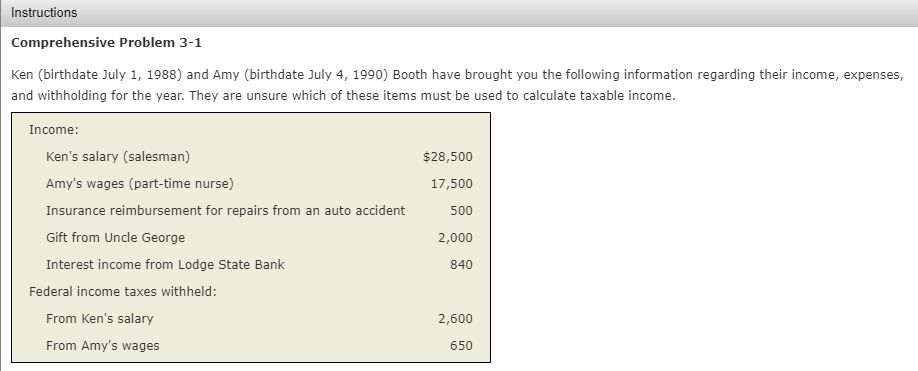

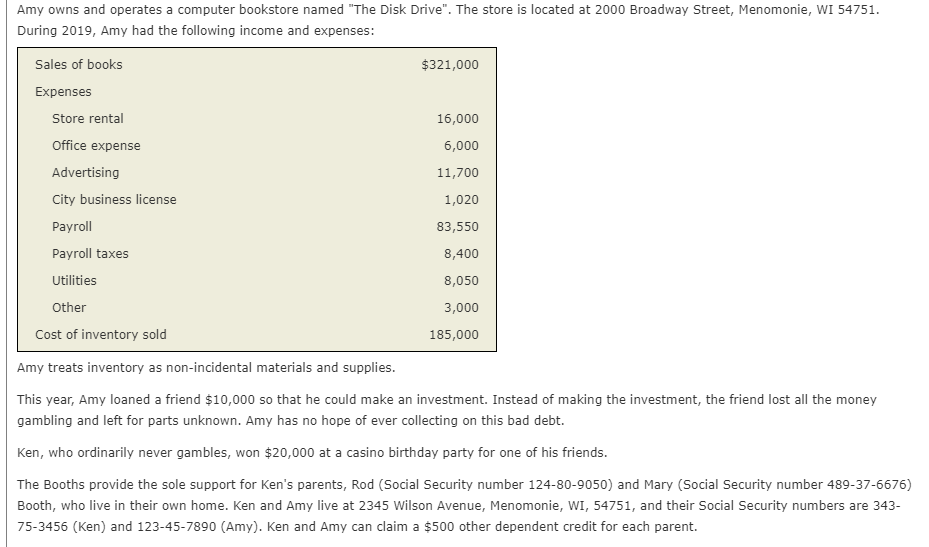

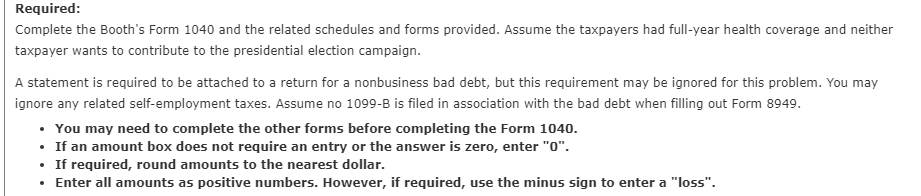

