Answered step by step

Verified Expert Solution

Question

1 Approved Answer

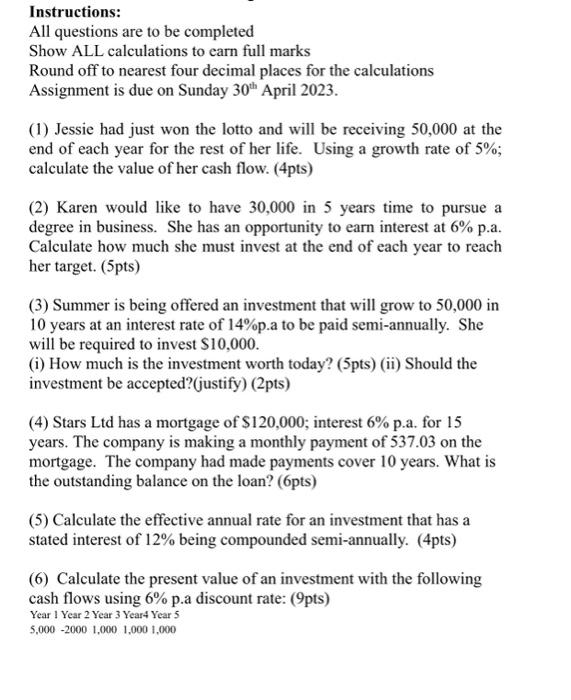

Instructions: All questions are to be completed Show ALL calculations to earn full marks Round off to nearest four decimal places for the calculations Assignment

Instructions: All questions are to be completed Show ALL calculations to earn full marks Round off to nearest four decimal places for the calculations Assignment is due on Sunday 30th April 2023. (1) Jessie had just won the lotto and will be receiving 50,000 at the end of each year for the rest of her life. Using a growth rate of 5%; calculate the value of her cash flow. (4pts) (2) Karen would like to have 30,000 in 5 years time to pursue a degree in business. She has an opportunity to earn interest at 6% p.a. Calculate how much she must invest at the end of each year to reach her target. (5pts) (3) Summer is being offered an investment that will grow to 50,000 in 10 years at an interest rate of 14%p.a to be paid semi-annually. She will be required to invest $10,000. (i) How much is the investment worth today? (5pts) (ii) Should the investment be accepted? (justify) (2pts) (4) Stars Ltd has a mortgage of $120,000; interest 6% p.a. for 15 years. The company is making a monthly payment of 537.03 on the mortgage. The company had made payments cover 10 years. What is the outstanding balance on the loan? (6pts) (5) Calculate the effective annual rate for an investment that has a stated interest of 12% being compounded semi-annually. (4pts) (6) Calculate the present value of an investment with the following cash flows using 6% p.a discount rate: (9pts) Year 1 Year 2 Year 3 Year4 Year 5 5,000 -2000 1,000 1,000 1,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started