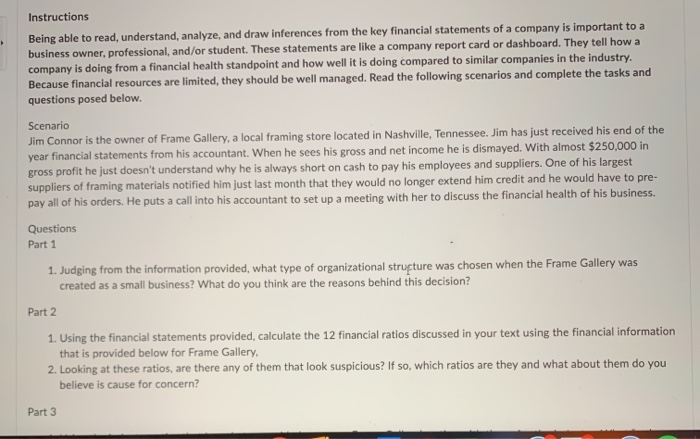

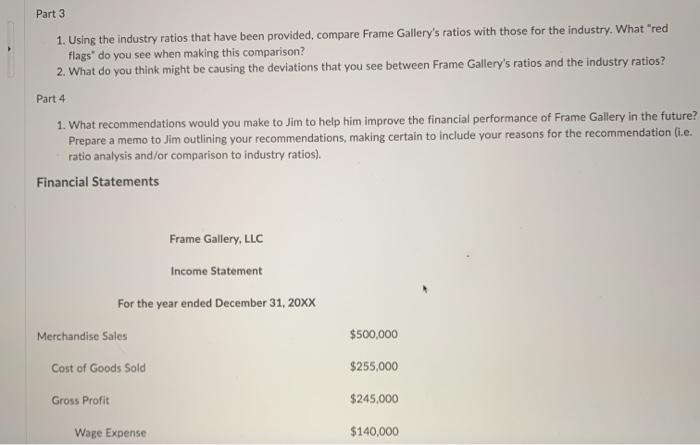

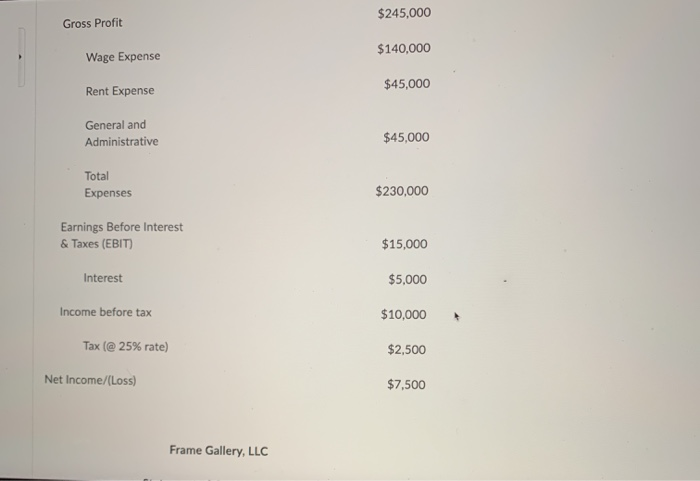

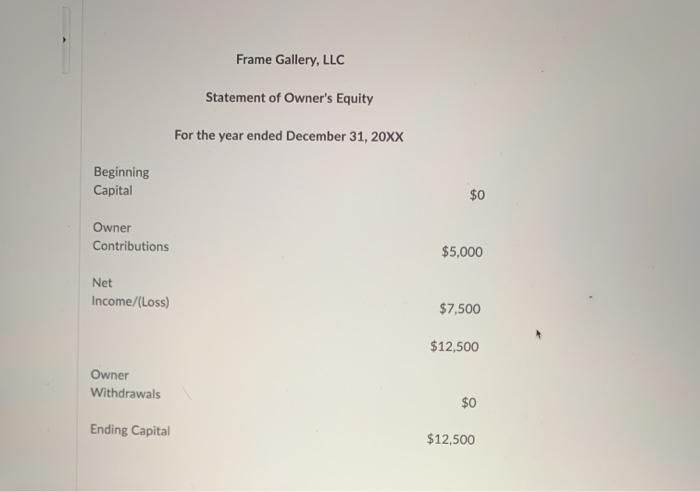

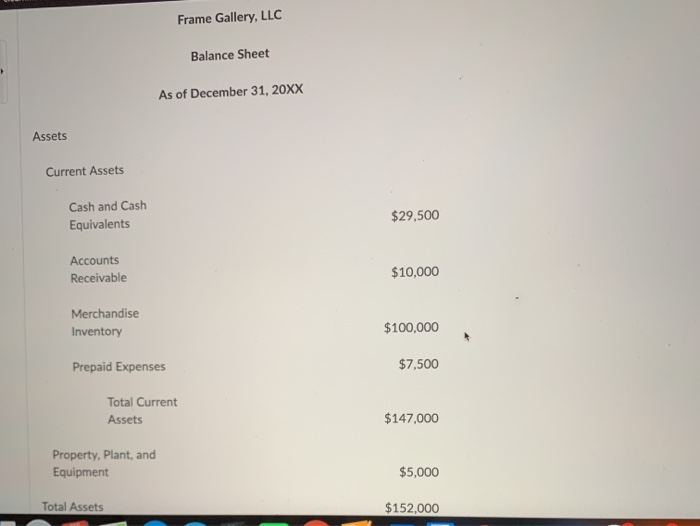

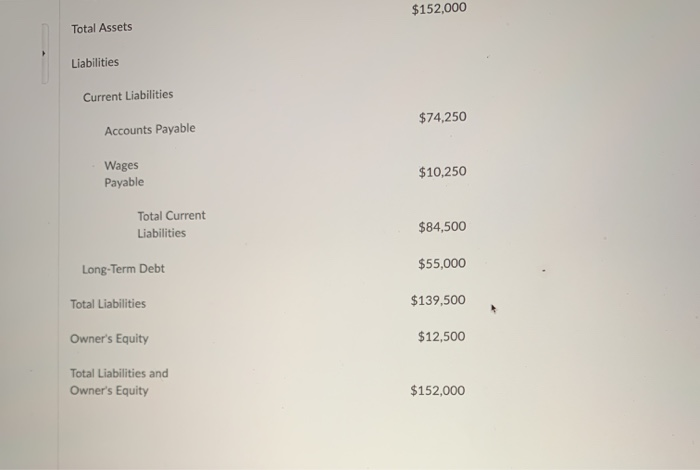

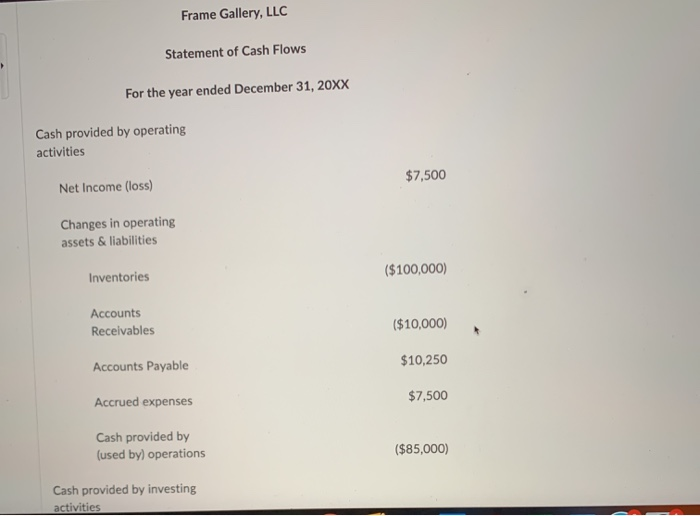

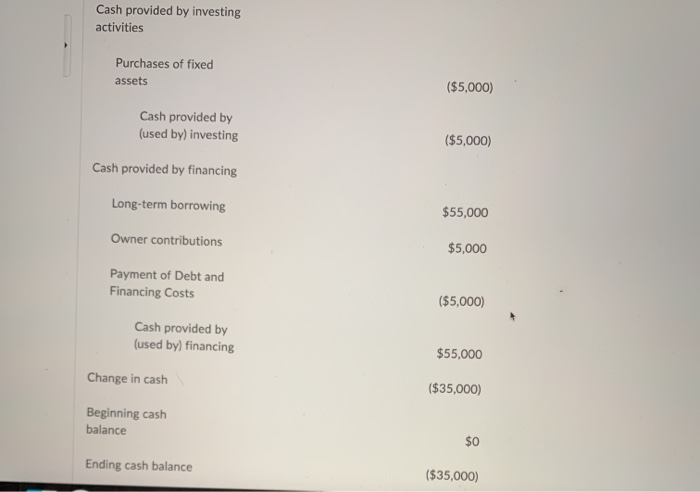

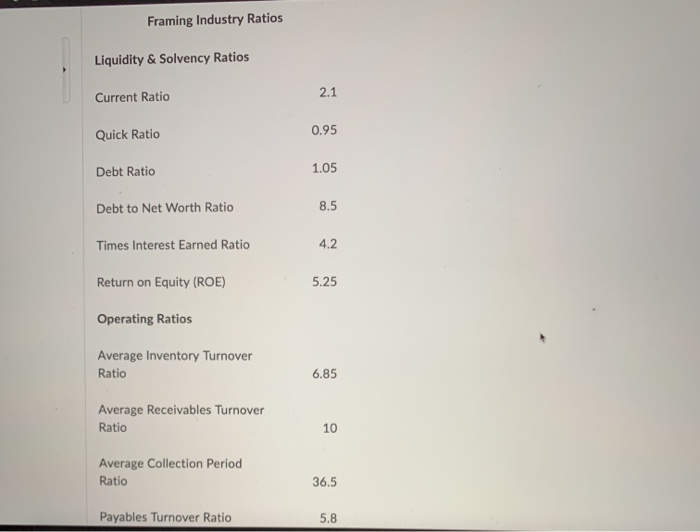

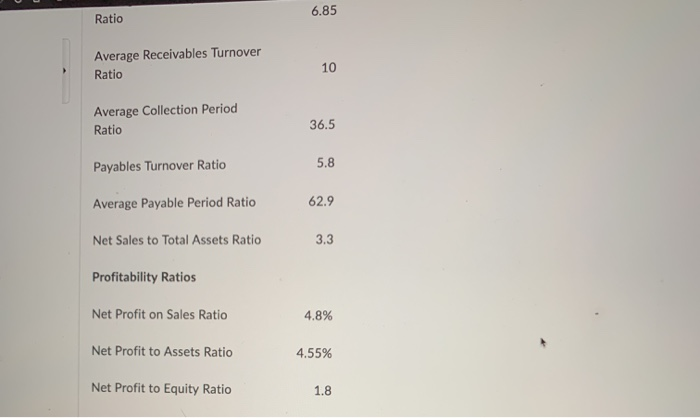

Instructions Being able to read, understand, analyze, and draw inferences from the key financial statements of a company is important to a business owner, professional, and/or student. These statements are like a company report card or dashboard. They tell how a company is doing from a financial health standpoint and how well it is doing compared to similar companies in the industry, Because financial resources are limited, they should be well managed. Read the following scenarios and complete the tasks and questions posed below. Scenario Jim Connor is the owner of Frame Gallery, a local framing store located in Nashville, Tennessee. Jim has just received his end of the year financial statements from his accountant. When he sees his gross and net income he is dismayed. With almost $250,000 in gross profit he just doesn't understand why he is always short on cash to pay his employees and suppliers. One of his largest suppliers of framing materials notified him just last month that they would no longer extend him credit and he would have to pre- pay all of his orders. He puts a call into his accountant to set up a meeting with her to discuss the financial health of his business. Questions Part 1 1. Judging from the information provided, what type of organizational structure was chosen when the Frame Gallery was created as a small business? What do you think are the reasons behind this decision? Part 2 1. Using the financial statements provided, calculate the 12 financial ratios discussed in your text using the financial information that is provided below for Frame Gallery, 2. Looking at these ratios, are there any of them that look suspicious? If so, which ratios are they and what about them do you believe is cause for concern? Part 3 Part 3 1. Using the industry ratios that have been provided, compare Frame Gallery's ratios with those for the industry. What "red flags" do you see when making this comparison? 