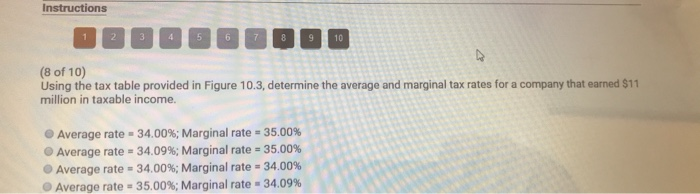

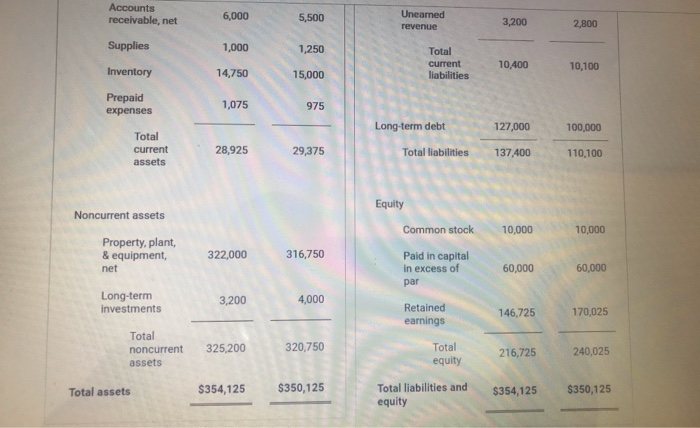

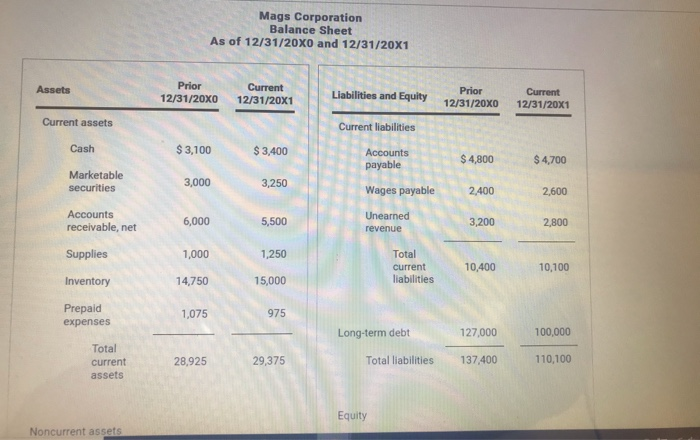

Instructions (8 of 10) Using the tax table provided in Figure 10.3, determine the average and marginal tax rates for a company that earned $11 million in taxable income. Average rate - 34.00%; Marginal rate - 35.00% Average rate = 34.09%; Marginal rate - 35.00% Average rate = 34.00%; Marginal rate - 34.00% Average rate - 35.00%; Marginal rate - 34.09% Accounts receivable, net 6,000 5,500 Unearned revenue 3,200 2,800 Supplies 1,000 1,250 Total current 10,400 Inventory 10,100 14,750 15,000 liabilities Prepaid expenses 1,075 975 Long-term debt 127,000 100,000 Total current assets 28,925 29,375 Total liabilities 137,400 110,100 Equity Noncurrent assets Common stock 10,000 10,000 Property, plant, & equipment, 322,000 316,750 Paid in capital in excess of net 60,000 60,000 par Long-term investments 3,200 4,000 Retained earnings 146,725 170,025 Total noncurrent assets 325,200 320,750 Total equity 216,725 240,025 Total assets $354,125 Total liabilities and $350,125 $350,125 equity Mags Corporation Balance Sheet As of 12/31/20X0 and 12/31/20X1 Assets Prior 12/31/20x0 Current 12/31/20X1 Liabilities and Equity Prior 12/31/20XO Current 12/31/20X1 Current assets Current liabilities Cash $ 3,100 $ 3,400 Accounts payable $4,800 $4,700 Marketable securities 3,000 3,250 Wages payable 2.400 2,600 6,000 Accounts receivable, net 5,500 Unearned revenue 3,200 2,800 Supplies 1,000 1,250 Total current liabilities 10,400 10,100 Inventory 14,750 15,000 Prepaid expenses 1,075 975 Long-term debt 127,000 100,000 Total current assets 110,100 28,925 Total liabilities 29,375 137,400 Equity Noncurrent assets Instructions (8 of 10) Using the tax table provided in Figure 10.3, determine the average and marginal tax rates for a company that earned $11 million in taxable income. Average rate - 34.00%; Marginal rate - 35.00% Average rate = 34.09%; Marginal rate - 35.00% Average rate = 34.00%; Marginal rate - 34.00% Average rate - 35.00%; Marginal rate - 34.09% Accounts receivable, net 6,000 5,500 Unearned revenue 3,200 2,800 Supplies 1,000 1,250 Total current 10,400 Inventory 10,100 14,750 15,000 liabilities Prepaid expenses 1,075 975 Long-term debt 127,000 100,000 Total current assets 28,925 29,375 Total liabilities 137,400 110,100 Equity Noncurrent assets Common stock 10,000 10,000 Property, plant, & equipment, 322,000 316,750 Paid in capital in excess of net 60,000 60,000 par Long-term investments 3,200 4,000 Retained earnings 146,725 170,025 Total noncurrent assets 325,200 320,750 Total equity 216,725 240,025 Total assets $354,125 Total liabilities and $350,125 $350,125 equity Mags Corporation Balance Sheet As of 12/31/20X0 and 12/31/20X1 Assets Prior 12/31/20x0 Current 12/31/20X1 Liabilities and Equity Prior 12/31/20XO Current 12/31/20X1 Current assets Current liabilities Cash $ 3,100 $ 3,400 Accounts payable $4,800 $4,700 Marketable securities 3,000 3,250 Wages payable 2.400 2,600 6,000 Accounts receivable, net 5,500 Unearned revenue 3,200 2,800 Supplies 1,000 1,250 Total current liabilities 10,400 10,100 Inventory 14,750 15,000 Prepaid expenses 1,075 975 Long-term debt 127,000 100,000 Total current assets 110,100 28,925 Total liabilities 29,375 137,400 Equity Noncurrent assets