Answered step by step

Verified Expert Solution

Question

1 Approved Answer

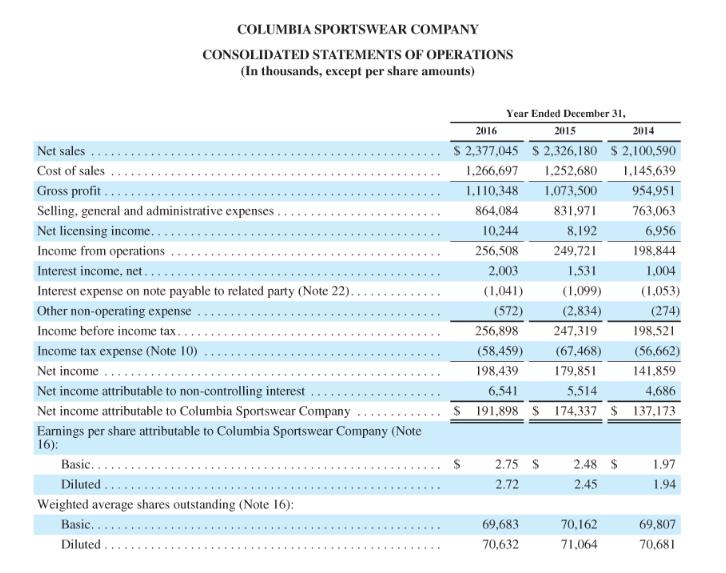

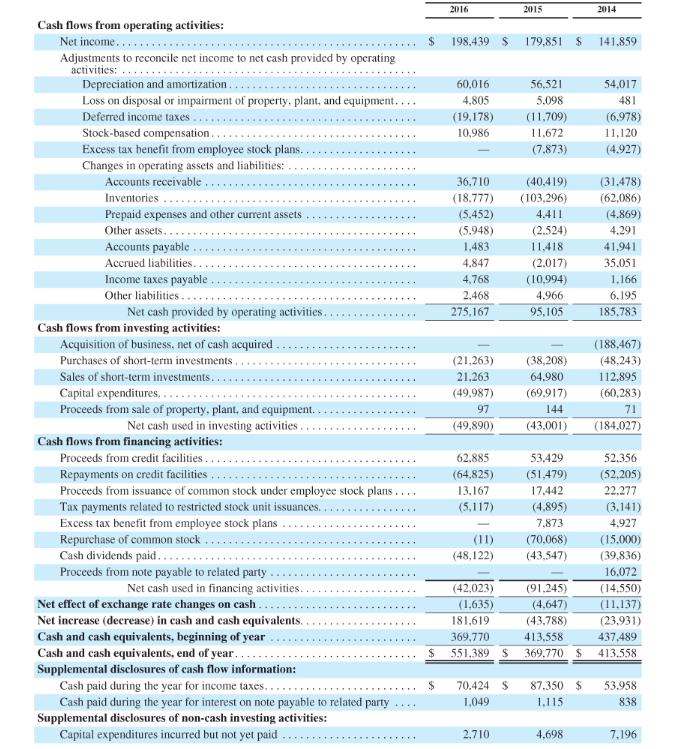

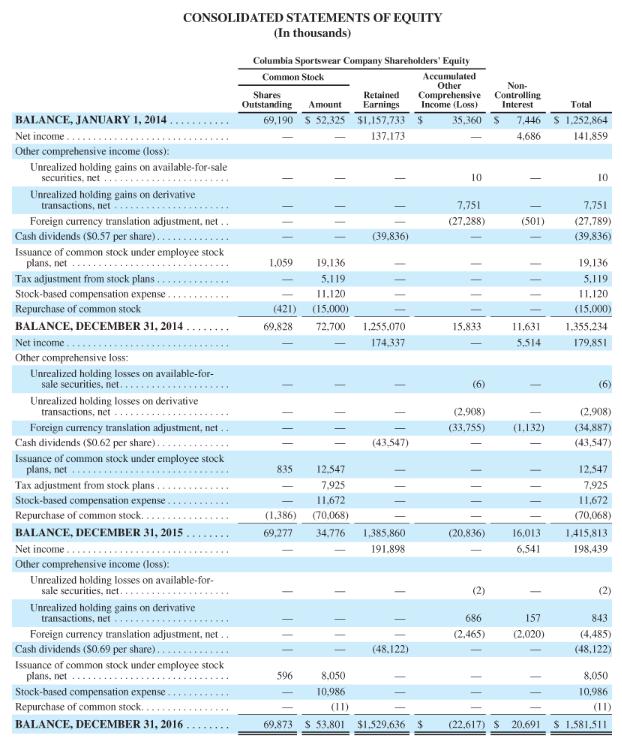

Based on the information contained in these financial statements, compute free cash flow for each company. COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands,