2. What do you think might be causing the deviations that you see between Frame Gallery's ratios and the industry ratios? Part 4 1. What recommendations would you make to Jim to help him improve the financial performance of Frame Gallery in the future? Prepare a memo to Jim outlining your recommendations, making certain to include your reasons for the recommendation (i.e. ratio analysis and/or comparison to industry ratios). Financial Statements Frame Gallery, LLC Income Statement For the year ended December 31, 20XX Merchandise Sales $500,000 Cost of Goods Sold $255,000 Gross Profit $245,000 Wage Expense $140,000 $245,000 Gross Profit $140,000 Wage Expense $45,000 Rent Expense General and Administrative $45,000 Total Expenses $230,000 Earnings Before Interest & Taxes (EBIT) $15,000 Interest $5,000 Income before tax $10,000 Tax (@ 25% rate) $2,500 Net Income/(Loss) $7,500 Frame Gallery, LLC Frame Gallery, LLC Statement of Owner's Equity For the year ended December 31, 20XX Beginning Capital Owner Contributions $5,000 Net Income/(Loss) $7,500 $12,500 Owner Withdrawals Ending Capital $12,500 Frame Gallery, LLC Balance Sheet As of December 31, 20XX Assets Current Assets Cash and Cash Equivalents $29,500 Accounts Receivable $10,000 Merchandise Inventory $100,000 $7,500 Prepaid Expenses Total Current Assets $147,000 Property, Plant, and Equipment $5,000 Total Assets $152.000 $152,000 Total Assets Liabilities Current Liabilities $74,250 Accounts Payable Wages Payable $10,250 Total Current Liabilities $84,500 Long-Term Debt $55,000 Total Liabilities $139,500 Owner's Equity $12,500 Total Liabilities and Owner's Equity $152,000 Frame Gallery, LLC Statement of Cash Flows For the year ended December 31, 20XX Cash provided by operating activities $7,500 Net Income (loss) Changes in operating assets & liabilities ($100,000) Inventories Accounts Receivables ($10,000) Accounts Payable $10,250 Accrued expenses $7,500 Cash provided by (used by) operations ($85,000) Cash provided by investing activities Cash provided by investing activities Purchases of fixed assets ($5,000) Cash provided by (used by) investing ($5,000) Cash provided by financing Long-term borrowing $55,000 Owner contributions $5,000 Payment of Debt and Financing Costs ($5,000) Cash provided by (used by) financing $55,000 Change in cash ($35,000) Beginning cash balance $0 Ending cash balance ($35,000) Framing Industry Ratios Liquidity & Solvency Ratios Current Ratio 2.1 Quick Ratio 0.95 Debt Ratio 1.05 Debt to Net Worth Ratio 8.5 Times Interest Earned Ratio Return on Equity (ROE) 5.25 Operating Ratios Average Inventory Turnover Ratio 6.85 Average Receivables Turnover Ratio Average Collection Period Ratio 36.5 Payables Turnover Ratio Ratio Average Receivables Turnover Ratio Average Collection Period Ratio Payables Turnover Ratio Average Payable Period Ratio Net Sales to Total Assets Ratio Profitability Ratios Net Profit on Sales Ratio 4.8% Net Profit to Assets Ratio 4.55% Net Profit to Equity Ratio 1.8 Instructions Being able to read, understand, analyze, and draw inferences from the key financial statements of a company is important to a business owner, professional, and/or student. These statements are like a company report card or dashboard. They tell how a company is doing from a financial health standpoint and how well it is doing compared to similar companies in the industry, Because financial resources are limited, they should be well managed. Read the following scenarios and complete the tasks and questions posed below. Scenario Jim Connor is the owner of Frame Gallery, a local framing store located in Nashville, Tennessee. Jim has just received his end of the year financial statements from his accountant. When he sees his gross and net income he is dismayed. With almost $250,000 in gross profit he