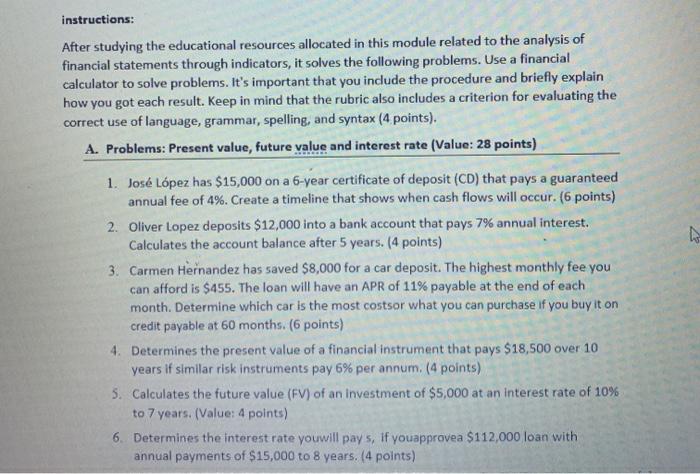

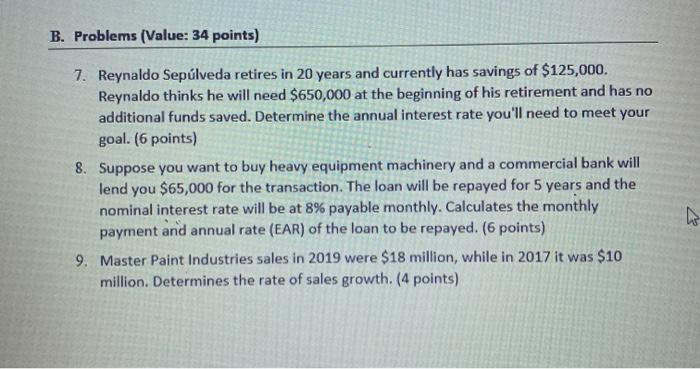

instructions: After studying the educational resources allocated in this module related to the analysis of financial statements through indicators, it solves the following problems. Use a financial calculator to solve problems. It's important that you include the procedure and briefly explain how you got each result. Keep in mind that the rubric also includes a criterion for evaluating the correct use of language, grammar, spelling, and syntax (4 points). A. Problems: Present value, future value and interest rate (Value: 28 points) 1. Jos Lpez has $15,000 on a 6-year certificate of deposit (CD) that pays a guaranteed annual fee of 4%. Create a timeline that shows when cash flows will occur. (6 points) 2. Oliver Lopez deposits $12,000 into a bank account that pays 7% annual interest. Calculates the account balance after 5 years. (4 points) 3. Carmen Hernandez has saved $8,000 for a car deposit. The highest monthly fee you can afford is $455. The loan will have an APR of 11% payable at the end of each month. Determine which car is the most costsor what you can purchase if you buy it on credit payable at 60 months. (6 points) 4. Determines the present value of a financial instrument that pays $18,500 over 10 years if similar risk instruments pay 6% per annum, (4 points) 5. Calculates the future value (FV) of an investment of $5,000 at an interest rate of 10% to 7 years. (Value: 4 points) 6. Determines the interest rate youwill pay s, if youapprovea $112,000 loan with annual payments of $15,000 to 8 years. (4 points) B. Problems (Value: 34 points) 7. Reynaldo Seplveda retires in 20 years and currently has savings of $125,000. Reynaldo thinks he will need $650,000 at the beginning of his retirement and has no additional funds saved. Determine the annual interest rate you'll need to meet your goal. (6 points) 8. Suppose you want to buy heavy equipment machinery and a commercial bank will lend you $65,000 for the transaction. The loan will be repayed for 5 years and the nominal interest rate will be at 8% payable monthly. Calculates the monthly payment and annual rate (EAR) of the loan to be repayed. (6 points) 9. Master Paint Industries sales in 2019 were $18 million, while in 2017 it was $10 million. Determines the rate of sales growth. (4 points)