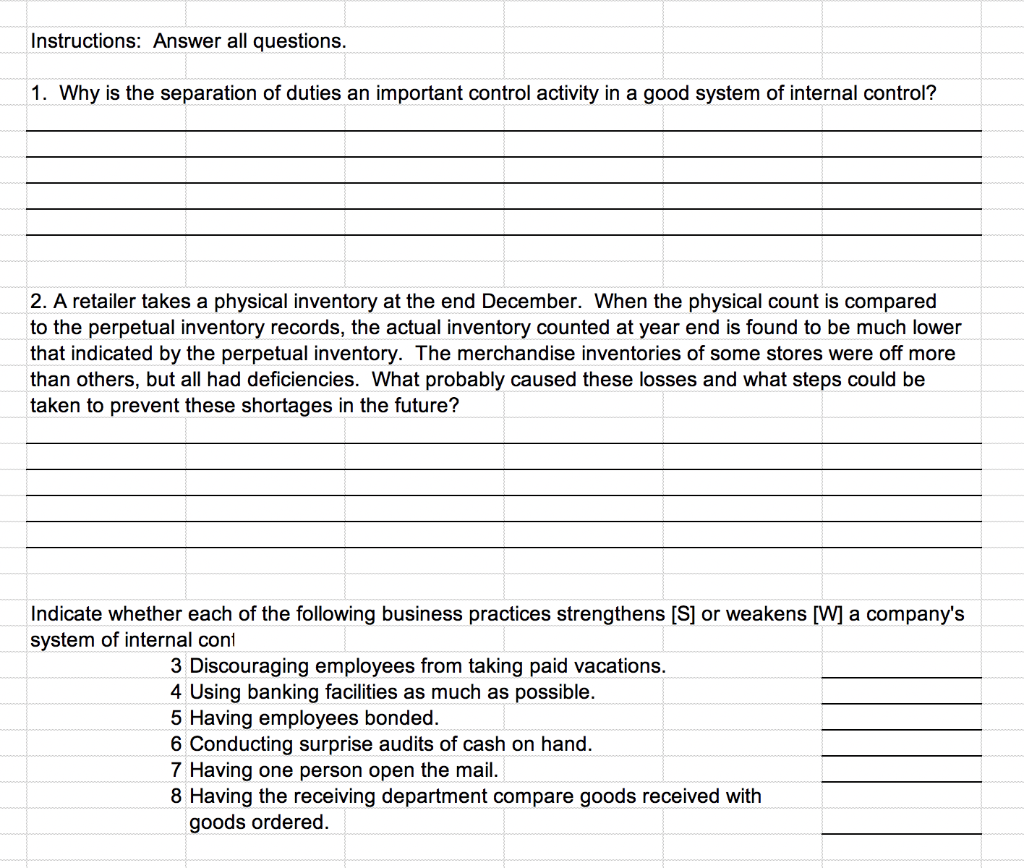

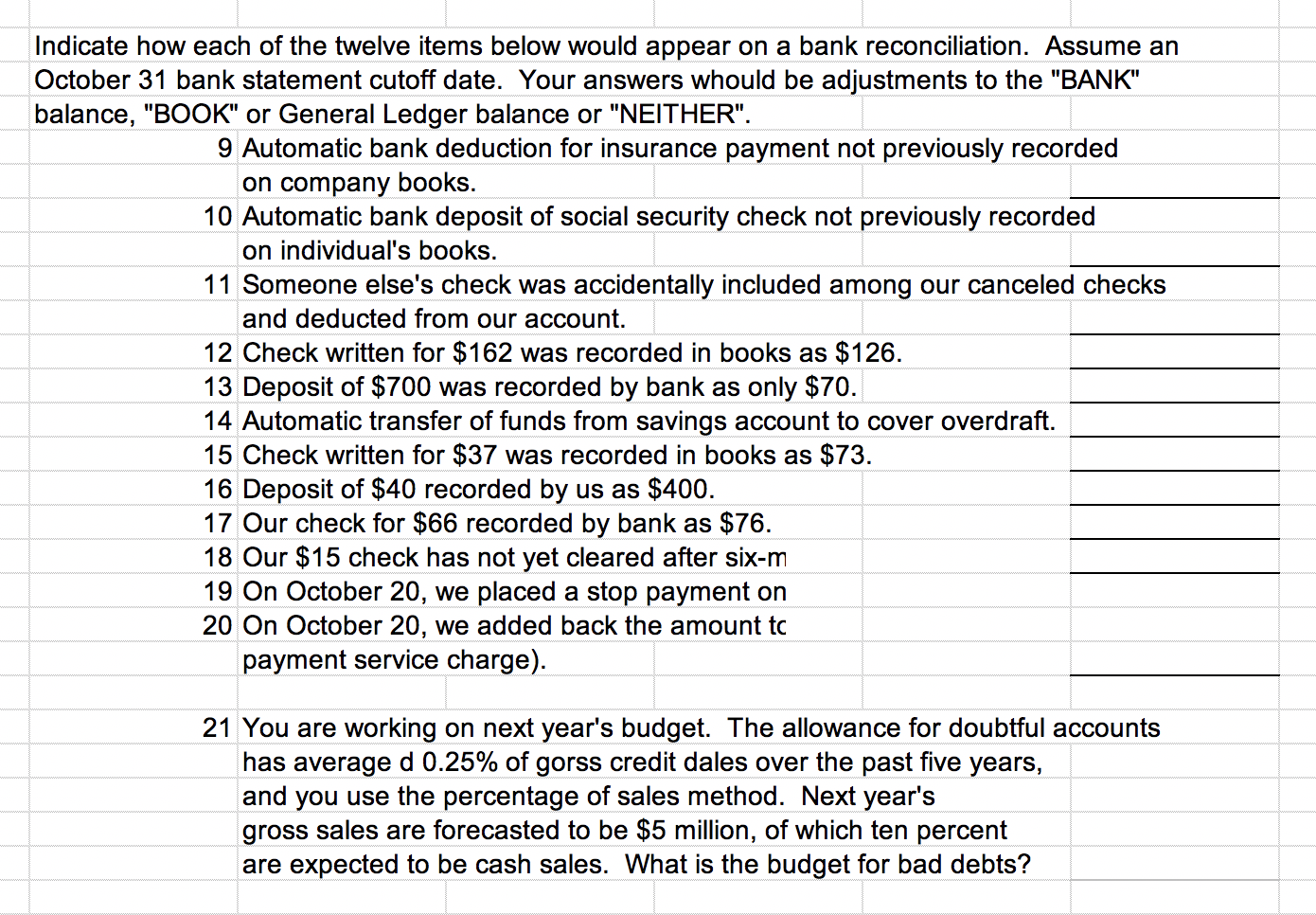

Instructions: Answer all questions. 1. Why is the separation of duties an important control activity in a good system of internal control? 2. A retailer takes a physical inventory at the end December. When the physical count is compared to the perpetual inventory records, the actual inventory counted at year end is found to be much lower that indicated by the perpetual inventory. The merchandise inventories of some stores were off more than others, but all had deficiencies. What probably caused these losses and what steps could be taken to prevent these shortages in the future? Indicate whether each of the following business practices strengthens [S] or weakens [W] a company's system of internal cont 3 Discouraging employees from taking paid vacations. 4 Using banking facilities as much as possible. 5 Having employees bonded. 6 Conducting surprise audits of cash on hand. 7 Having one person open the mail. 8 Having the receiving department compare goods received with goods ordered. Indicate how each of the twelve items below would appear on a bank reconciliation. Assume an October 31 bank statement cutoff date. Your answers whould be adjustments to the "BANK" balance, "BOOK" or General Ledger balance or "NEITHER". 9 Automatic bank deduction for insurance payment not previously recorded on company books. 10 Automatic bank deposit of social security check not previously recorded on individual's books. 11 Someone else's check was accidentally included among our canceled checks and deducted from our account. 12 Check written for $162 was recorded in books as $126. 13 Deposit of $700 was recorded by bank as only $70. 14 Automatic transfer of funds from savings account to cover overdraft. 15 Check written for $37 was recorded in books as $73. 16 Deposit of $40 recorded by us as $400. 17 Our check for $66 recorded by bank as $76. 18 Our $15 check has not yet cleared after six-m 19 On October 20, we placed a stop payment on 20 On October 20, we added back the amount to payment service charge). 21 You are working on next year's budget. The allowance for doubtful accounts has average d 0.25% of gorss credit dales over the past five years, and you use the percentage of sales method. Next year's gross sales are forecasted to be $5 million, of which ten percent are expected to be cash sales. What is the budget for bad debts