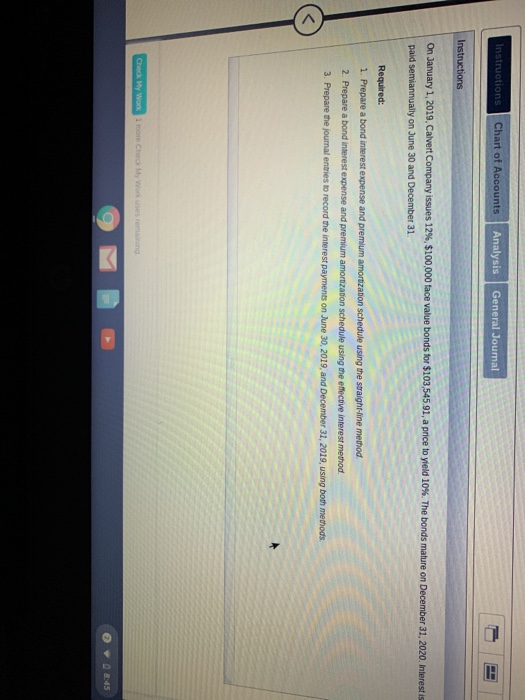

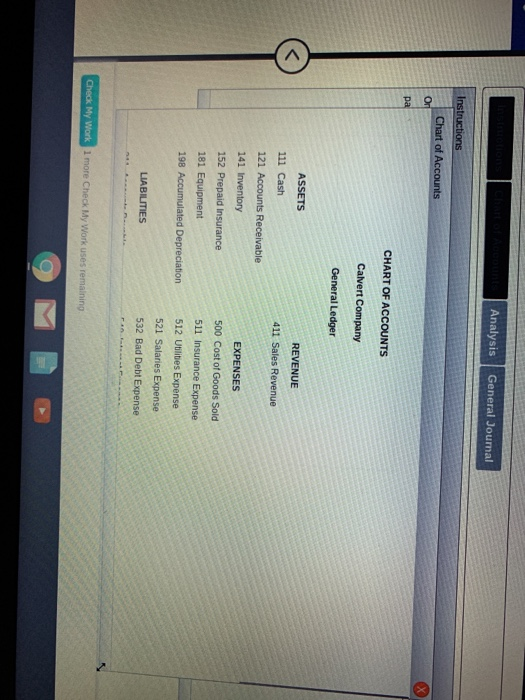

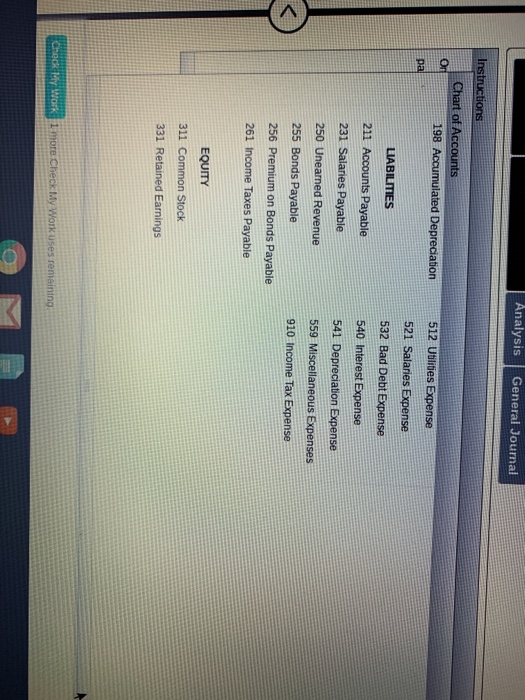

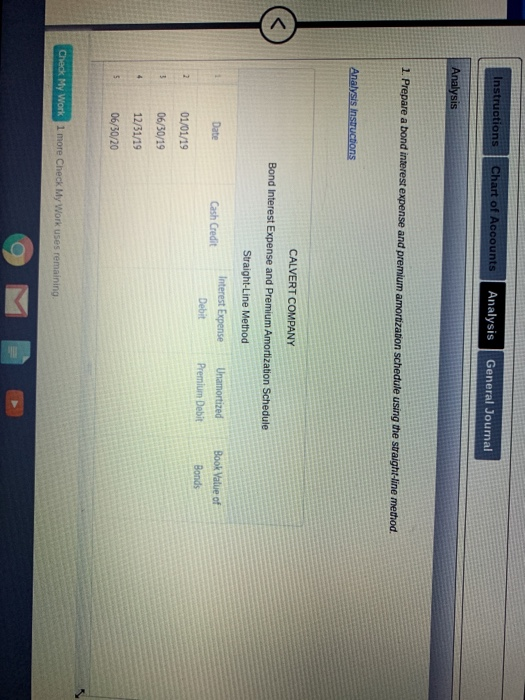

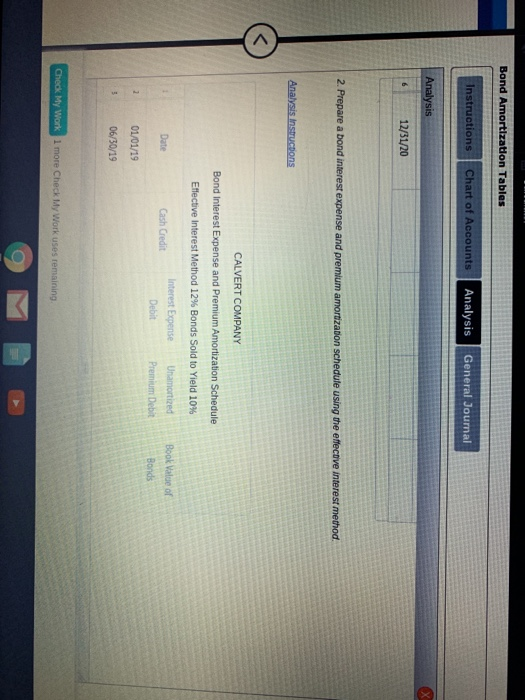

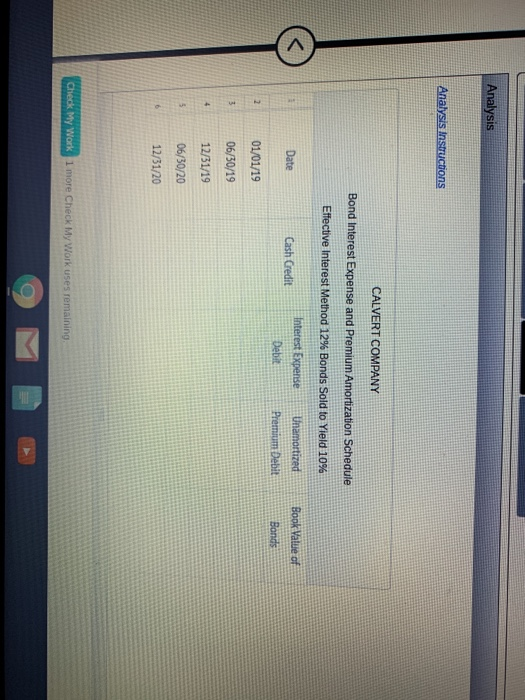

Instructions Chart of Accounts Analysis General Journal Instructions On January 1, 2019, Calvert Company issues 12%, $100,000 face value bonds for $103,545.91, a price to yield 10%. The bonds mature on December 31, 2020. Interestis paid semiannually on June 30 and December 31 Required: 1. Prepare a bond interest expense and premium amortization schedule using the straight-line method. 2. Prepare a bond interest expense and premium amortization schedule using the effective interest method. 3. Prepare the journal entries to record the interest payments on June 30, 2019, and December 31, 2019, using both methods Check My Work more CheckMy Wo n g 9 M 08:45 Analysis General Joumal Instructions Chart of Accounts CHART OF ACCOUNTS Calvert Company General Ledger REVENUE 411 Sales Revenue ASSETS 111 Cash 121 Accounts Receivable 141 Inventory 152 Prepaid Insurance 181 Equipment 198 Accumulated Depreciation EXPENSES 500 Cost of Goods Sold 511 Insurance Expense 512 Utilities Expense 521 Salaries Expense 532 Bad Debt Expense LIABILITIES Check My Work 1 more Check my work uses remaining Analysis General Journal Instructions Chart of Accounts 198 Accumulated Depreciation 512 Utilities Expense 521 Salaries Expense 532 Bad Debt Expense LIABILMES 211 Accounts Payable 231 Salaries Payable 250 Unearned Revenue 255 Bonds Payable 256 Premium on Bonds Payable 261 Income Taxes Payable 540 Interest Expense 541 Depreciation Expense 559 Miscellaneous Expenses 910 Income Tax Expense EQUITY 311 Common Stock 331 Retained Earnings Check My Work 1 more Check My Work uses remaining = Instructions Chart of Accounts Analysis General Journal Analysis 1. Prepare a bond interest expense and premium