Question

Instructions: After studying the educational resources assigned in this module related to the analysis of risk and performance in companies, solve the following problems. Use

Instructions:

After studying the educational resources assigned in this module related to the analysis of risk and performance in companies, solve the following problems. Use of the Microsoft Excel application or a financial calculator is recommended for calculations. It is important that you include the procedure and briefly explain how you obtained each result. Keep in mind that the rubric also includes criteria for evaluating the correct use of language, grammar, spelling, and syntax (4 points).

A. Practical exercises (Value: 34 points)

1. Explain how different statistical measures of individual risk help managers and business owners make better decisions. For your answer, consider the following statistical measures of risk: probability distributions, expected rates of return, historical rates, standard deviation, coefficient of variation, and Sharpe's ratio. (12 points)

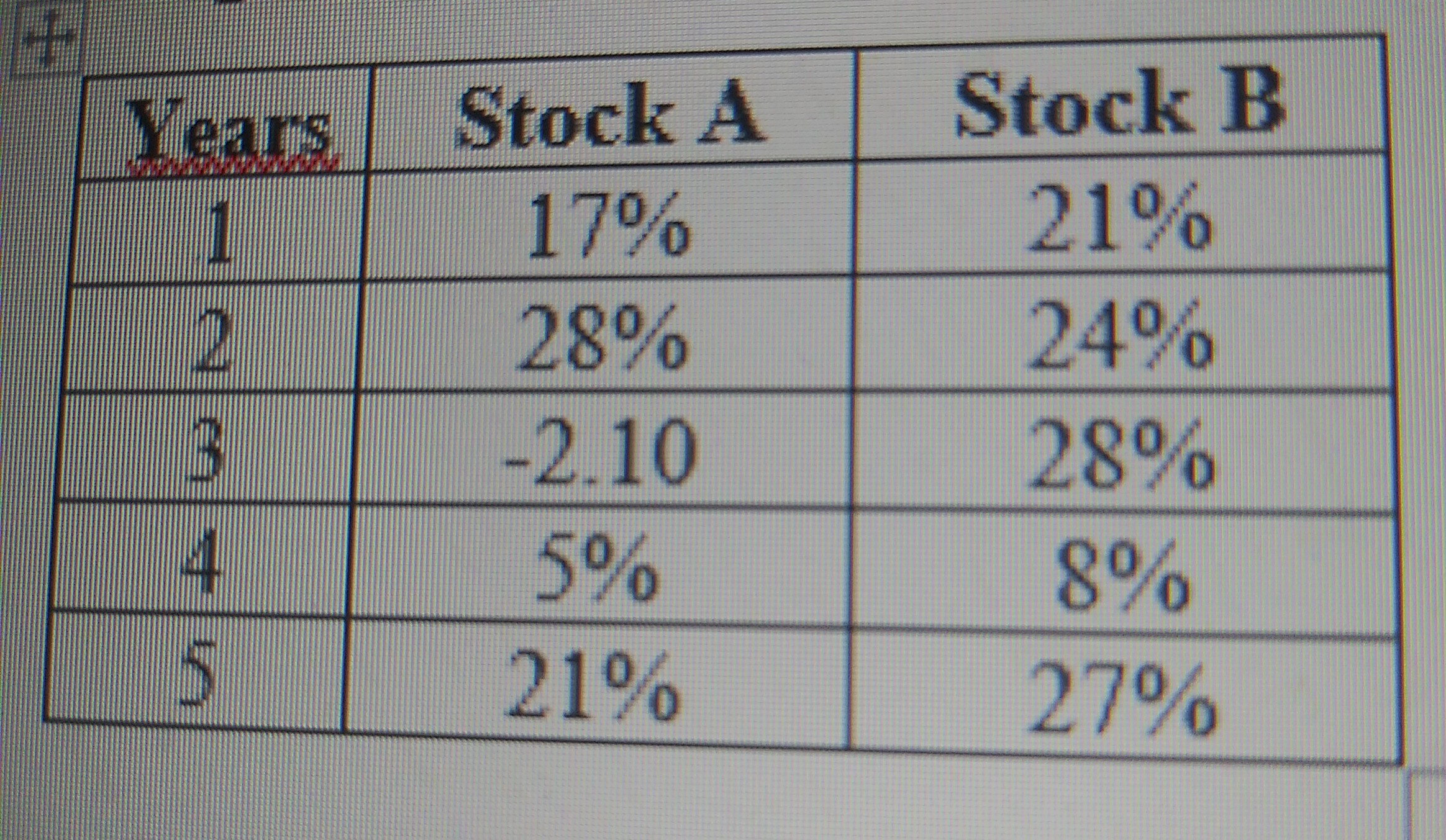

2. Over the past 5 years, River Valley Industries has posted a 3% risk-free rate and the following return on stocks A and B:

