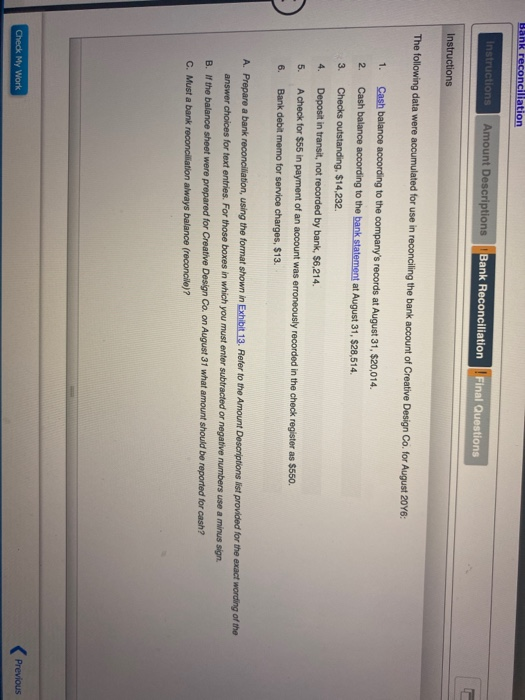

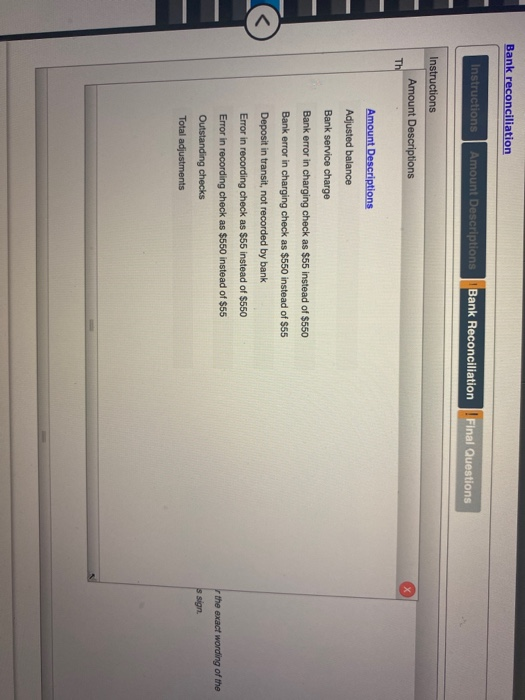

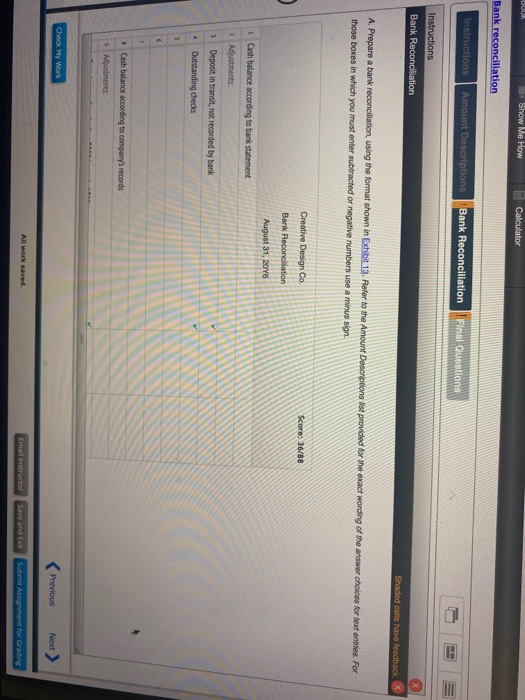

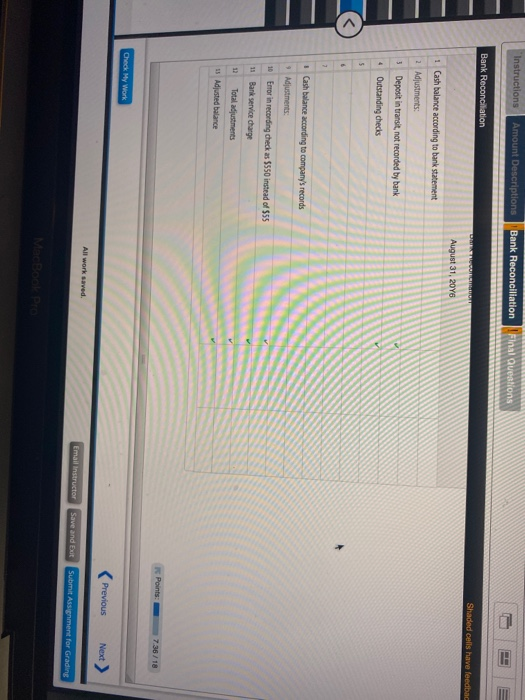

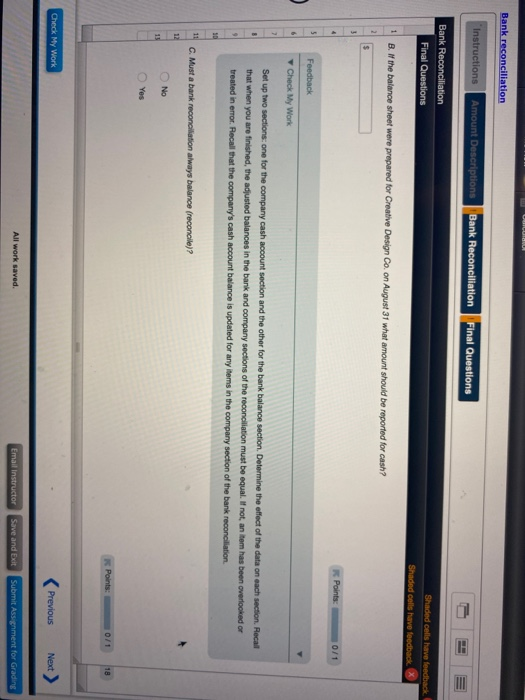

Instructions Amount Descriptions Bank Reconciliation Final Questions Instructions The following data were accumulated for use in reconciling the bank account of Creative Design Co. for August 20Y6 1. 2 3. Cash balance according to the company's records at August 31, $20,014 Cash balance according to the bank statement at August 31, $28,514 Checks outstanding. $14.232 Deposit in transit, not recorded by bank, $6.214. A check for $55 in payment of an account was erroneously recorded in the check register as $550. Bank debit memo for service charges, $13. 4. 6. A Prepare a bank reconciliation using the format shown in Exhibit 13. Refer to the Amount Descriptions is provided for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign B. the balance sheet were prepared for Creative Design Co. on August 31 what amount should be reported for cash? C. Must a bank reconciliation always balance (reconcile)? Check My Work Previous BOHR Peconciliation Instructions Amount Descriptions Bank Reconciliation Final Questions Instructions Amount Descriptions Amount Descriptions Adjusted balance Bank service charge Bank error in charging check as $55 instead of $550 Bank error in charging check as $550 instead of $55 Deposit in transit, not recorded by bank Error in recording check as $55 instead of $550 Error in recording check as $550 instead of $55 Outstanding checks Total adjustments the exact wording of the sign Wank reconciliation Instructions Amount Descriptions Bank Reconciliation Questions Instructions Bank Reconciliation A. Prepare a bank reconciliation