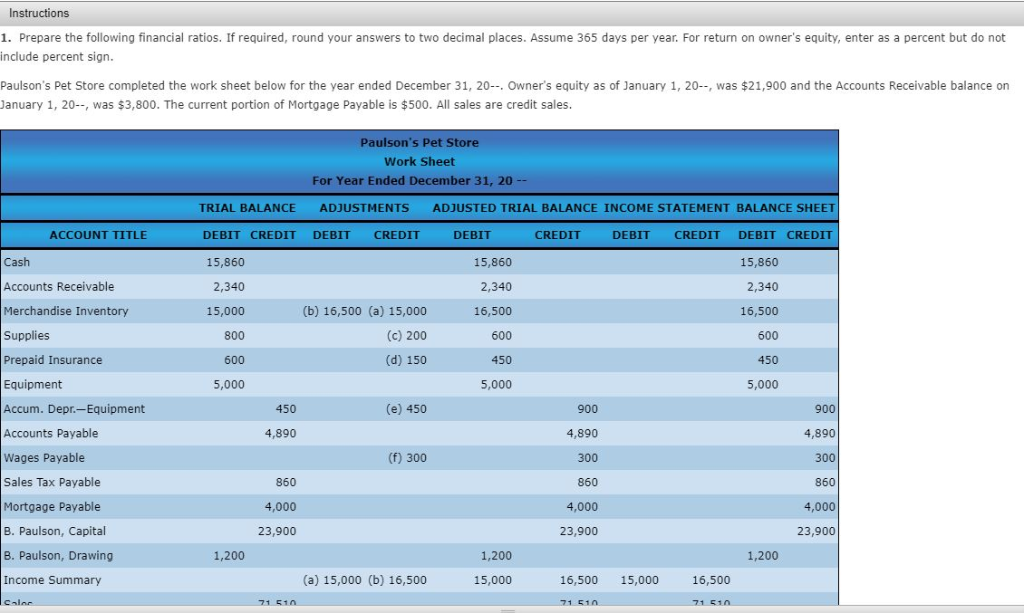

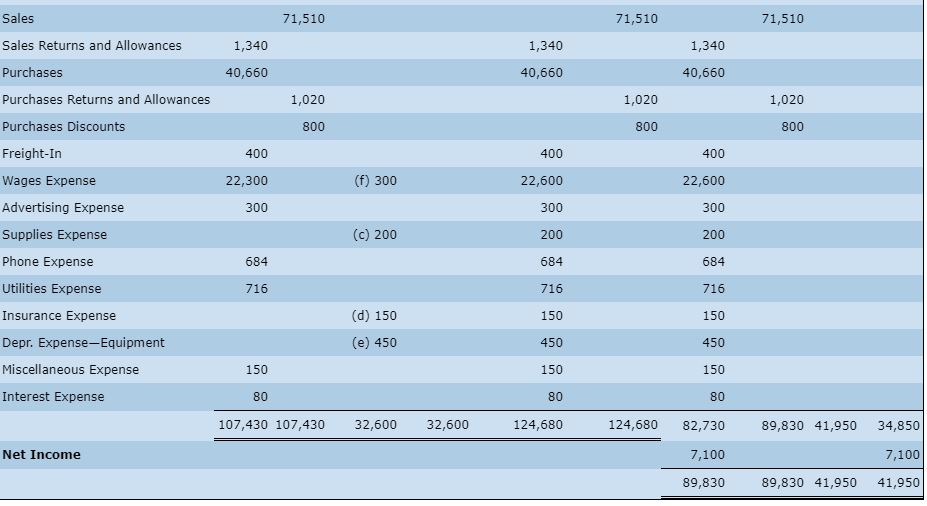

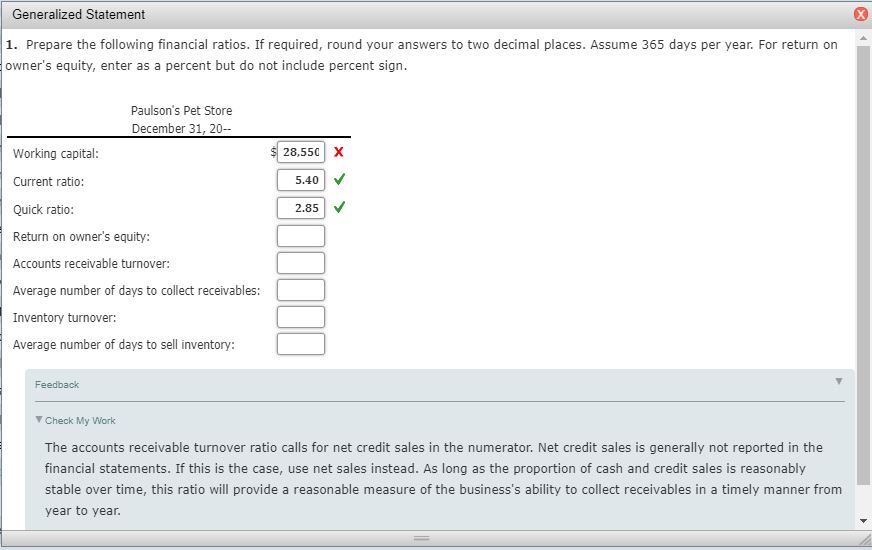

Instructions 1. Prepare the following financial ratios. If required, round your answers to two decimal places. Assume 365 days per year. For return on owner's equity, enter as a percent but do not include percent sign Paulson's Pet Store completed the work sheet below for the year ended December 31, 20--. Owner's equity as of January 1, 20-, was $21,900 and the Accounts Receivable balance on anuary 1, 20, was $3,800. The current portion of Mortgage Payable is $500. All sales are credit sales Paulson's Pet Store Work Sheet For Year Ended December 31, 20 - TRIAL BALANCE ADJUSTMENTS ADJUSTED TRIAL BALANCE INCOME STATEMENT BALANCE SHEET ACCOUNT TITLE DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT Cash Accounts Receivable Merchandise Inventory Supplies Prepaid Insurance Equipment Accum. Depr.-Equipment Accounts Payable Wages Payable Sales Tax Payable Mortgage Payable B. Paulson, Capital B. Paulson, Drawing Income Summary 15,860 2,340 16,500 600 450 5,000 15,860 2,340 16,500 600 450 5,000 15,860 2,340 15,000 800 600 5,000 (b) 16,500 (a) 15,000 (c) 200 (d) 150 450 900 4,890 300 860 4,000 23,900 (e) 450 900 4,890 300 860 4,000 23,900 4,890 (f) 300 860 4,000 23,900 1,200 1,200 1,200 (a) 15,000 (b) 16,500 16,500 15,000 16,500 15,000 1 51 71 51 Sales Sales Returns and Allowances Purchases Purchases Returns and Allowances Purchases