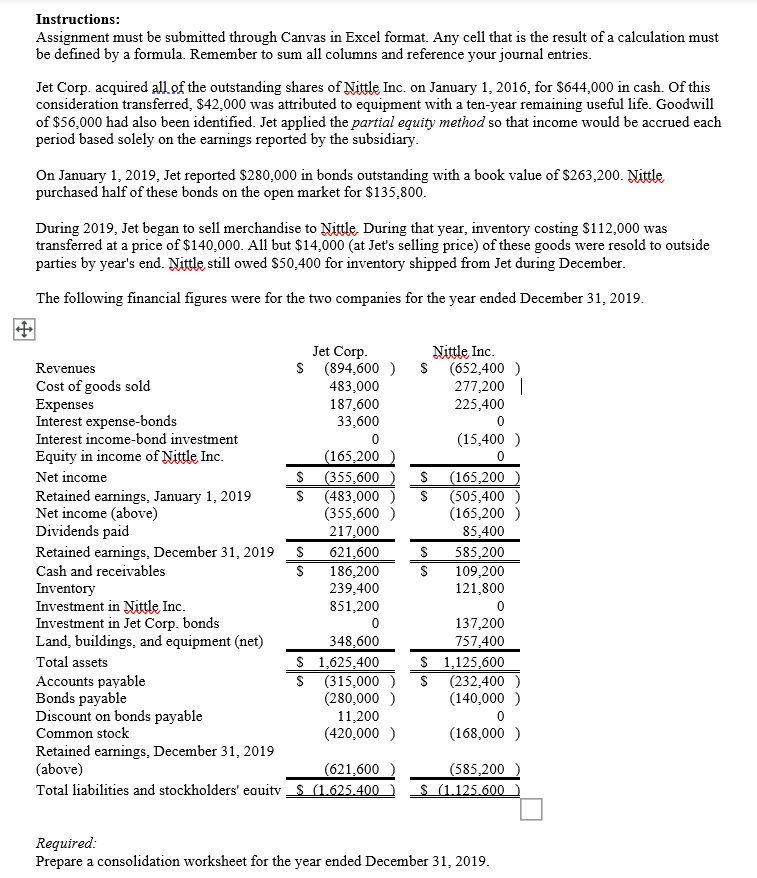

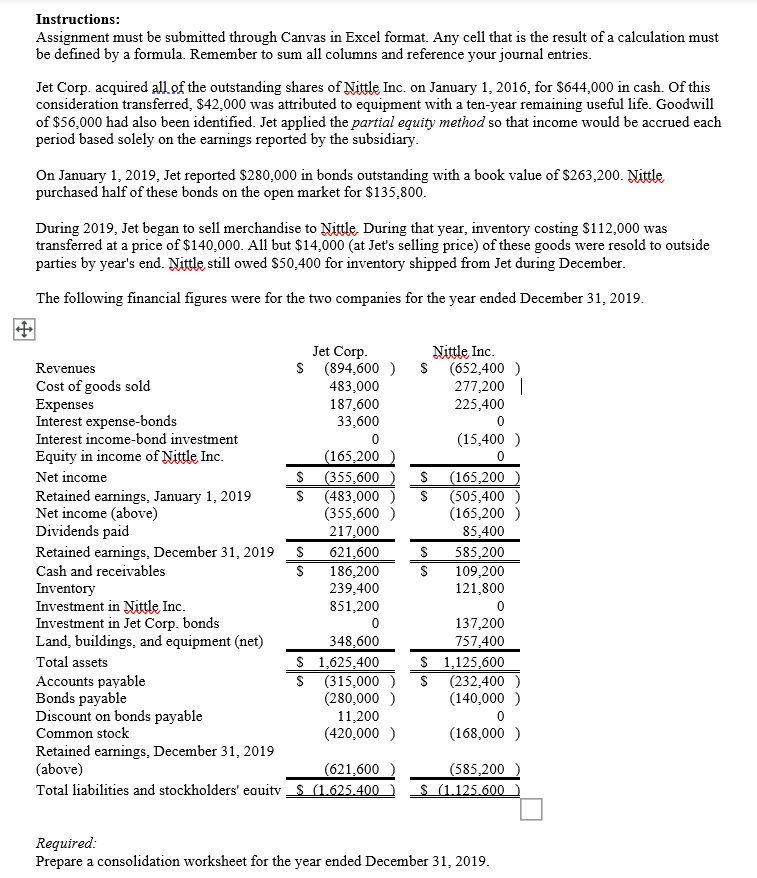

Instructions: Assignment must be submitted through Canvas in Excel format. Any cell that is the result of a calculation must be defined by a formula. Remember to sum all columns and reference your journal entries. Jet Corp. acquired all of the outstanding shares of Nittle Inc. on January 1, 2016, for $644,000 in cash. Of this consideration transferred, $42,000 was attributed to equipment with a ten-year remaining useful life. Goodwill of $56,000 had also been identified. Jet applied the partial equity method so that income would be accrued each period based solely on the earnings reported by the subsidiary. On January 1, 2019, Jet reported $280,000 in bonds outstanding with a book value of $263,200. Nittle purchased half of these bonds on the open market for $135,800. During 2019, Jet began to sell merchandise to Nittle. During that year, inventory costing $112,000 was transferred at a price of $140,000. All but $14,000 (at Jet's selling price) of these goods were resold to outside parties by year's end. Nittle still owed $50,400 for inventory shipped from Jet during December. The following financial figures were for the two companies for the year ended December 31, 2019. Nittle Inc. $ (652,400) 277,200 225,400 0 (15,400) Jet Corp Revenues $ (894,600 ) Cost of goods sold 483,000 Expenses 187,600 Interest expense-bonds 33,600 Interest income-bond investment 0 Equity in income of Nittle Inc. (165,200 Net income S (355,600 Retained earnings, January 1, 2019 $ (483,000) Net income (above) (355,600 ) Dividends paid 217,000 Retained earnings, December 31, 2019 S 621,600 Cash and receivables S 186,200 Inventory 239,400 Investment in Nittle Inc. 851,200 Investment in Jet Corp. bonds 0 Land, buildings, and equipment (net) 348,600 Total assets S 1,625,400 Accounts payable S (315,000) Bonds payable (280,000) Discount on bonds payable 11,200 Common stock (420,000) Retained earnings, December 31, 2019 (above) (621,600 Total liabilities and stockholders' eauitv S (1.625.400 S (165,200 $ (505,400 (165,200 ) 85,400 S 585,200 S 109,200 121,800 0 137,200 757,400 $ 1,125,600 S (232,400) (140,000) 0 (168,000) (585,200) S (1.125.600 Required: Prepare a consolidation