using the format shown in Exhibit 13. Refer to the Amount Description is provided for the exact wording of the answer choices for text entries. For those bones in which you must enter subtracted or negative numbers use a mission Shaded cons have feedback Creative Design Co Bark Reconciliation Score: 16/8 Cash balance according to bank statement August 31, 2015 Deposit in transit, not recorded by bank Outstanding checks Cash balance according to company's records Deck My Work Previous Next > Imac Save and Et Bank Reconciliation Final Quvations Bank Reconciliation 1 Cash balance according to bank statement August 31, 2016 Shaded cells have feed Deposit in transit, not recorded by ban Outstanding checks Cash banor according to company's records Emain recording ched as 5550 instead of 555 dute balance Check My Work 7.36/18 Previous Next > Email Instructor Save and Et Suomessignment for Grading Bank reconciliation Instructions Amount Descriptions Bank Reconciliation Final Questions Bank Reconciliation Final Questions Shaded cells have feedback Shaded ces have feed B. Ir the balance sheet were prepared for Creative Design Co. on August 31 what amount should be reported for cash? Points: Feedback Check My Work Set up two sections one for the company cash account section and the other for the bank balance section. Determine the effect of the data on each section Recal that when you are the red balances in the bank and company sections of the condition must be co n tam os c ooked dinero Recal the company's cash account balance is updated for any in the company section of the bank reconcion C Must a bank reconciliation was balance reconcil? No Points: 0 Check My Work Previous Next > All work saved. Email Instructor Save and Exit Submit Assignment for Grading