1.) Prepare the Income statement, Statement of owners equity, and the balance sheet. 2.) Prepare the Closing journal entries and Post-closing trial balance Tyler's Consulting

1.) Prepare the Income statement, Statement of owner’s equity, and the balance sheet.

2.) Prepare the Closing journal entries and Post-closing trial balance

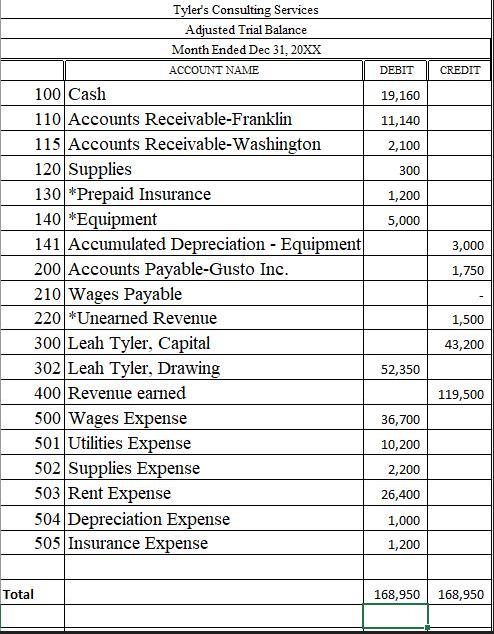

Tyler's Consulting Services Adjusted Trial Balance Month Ended Dec 31, 20XX ACCOUNT NAME Total 100 Cash 110 Accounts Receivable-Franklin 115 Accounts 120 Supplies Receivable-Washington 130 *Prepaid Insurance 140 *Equipment 141 Accumulated Depreciation - Equipment 200 Accounts Payable-Gusto Inc. 210 Wages Payable 220 *Unearned Revenue 300 Leah Tyler, Capital 302 Leah Tyler, Drawing 400 Revenue earned 500 Wages Expense 501 Utilities Expense 502 Supplies Expense 503 Rent Expense 504 Depreciation Expense 505 Insurance Expense DEBIT CREDIT 19,160 11,140 2,100 300 1,200 5,000 52,350 36,700 10,200 2,200 26,400 1,000 1,200 3,000 1,750 1,500 43,200 119,500 168,950 168,950

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the income statement statement of owners equity and balance sheet based on the provided adjusted trial balance for Tylers consulting servic...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started