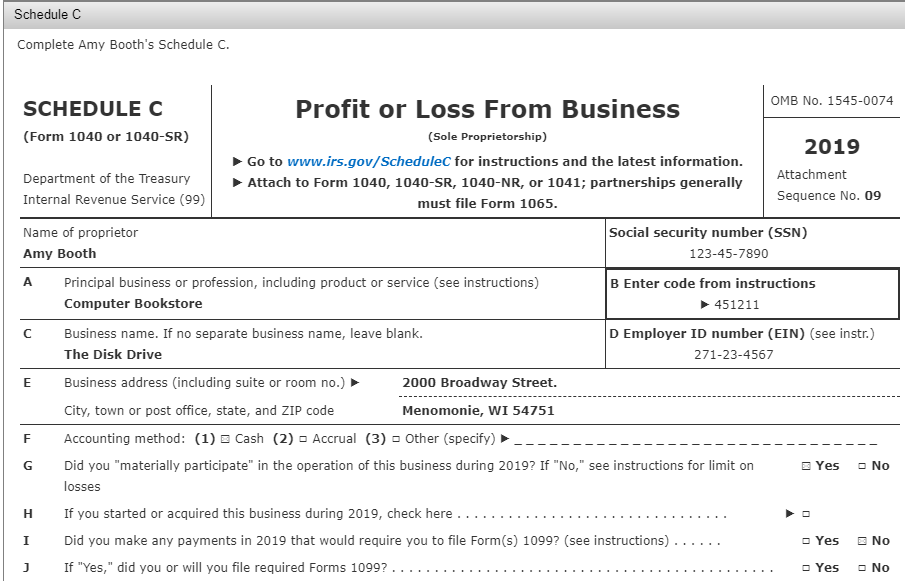

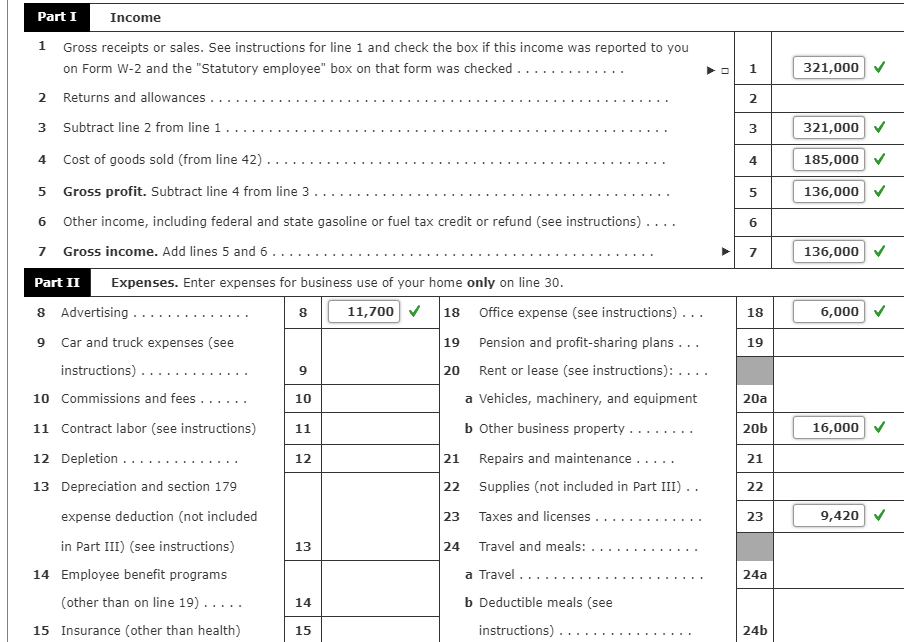

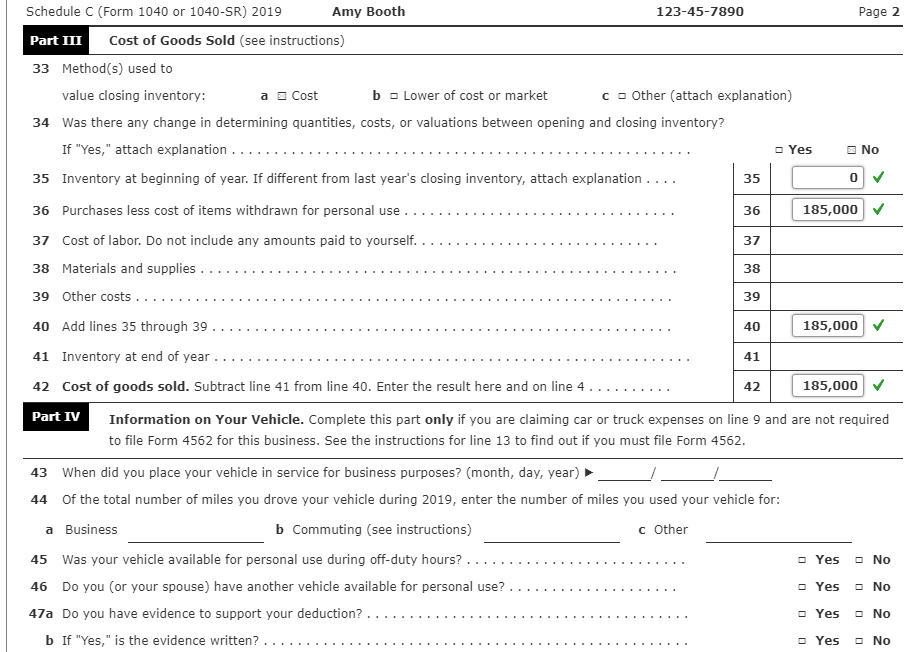