just doesn't understand why he is always short on cash to pay his employees and suppliers. One of his largest suppliers of framing materials notified him just last month that they would no longer extend him credit and he would have to pre- pay all of his orders. He puts a call into his accountant to set up a meeting with her to discuss the financial health of his business. Questions Part 1 1. Judging from the information provided, what type of organizational structure was chosen when the Frame Gallery was created as a small business? What do you think are the reasons behind this decision? Part 2 1. Using the financial statements provided, calculate the 12 financial ratios discussed in your text using the financial information that is provided below for Frame Gallery, 2. Looking at these ratios, are there any of them that look suspicious? If so, which ratios are they and what about them do you believe is cause for concern? Part 3 Part 3 1. Using the industry ratios that have been provided, compare Frame Gallery's ratios with those for the industry. What "red flags" do you see when making this comparison? 2. What do you think might be causing the deviations that you see between Frame Gallery's ratios and the industry ratios? Part 4 1. What recommendations would you make to Jim to help him improve the financial performance of Frame Gallery in the future? Prepare a memo to Jim outlining your recommendations, making certain to include your reasons for the recommendation (i.e. ratio analysis and/or comparison to industry ratios). Financial Statements Frame Gallery, LLC Income Statement For the year ended December 31, 20XX Merchandise Sales $500,000 Cost of Goods Sold $255,000 Gross Profit $245,000 Wage Expense $140,000 $245,000 Gross Profit $140,000 Wage Expense $45,000 Rent Expense General and Administrative $45,000 Total Expenses $230,000 Earnings Before Interest & Taxes (EBIT) $15,000 Interest $5,000 Income before tax $10,000 Tax (@ 25% rate) $2,500 Net Income/(Loss) $7,500 Frame Gallery, LLC Frame Gallery, LLC Statement of Owner's