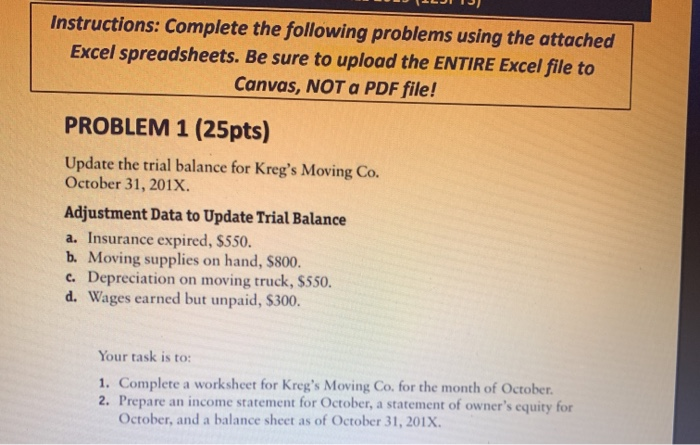

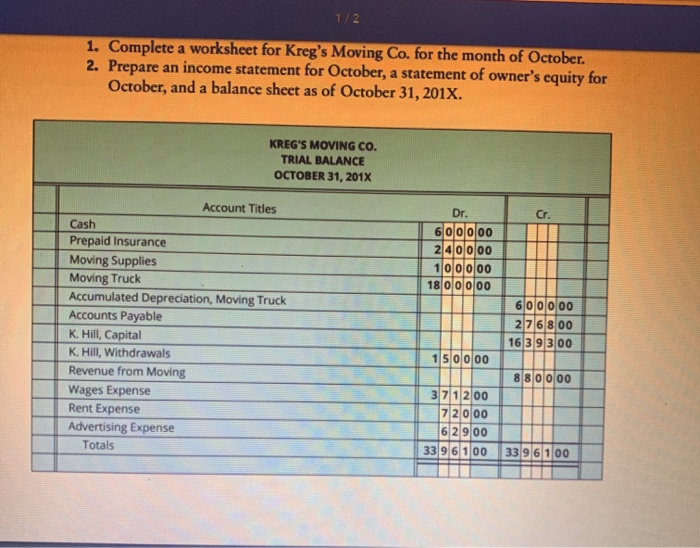

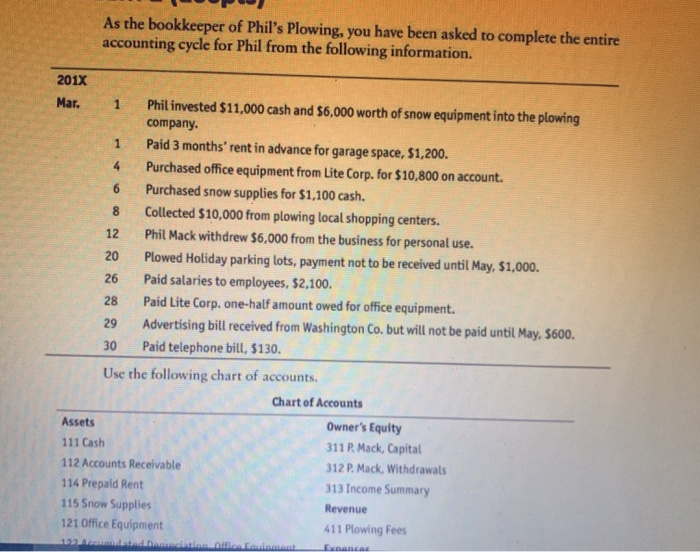

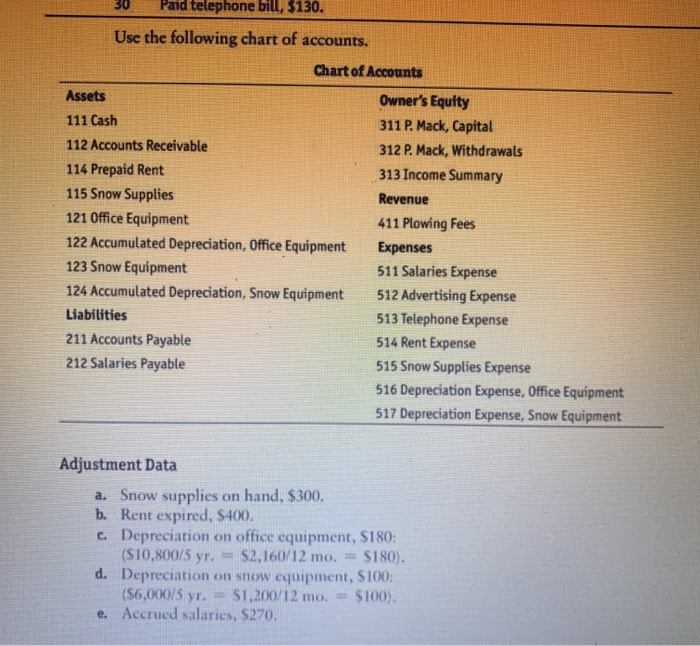

Instructions: Complete the following problems using the attached Excel spreadsheets. Be sure to upload the ENTIRE Excel file to Canvas, NOT a PDF file! PROBLEM 1 (25pts) Update the trial balance for Kreg's Moving Co. October 31, 201X. Adjustment Data to Update Trial Balance a. Insurance expired, $550. b. Moving supplies on hand, $800. c. Depreciation on moving truck, $550. d. Wages earned but unpaid, $300. Your task is to: 1. Complete a worksheet for Kreg's Moving Co, for the month of October 2. Prepare an income statement for October, a statement of owner's equity for October, and a balance sheet as of October 31, 201X. 112 1. Complete a worksheet for Kreg's Moving Co. for the month of October 2. Prepare an income statement for October, a statement of owner's equity for October, and a balance sheet as of October 31, 2018. KREG'S MOVING CO. TRIAL BALANCE OCTOBER 31, 2017 Account Titles Cash Prepaid Insurance Moving Supplies . Moving Truck Accumulated Depreciation, Moving Truck Accounts Payable K. Hill, Capital K. Hill, Withdrawals Revenue from Moving Wages Expense Rent Expense Advertising Expense Totals Dr. 60 00 00 2 40 000 10 00 00 18 0 0 0 00 60 00 00 2 7 6 800 16 3 9 3.00 150 000 8 8 0 0 00 37 12 00 172 000 6 2 900 33 96100 33 96 100 As the bookkeeper of Phil's Plowing, you have been asked to complete the entire accounting cycle for Phil from the following information. 