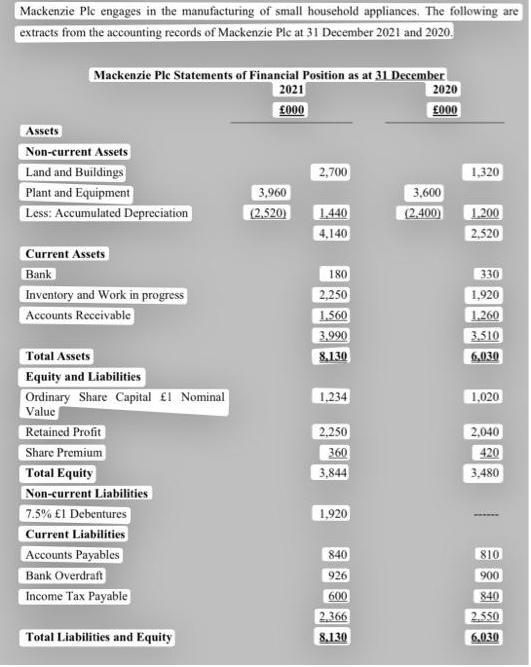

Mackenzie Plc engages in the manufacturing of small household appliances. The following are extracts from the accounting records of Mackenzie Ple at 31 December

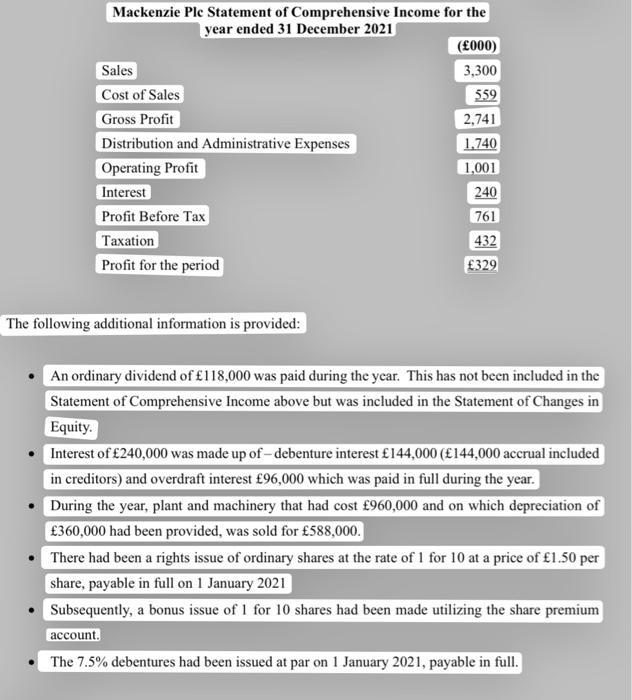

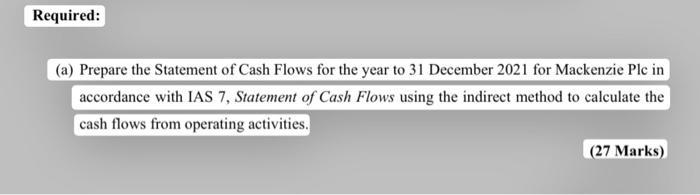

Mackenzie Plc engages in the manufacturing of small household appliances. The following are extracts from the accounting records of Mackenzie Ple at 31 December 2021 and 2020. Mackenzie Ple Statements of Financial Position as at 31 December 2021 000 Assets Non-current Assets Land and Buildings Plant and Equipment Less: Accumulated Depreciation Current Assets Bank Inventory and Work in progress Accounts Receivable Total Assets Equity and Liabilities Ordinary Share Capital 1 Nominal Value Retained Profit Share Premium Total Equity Non-current Liabilities 7.5% 1 Debentures Current Liabilities Accounts Payables Bank Overdraft Income Tax Payable Total Liabilities and Equity 3,960 (2.520) 2,700 1.440 4,140 180 2,250 1.560 3,990 8.130 1,234 2,250 360 3,844 1,920 840 926 600 2.366 8.130 2020 000 3,600 (2,400) 1,320 1.200 2,520 330 1,920 1,260 3.510 6,030 1,020 2,040 420 3,480 810 900 840 2.550 6.030 Mackenzie Ple Statement of Comprehensive Income for the year ended 31 December 2021 Sales Cost of Sales Gross Profit Distribution and Administrative Expenses Operating Profit Interest Profit Before Tax Taxation Profit for the period The following additional information is provided: (000) 3,300 559 2,741 1.740 1,001 240 761 432 329 An ordinary dividend of 118,000 was paid during the year. This has not been included in the Statement of Comprehensive Income above but was included in the Statement of Changes in Equity. Interest of 240,000 was made up of -debenture interest 144,000 (144,000 accrual included in creditors) and overdraft interest 96,000 which was paid in full during the year. During the year, plant and machinery that had cost 960,000 and on which depreciation of 360,000 had been provided, was sold for 588,000. There had been a rights issue of ordinary shares at the rate of 1 for 10 at a price of 1.50 per share, payable in full on 1 January 2021 Subsequently, a bonus issue of 1 for 10 shares had been made utilizing the share premium account. The 7.5% debentures had been issued at par on 1 January 2021, payable in full. Required: (a) Prepare the Statement of Cash Flows for the year to 31 December 2021 for Mackenzie Plc in accordance with IAS 7, Statement of Cash Flows using the indirect method to calculate the cash flows from operating activities. (27 Marks) (b) Write a short note on disadvantages of statement of cash flow in the overall context of financial reporting. (6 Marks

Step by Step Solution

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Step 13 Cash flow statement The cash flow statement shows changes which take place in cash balance o...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started