worksheet for the year ended December 31, 2019. Instructions: Assignment must be submitted through Canvas in Excel format. Any cell that is the result of a calculation must be defined by a formula. Remember to sum all columns and reference your journal entries. Jet Corp. acquired all of the outstanding shares of Nittle Inc. on January 1, 2016, for $644,000 in cash. Of this consideration transferred, $42,000 was attributed to equipment with a ten-year remaining useful life. Goodwill of $56,000 had also been identified. Jet applied the partial equity method so that income would be accrued each period based solely on the earnings reported by the subsidiary. On January 1, 2019, Jet reported $280,000 in bonds outstanding with a book value of $263,200. Nittle purchased half of these bonds on the open market for $135,800. During 2019, Jet began to sell merchandise to Nittle. During that year, inventory costing $112,000 was transferred at a price of $140,000. All but $14,000 (at Jet's selling price) of these goods were resold to outside parties by year's end. Nittle still owed $50,400 for inventory shipped from Jet during December. The following financial figures were for the two companies for the year ended December 31, 2019. Nittle Inc. $ (652,400) 277,200 225,400 0 (15,400) Jet Corp Revenues $ (894,600 ) Cost of goods sold 483,000 Expenses 187,600 Interest expense-bonds 33,600 Interest income-bond investment 0 Equity in income of Nittle Inc. (165,200 Net income S (355,600 Retained earnings, January 1, 2019 $ (483,000) Net income (above) (355,600 ) Dividends paid 217,000 Retained earnings, December 31, 2019 S 621,600 Cash and receivables S 186,200 Inventory 239,400 Investment in Nittle Inc. 851,200 Investment in Jet Corp. bonds 0 Land, buildings, and equipment (net) 348,600 Total assets S 1,625,400 Accounts payable S (315,000) Bonds payable (280,000) Discount on bonds payable 11,200 Common stock (420,000) Retained earnings, December 31, 2019 (above) (621,600 Total liabilities and stockholders' eauitv S (1.625.400 S (165,200 $ (505,400 (165,200 ) 85,400 S 585,200 S 109,200 121,800 0 137,200 757,400 $ 1,125,600 S (232,400) (140,000) 0 (168,000) (585,200) S (1.125.600 Required: Prepare a consolidation worksheet for the year ended December 31, 2019