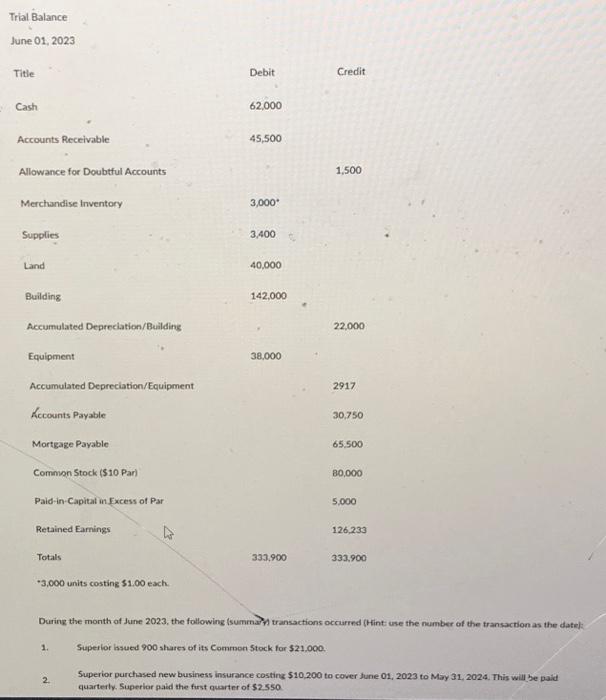

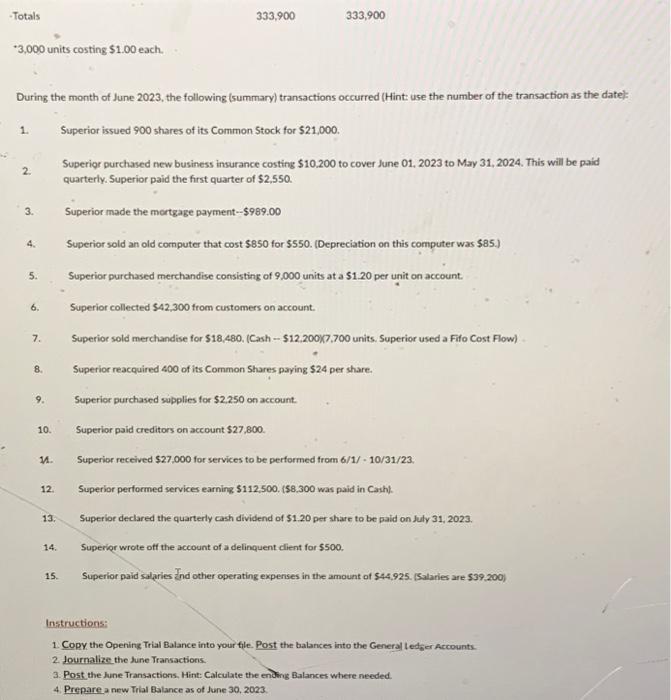

Instructions: 5. Journallze the adjusting entries. (Round all amounts to Whole Dollars.) 6. Post the Adjusting Entries. (Hint: Calculate new balances where needed.) 7. Prepare an Adjusted Trial Balance as of June 30, 2023. 8. Journalize the Closing Entries. (Hint: Use your Adjusted Triai Balance for the accounts and balances)) The End During the month of June 2023, the following (summain transactions occurrnd (Hint use the number of the transaction as the date): 1. Superior issued 900 shares of its Comrmon Stock for $21,000. 2. Superior purchased new business insurance costing $10,200 to cover lune 01, 2023 to May 31,2024 . This will be paid quarterly. Superior paid the furst quarter of $2.550 3,000 units costing $1.00 each. During the month of June 2023, the following (summary) transactions occurred (Hint: use the number of the transaction as the date) 1. Superior issued 900 shares of its Common Stock for $21,000. 2. Superior purchased new business insurance costing $10.200 to cover June 01,2023 to May 31, 2024. This will be paid quarterly. Superior paid the first quarter of $2,550. 3. Superior made the mortgage payment- $999.00 4. Superior sold an old computer that cost $850 for $550. (Depreciation on this computer was $85.) 5. Superior purchased merchandise consisting of 9.000 units at a $1.20 per unit on account. 6. Superior collected $42,300 from customers on account. 7. Superior sold merchandise for $18,480. (Cash - $12,200)(7,700 units. Superior used a Fifo Cost Flow) 8. Superior reacquired 400 of its Common Shares paying $24 per share. 9. Superior purchased supplies for $2.250 on account. 10. Superior paid creditors on account $27,800. 11. Superior received $27,000 for services to be performed from 6/1/10/31/23. 12. Superior performed services earning $112,500, (\$8,300 was paid in Cash). 13. Superior declared the quarterly cash dividend of $1.20 per share to be paid on July 31,2023 . 14. Superier wrote off the account of a delinquent client for $500. 15. Superior paid salaries 2nd other operating expenses in the amount of $44,925. (Salaries are $39.200 ) Instructions: 1. Copy the Opening Trial Balance into your file. Post the balances into the General Lether Accounts. 2. Journalize the June Transactions. 3. Post the lune Transactions, Hint: Calculate the ending Balances where needed. 4. Prepare a new Trial Balance as of June 30,2023