amortization schedule using the straight-line method. Analysis Instructions CALVERT COMPANY Bond Interest Expense and Premium Amortization Schedule Straight-Line Method Date Interest Expense Unamortized Cash Credit Book Value of Debit Premium Debit Bonds 01/01/19 06/30/19 12/31/19 06/30/20 Check My Work 1 more Check My Work uses remaining Bond Amortization Tables Instructions Chart of Accounts Analysis General Joumal Analysis 12/31/20 2. Prepare a bond interest expense and premium amortization schedule using the effective interest method Analysis Instructions CALVERT COMPANY Bond Interest Expense and Premium Amortization Schedule Effective Interest Method 12% Bonds Sold to Yield 10% Interest Expense Book Value of Date Cash Credit Uhamortized Premium Debit Debit Bonds 01/01/19 06/30/19 Check My Work 1 more Check My Work uses remaining. Analysis Analysis Instructions CALVERT COMPANY Bond Interest Expense and Premium Amortization Schedule Effective Interest Method 12% Bonds Sold to Yield 10% Interest Experise Date Cash Credit Book Value of Unamortized Premium Debit Debat Bonds 01/01/19 06/30/19 12/31/19 06/30/20 12/31/20 Check My Work 1 more Check My Work uses remaining, Instructions Chart of Accounts Analysis General Journal Analysis General Journal 3. Prepare the journal entries to record the interest payments on June 30, 2019 and December 31, 2019, using the straight line method. General Journal ons GENERAL JOURNAL ACCOUNT TITLE Check My Work more Check My Wo r m Instructions Chart of Accounts Analysis General Joumal Analysis General Journal 30. Prepare the journal entries to record the interest payments on June 30, 2019, and December 31, 2019, using the effective interest method General mansons GENERAL JOURNAL ACCOUNT TITLE DM Wonimore Checky Woksesta General Joumu Analysis General Journal General Journal Instructions GENERAL JOURNAL PAGE 1 ACCOUNT TITLE POST. RIE CREDIT Chery W ine Checy Workestering