Years

Stock A

Stock B

1

17%

21%

2

28%

24%

3

-2.10

28%

4

5%

8%

5

21%

27%

Find the coefficient of variation for stocks A and B. Find and explain which stock performed better. (4 points)

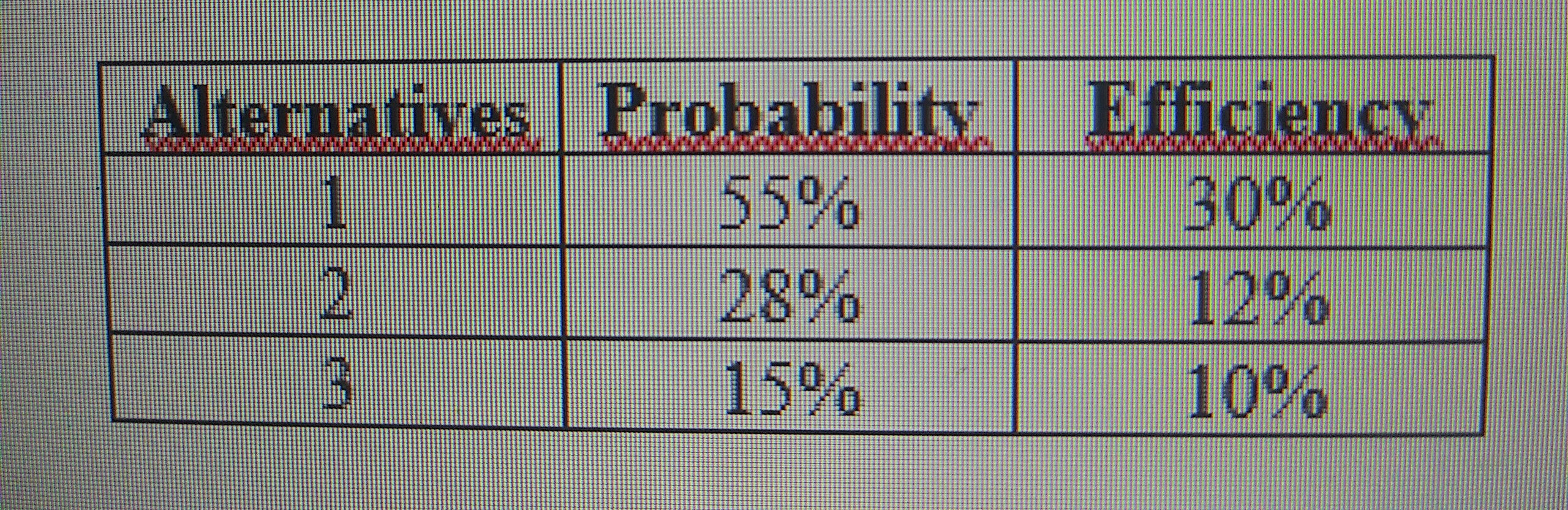

3. Suppose New Investors Inc. has the following investment alternatives:

Alternatives

Probability

Efficiency

1

55%

30%

2

28%

12%

3

15%

10%

Determine the expected return. (4 points)

4. Suppose you have invested $ 35,000 in stocks with a beta of 0.9 and another $ 17,000 invested in stocks with a volatility (beta) of 3.2%. Determines the volatility percentage (beta) of the portfolio. (4 points)

5. Suppose the risk-free rate is 7.7% and the market return is 10%. Calculates the expected rate of return on a stock with a volatility (beta) of 3%. (4 points)

6. Determine the expected rate of return for Campo Industries, assuming that the inflation rate will be 3.2%. Also, the risk-free rate is 2.2% and the market risk premium is 5.1%. The company has a beta of 1.7% and the rate of return for the last 4 years has been 7.6%. (6 points)

B. Case: Assessing risk and return (Value: 30 points)

Silver Industries Company "Y" shares have an expected return of 15%, a beta coefficient of 0.8, and a standard deviation of expected returns of 31%. The company's Z shares have an expected return of 11.3%, a beta coefficient of 1.5, and a standard deviation of 25%. The risk-free rate is 5% and the market risk premium is 4%. (30 points)

to. Determine the coefficient of variation for each stock.

b. Explain which action is riskier for diversified investors.

c. Calculate the expected rate of return for both stocks.

d. Explain which of the stocks might be more attractive to investors.

and. Calculate the return on a portfolio that has $ 9,200 invested in Stock "Y" and $ 3,500 invested in Stock "Z".

F. Suppose the market risk premium increases to 7%, which of the stocks would have a higher return?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started