Discounts Freight-In Wages Expense Advertising Expense Supplies Expense Phone Expense Utilities Expense Insurance Expense Depr. Expense-Equipment Miscellaneous Expense Interest Expense 71,510 71,510 71,510 1,340 1,340 1,340 40,660 40,660 40,660 1,020 1,020 1,020 800 800 800 400 22,300 300 400 22,600 300 200 684 716 150 450 150 80 124,680 400 22,600 300 200 684 716 150 450 150 80 124,680 82,730 7,100 89,830 (f) 300 (c) 200 684 716 (d) 150 (e) 450 150 80 107,430 107,430 32,600 32,600 89,830 41,950 34,850 7,100 89,830 41,950 41,950 Net Income Generalized Statement 1. Prepare the following financial ratios. If required, round your answers to two decimal places. Assume 365 days per year. For return on owner's equity, enter as a percent but do not include percent sign. Paulson's Pet Store December 31, 20 28,550 X Working capital: Current ratio: Quick ratio: Return on owner's equity: Accounts receivable turnover: Average number of days to collect receivables: Inventory turnover: Average number of days to sell inventory: 5.40 2.85 Feedbach V Check My Work The accounts receivable turnover ratio calls for net credit sales in the numerator. Net credit sales is generally not reported in the financial statements. If this is the case, use net sales instead. As long as the proportion of cash and credit sales is reasonably stable over time, this ratio will provide a reasonable measure of the business's ability to collect receivables in a timely manner from year to year