8 12 201X Mar. Phil invested $11,000 cash and $6,000 worth of snow equipment into the plowing company. Paid 3 months' rent in advance for garage space, $1,200. Purchased office equipment from Lite Corp. for $10,800 on account. Purchased snow supplies for $1,100 cash. Collected $10,000 from plowing local shopping centers. Phil Mack withdrew $6,000 from the business for personal use. 20 Plowed Holiday parking lots, payment not to be received until May, $1,000. 26 Paid salaries to employees, $2,100. 28 Paid Lite Corp. one-half amount owed for office equipment. 29 Advertising bill received from Washington Co. but will not be paid until May, 5600. 30 Paid telephone bill, $130. Use the following chart of accounts. Chart of Accounts Assets Owner's Equity 111 Cash 311 P. Mack, Capital 112 Accounts Receivable 312 P. Mack, Withdrawals 114 Prepaid Rent 313 Income Summary 115 Snow Supplies Revenue 121 Office Equipment 411 Plowing Fees 122 anatomi ca rald telephone bill, $130. Use the following chart of accounts. Chart of Accounts Assets Owner's Equity 111 Cash 311 P. Mack, Capital 112 Accounts Receivable 312 P. Mack, Withdrawals 114 Prepaid Rent 313 Income Summary 115 Snow Supplies Revenue 121 Office Equipment 411 Plowing Fees 122 Accumulated Depreciation, Office Equipment Expenses 123 Snow Equipment 511 Salaries Expense 124 Accumulated Depreciation, Snow Equipment 512 Advertising Expense Liabilities 513 Telephone Expense 211 Accounts Payable 514 Rent Expense 212 Salaries Payable 515 Snow Supplies Expense 516 Depreciation Expense, Office Equipment 517 Depreciation Expense, Snow Equipment Adjustment Data a. Snow supplies on hand, $300. b. Rent expired, S400. c. Depreciation on office equipment, S180: ($10,800/5 yr.= $2,160/12 mo. = $180). d. Depreciation on snow equipment, S100: ($6,000/5 yr. - 51,200/12 mo. = 5100), e. Accrued salaries, $270