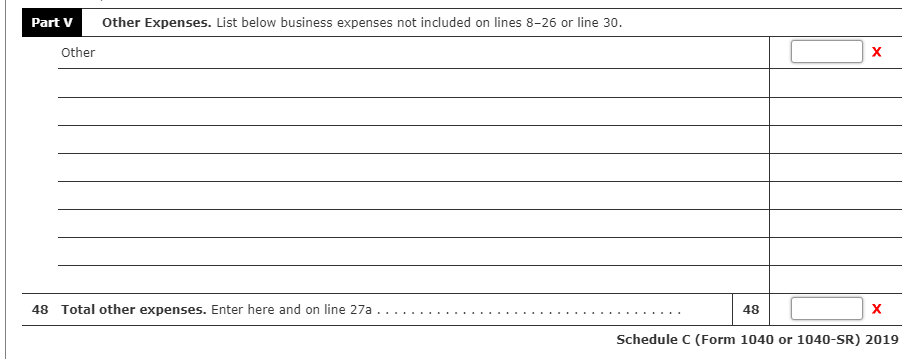

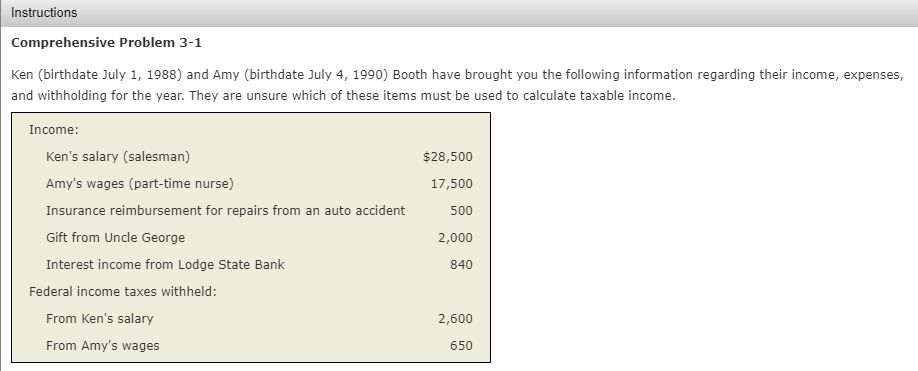

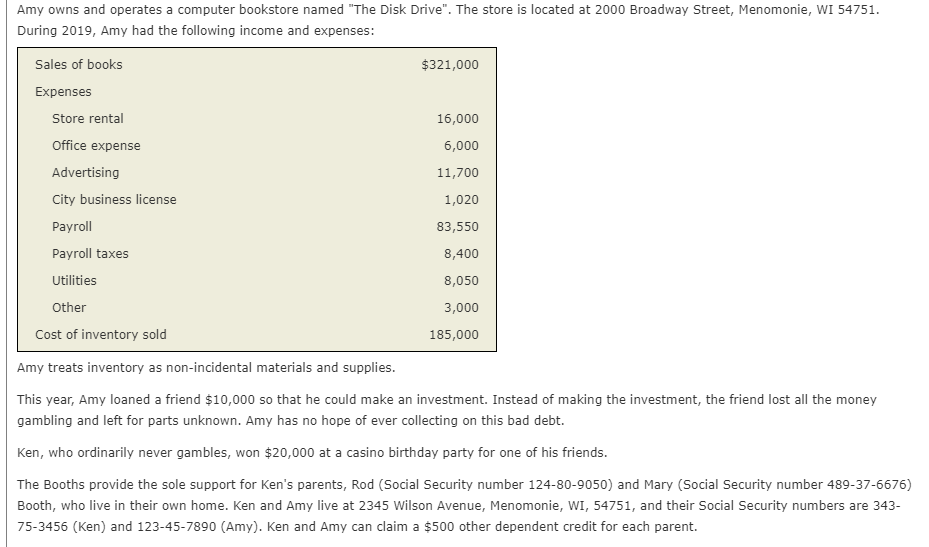

