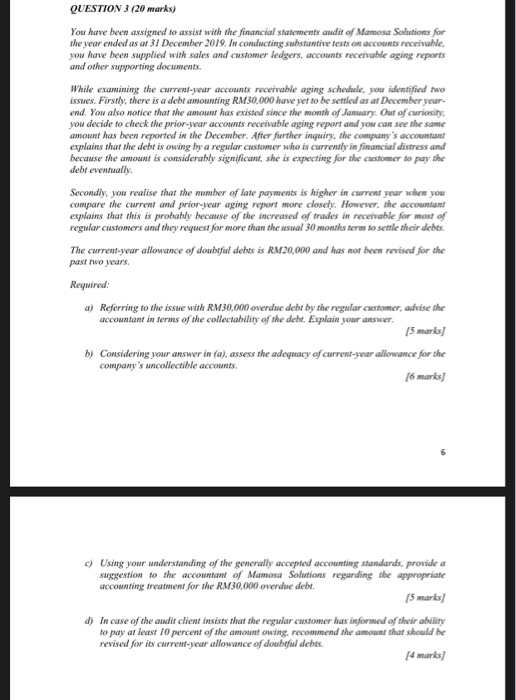

QUESTION 3 (20 marks) You have been assigned to assist with the financial statements andit of Mamosa Solutions for the year ended as at 31 December 2019. In conducting substantive tests on accounts receivable. you have been supplied with sales and customer ledgers, accounts receivable aging reports and other supporting documents. While examining the current-year accounts receivable aging schedule, you identified two issues. Firstly, there is a debramounting RM30,000 have yet to be settled as at December year- end. You also notice that the amount has existed since the month of January. Out of curiosity you decide to check the prior-year accounts receivable aging report and you can see the same amount has been reported in the December. After further inquiry, the company's accountant explains that the debt is owing by a regular customer who is currently in financial distress and because the amount is considerably significant, she is expecting for the customer to pay the debt eventually Secondly, you realise that the number of late payments is higher in current year when you compare the current and prior-year aging report more closely. However, the accountant explains that this is probably because of the increased of trades in receivable for most of regular customers and they request for more than the usual 30 months term to settle their debts. The current-year allowance of doubtful debts is RM20,000 and has not been revised for the past two years. Required: a) Referring to the issue with RM30,000 overdue debt by the regular customer, advise the accountant in terms of the collectability of the debt. Explain your answer. 15 marks] b) Considering your answer in (a), assess the adequacy of curreni-year allowance for the company's uncollectible accounts. 16 marks) c) Using your understanding of the generally accepted accounting standards, provide a suggestion to the accountant of Mamosa Solutions regarding the appropriate accounting treatment for the RM30,000 overdue debt. (5 marks] d) In case of the audit client insists that the regular customer has informed of their ability to pay at least 10 percent of the amount owing, recommend the amount that should be revised for its current-year allowance of doubtful debts. [4 marks) QUESTION 3 (20 marks) You have been assigned to assist with the financial statements andit of Mamosa Solutions for the year ended as at 31 December 2019. In conducting substantive tests on accounts receivable. you have been supplied with sales and customer ledgers, accounts receivable aging reports and other supporting documents. While examining the current-year accounts receivable aging schedule, you identified two issues. Firstly, there is a debramounting RM30,000 have yet to be settled as at December year- end. You also notice that the amount has existed since the month of January. Out of curiosity you decide to check the prior-year accounts receivable aging report and you can see the same amount has been reported in the December. After further inquiry, the company's accountant explains that the debt is owing by a regular customer who is currently in financial distress and because the amount is considerably significant, she is expecting for the customer to pay the debt eventually Secondly, you realise that the number of late payments is higher in current year when you compare the current and prior-year aging report more closely. However, the accountant explains that this is probably because of the increased of trades in receivable for most of regular customers and they request for more than the usual 30 months term to settle their debts. The current-year allowance of doubtful debts is RM20,000 and has not been revised for the past two years. Required: a) Referring to the issue with RM30,000 overdue debt by the regular customer, advise the accountant in terms of the collectability of the debt. Explain your answer. 15 marks] b) Considering your answer in (a), assess the adequacy of curreni-year allowance for the company's uncollectible accounts. 16 marks) c) Using your understanding of the generally accepted accounting standards, provide a suggestion to the accountant of Mamosa Solutions regarding the appropriate accounting treatment for the RM30,000 overdue debt. (5 marks] d) In case of the audit client insists that the regular customer has informed of their ability to pay at least 10 percent of the amount owing, recommend the amount that should be revised for its current-year allowance of doubtful debts. [4 marks)