Equity For the year ended December 31, 20XX Beginning Capital Owner Contributions $5,000 Net Income/(Loss) $7,500 $12,500 Owner Withdrawals Ending Capital $12,500 Frame Gallery, LLC Balance Sheet As of December 31, 20XX Assets Current Assets Cash and Cash Equivalents $29,500 Accounts Receivable $10,000 Merchandise Inventory $100,000 $7,500 Prepaid Expenses Total Current Assets $147,000 Property, Plant, and Equipment $5,000 Total Assets $152.000 $152,000 Total Assets Liabilities Current Liabilities $74,250 Accounts Payable Wages Payable $10,250 Total Current Liabilities $84,500 Long-Term Debt $55,000 Total Liabilities $139,500 Owner's Equity $12,500 Total Liabilities and Owner's Equity $152,000 Frame Gallery, LLC Statement of Cash Flows For the year ended December 31, 20XX Cash provided by operating activities $7,500 Net Income (loss) Changes in operating assets & liabilities ($100,000) Inventories Accounts Receivables ($10,000) Accounts Payable $10,250 Accrued expenses $7,500 Cash provided by (used by) operations ($85,000) Cash provided by investing activities Cash provided by investing activities Purchases of fixed assets ($5,000) Cash provided by (used by) investing ($5,000) Cash provided by financing Long-term borrowing $55,000 Owner contributions $5,000 Payment of Debt and Financing Costs ($5,000) Cash provided by (used by) financing $55,000 Change in cash ($35,000) Beginning cash balance $0 Ending cash balance ($35,000) Framing Industry Ratios Liquidity & Solvency Ratios Current Ratio 2.1 Quick Ratio 0.95 Debt Ratio 1.05 Debt to Net Worth Ratio 8.5 Times Interest Earned Ratio Return on Equity (ROE) 5.25 Operating Ratios Average Inventory Turnover Ratio 6.85 Average Receivables Turnover Ratio Average Collection Period Ratio 36.5 Payables Turnover Ratio Ratio Average Receivables Turnover Ratio Average Collection Period Ratio Payables Turnover Ratio Average Payable Period Ratio Net Sales to Total Assets Ratio Profitability Ratios Net Profit on Sales Ratio 4.8% Net Profit to Assets Ratio 4.55% Net Profit to Equity Ratio 1.8