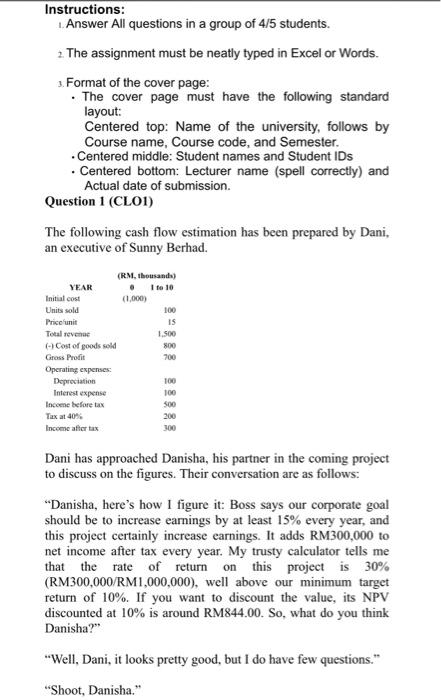

Instructions: Answer All questions in a group of 4/5 students. 2. The assignment must be neatly typed in Excel or Words. 3. Format of the cover page: The cover page must have the following standard layout: Centered top: Name of the university, follows by Course name, Course code, and Semester. Centered middle: Student names and Student IDs Centered bottom: Lecturer name (spell correctly) and Actual date of submission. Question 1 (CLOI) The following cash flow estimation has been prepared by Dani, an executive of Sunny Berhad. 100 (RM. thousands) YEAR I to 10 Initial cost (1,000) Units sold Price unit IS Total revenue 1.500 Cost of goods sold 800 Gross Profit 700 Operating expenses Depreciation 100 Interest expense 100 Income before tax SOO Tax at 40% 200 Income after tax 300 Dani has approached Danisha, his partner in the coming project to discuss on the figures. Their conversation are as follows: "Danisha, here's how I figure it: Boss says our corporate goal should be to increase earnings by at least 15% every year, and this project certainly increase earnings. It adds RM300,000 to net income after tax every year. My trusty calculator tells me that the rate of return on this project is 30% (RM300,000/RM1,000,000), well above our minimum target return of 10%. If you want to discount the value, its NPV discounted at 10% is around RM844.00. So, what do you think Danisha?" "Well, Dani, it looks pretty good, but I do have few questions." "Shoot, Danisha." Well, Dani, it looks pretty good, but I do have few questions." "Shoot, Danisha. "What about increases in accounts receivable and stuff like that? "Not relevant. We will get that money back when the project terminates, so it's equivalent to an interest-free loan, which is more of a benefit than a cost. But, Dani, what about extra selling and administrative costs? Haven't you left those out? "That is the beauty of this, Danisha. Given the recent recession, I figure we can handle the added business with existing personnel. In fact, one of the virtues of the proposal is that we should be able to retain some people we would otherwise have to terminate." "Well, you've convinced me, Dani. Now, I think it will be only fair if the boss puts you in charge of the existing new project. Required: As students of Financial Management, discuss how many errors you can spot and explain briefly why each is an error. By giving your own assumptions when needed, prepare a new cash flow estimation for the next 10 years