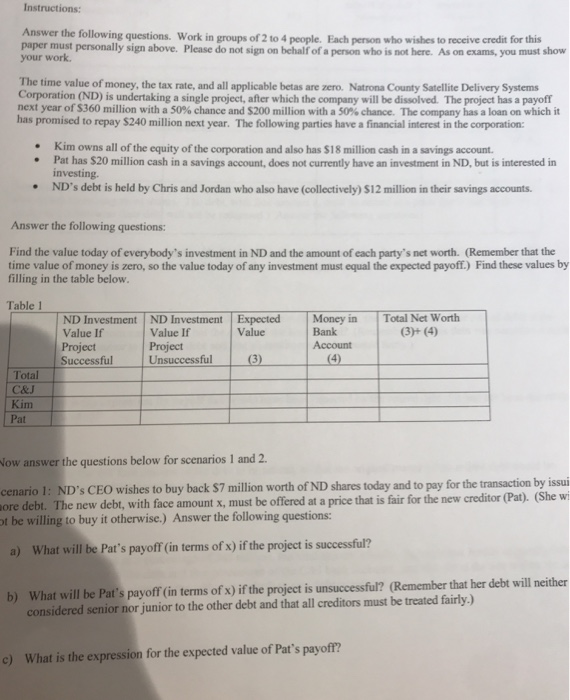

Instructions: Answer the following questions. Work in groups of 2 to 4 people. Each person who wishes to receive credit for this paper must personally sign above. Please do not sign on behalf of a person who is not here. As on exams, you must show your work The time value of money, the tax rate, and all applicable betas are zero. Natrona County Satellite Delivery Systems Corporation (ND) is undertaking a single project, after which the company will be dissolved. The project has a payoff next year of S360 million with a 50% chance and $200 million with a 50% chance. The company has a loan on which it has promised to repay $240 million next year. The following parties have a financial interest in the corporation: Kim owns all of the equity of the corporation and also has $18 million cash in a savings account. Pat has $20 million cash in a savings account, does not currently have an investment in ND, but is interested in investing. ND's debt is held by Chris and Jordan who also have (collectively) $12 million in their savings accounts. Answer the following questions: Find the value today of everybody's investment in ND and the amount of each party's net worth. (Remember that the time value of money is zero, so the value today of any investment must equal the expected payoff.) Find these values by filling in the table below. Table 1 ND Investment ND Investment Expected Value If Value If Value Project Project Successful Unsuccessful (3) Money in Bank Account (4) Total Net Worth (3)+ (4) Total C &J Kim Pat Wow answer the questions below for scenarios 1 and 2. cenario 1: ND's CEO wishes to buy back $7 million worth of ND shares today and to pay for the transaction by issui more debt. The new debt, with face amount x, must be offered at a price that is fair for the new creditor (Pat). (She wi of be willing to buy it otherwise.) Answer the following questions: a) What will be Pat's payoff (in terms of x) if the project is successful? b) What will be Pat's payoff (in terms of x) if the project is unsuccessful? (Remember that her debt will neither considered senior nor junior to the other debt and that all creditors must be treated fairly.) c) What is the expression for the expected value of Pat's payoff? Instructions: Answer the following questions. Work in groups of 2 to 4 people. Each person who wishes to receive credit for this paper must personally sign above. Please do not sign on behalf of a person who is not here. As on exams, you must show your work The time value of money, the tax rate, and all applicable betas are zero. Natrona County Satellite Delivery Systems Corporation (ND) is undertaking a single project, after which the company will be dissolved. The project has a payoff next year of S360 million with a 50% chance and $200 million with a 50% chance. The company has a loan on which it has promised to repay $240 million next year. The following parties have a financial interest in the corporation: Kim owns all of the equity of the corporation and also has $18 million cash in a savings account. Pat has $20 million cash in a savings account, does not currently have an investment in ND, but is interested in investing. ND's debt is held by Chris and Jordan who also have (collectively) $12 million in their savings accounts. Answer the following questions: Find the value today of everybody's investment in ND and the amount of each party's net worth. (Remember that the time value of money is zero, so the value today of any investment must equal the expected payoff.) Find these values by filling in the table below. Table 1 ND Investment ND Investment Expected Value If Value If Value Project Project Successful Unsuccessful (3) Money in Bank Account (4) Total Net Worth (3)+ (4) Total C &J Kim Pat Wow answer the questions below for scenarios 1 and 2. cenario 1: ND's CEO wishes to buy back $7 million worth of ND shares today and to pay for the transaction by issui more debt. The new debt, with face amount x, must be offered at a price that is fair for the new creditor (Pat). (She wi of be willing to buy it otherwise.) Answer the following questions: a) What will be Pat's payoff (in terms of x) if the project is successful? b) What will be Pat's payoff (in terms of x) if the project is unsuccessful? (Remember that her debt will neither considered senior nor junior to the other debt and that all creditors must be treated fairly.) c) What is the expression for the expected value of Pat's payoff