Answered step by step

Verified Expert Solution

Question

1 Approved Answer

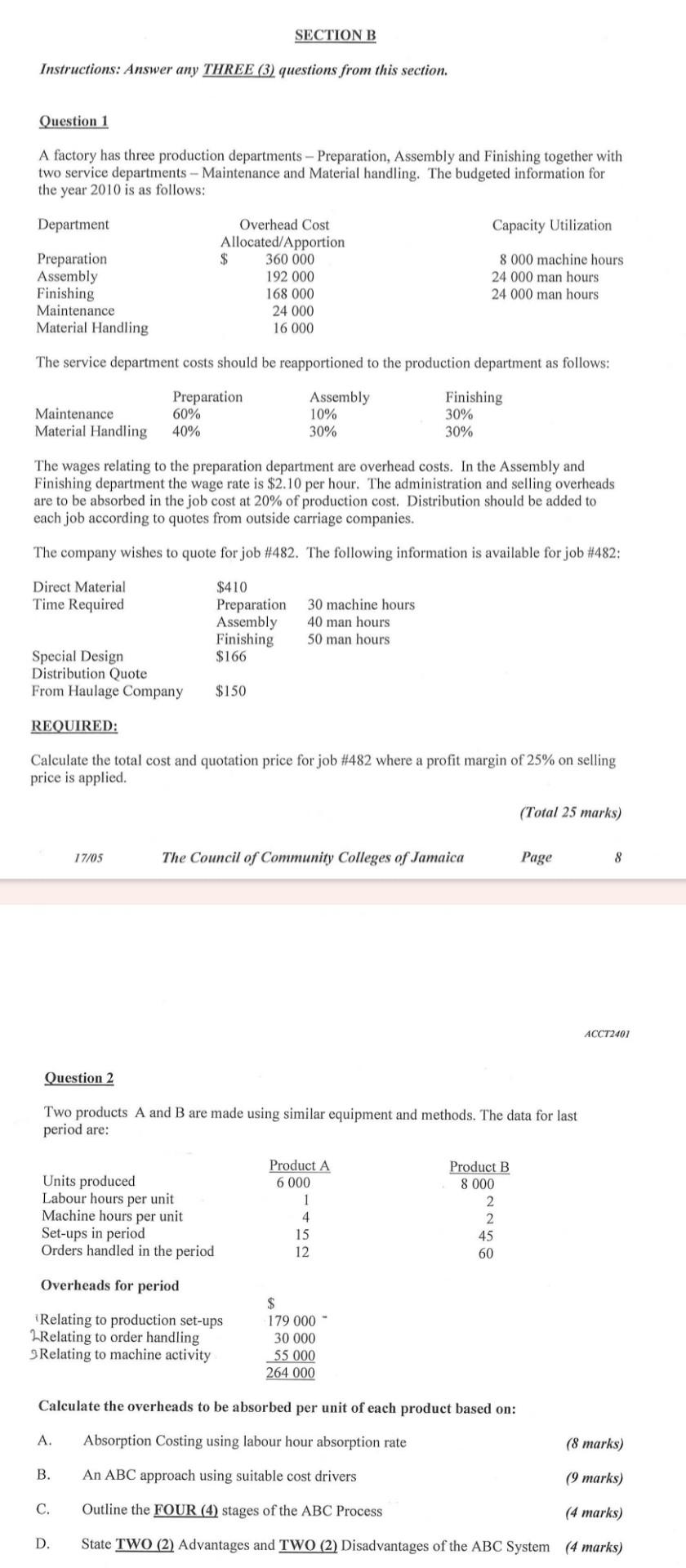

Instructions: Answer any THREE (3) questions from this section. Question 1 A factory has three production departments - Preparation, Assembly and Finishing together with two

Instructions: Answer any THREE (3) questions from this section. Question 1 A factory has three production departments - Preparation, Assembly and Finishing together with two service departments - Maintenance and Material handling. The budgeted information for the year 2010 is as follows: The service department costs should be reapportioned to the production department as follows: The wages relating to the preparation department are overhead costs. In the Assembly and Finishing department the wage rate is $2.10 per hour. The administration and selling overheads are to be absorbed in the job cost at 20% of production cost. Distribution should be added to each job according to quotes from outside carriage companies. The company wishes to quote for job \#482. The following information is available for job \#482: REOUIRED: Calculate the total cost and quotation price for job \#482 where a profit margin of 25% on selling price is applied. (Total 25 marks) The Council of Community Colleges of Jamaica Page 8 ACCT2401 Question 2 Two products A and B are made using similar equipment and methods. The data for last period are: Overheads for period Calculate the overheads to be absorbed per unit of each product based on: A. Absorption Costing using labour hour absorption rate (8 marks) B. An ABC approach using suitable cost drivers (9 marks) C. Outline the FOUR (4) stages of the ABC Process (4 marks) D. State TWO (2) Advantages and TWO (2) Disadvantages of the ABC System (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started