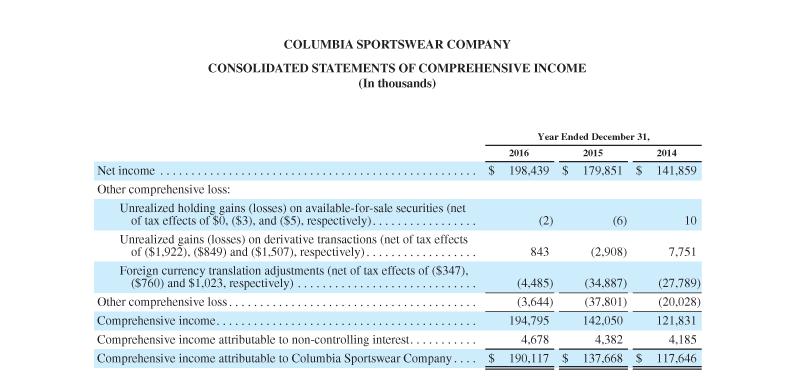

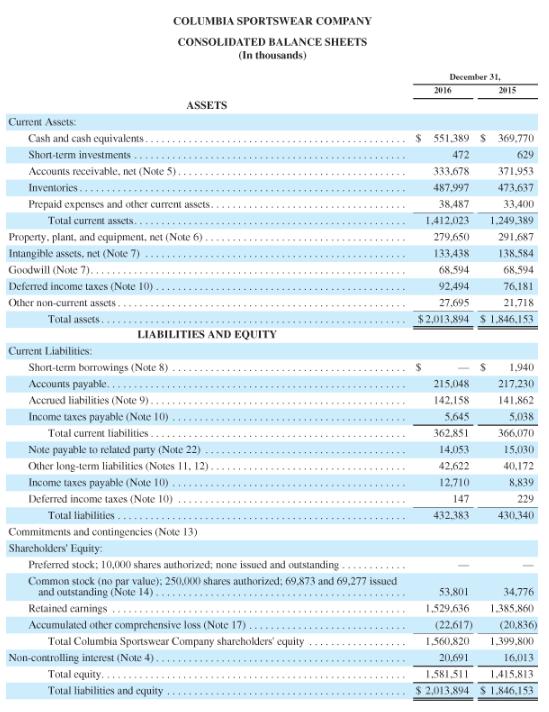

Based on the information contained in these financial statements, compute free cash flow for each company.

COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per share amounts) Year Ended December 31, 2016 2015 2014 S 2,377,045 S 2,326,180 $ 2,100,590 1,252,680 Net sales Cost of sales 1,266,697 1,145,639 Gross profit... 1,073,500 1,110,348 954,951 Selling, general and administrative expenses . 864,084 831,971 763,063 Net licensing income.. Income from operations 10,244 8,192 6,956 256,508 249,721 198.844 Interest income, net.. 2,003 1,531 1,004 ........ Interest expense on note payable to related party (Note 22). (1,041) (1,099) (1,053) Other non-operating expense (572) (2,834) (274) Income before income tax.. 256,898 247,319 198,521 Income tax expense (Note 10) (58,459) (67,468) (56,662) .... Net income 198,439 179,851 141,859 Net income attributable to non-controlling interest 6.541 5.514 4,686 ....... Net income attributable to Columbia Sportswear Company S 191,898 S 174,337 $ 137,173 **..... ... Earnings per share attributable to Columbia Sportswear Company (Note 16): Basic.. 2.75 $ 2.48 $ 1.97 Diluted . 2.72 2.45 1.94 Weighted average shares outstanding (Note 16): Basic.. 69,683 70,162 69,807 Diluted 70,632 71,064 70,681

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started