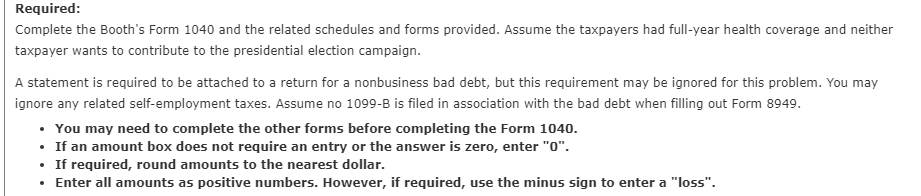

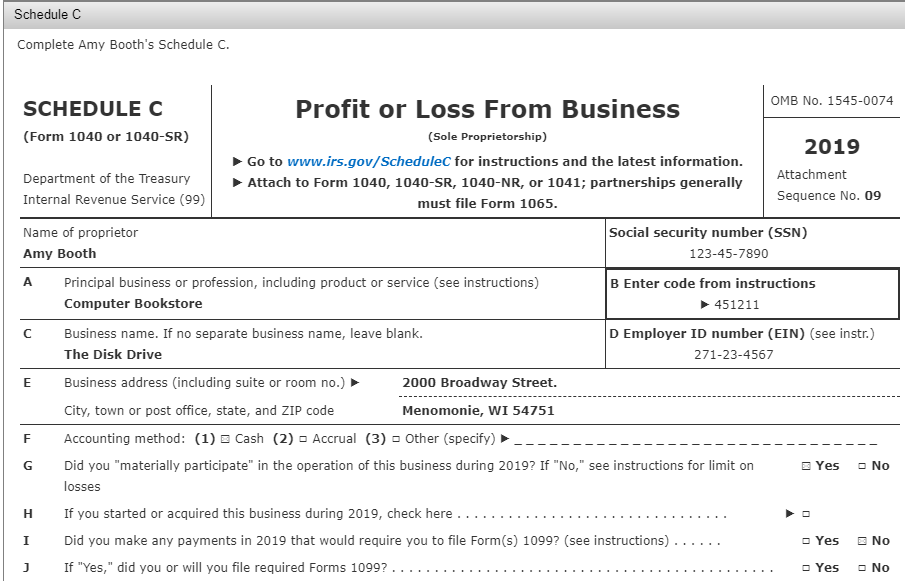

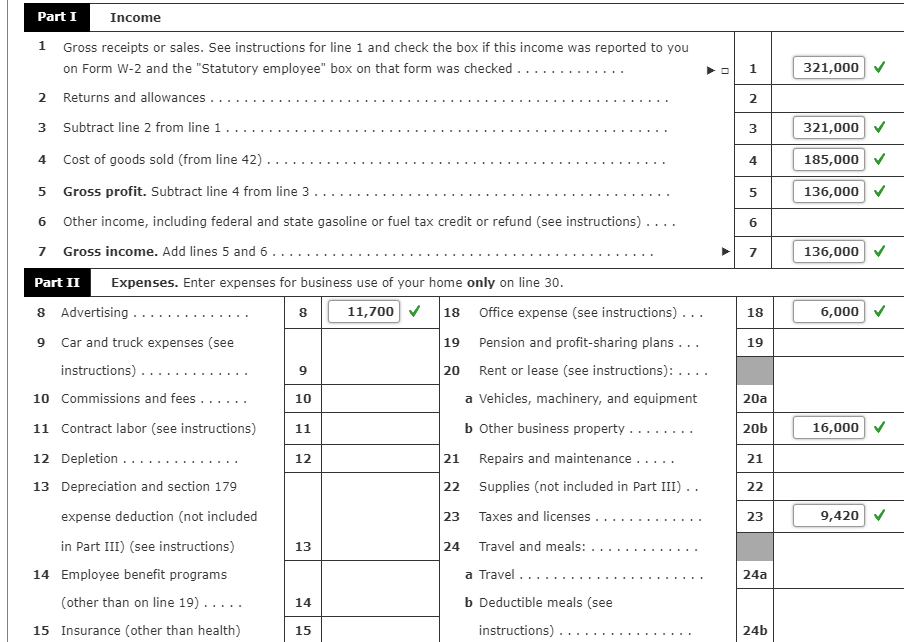

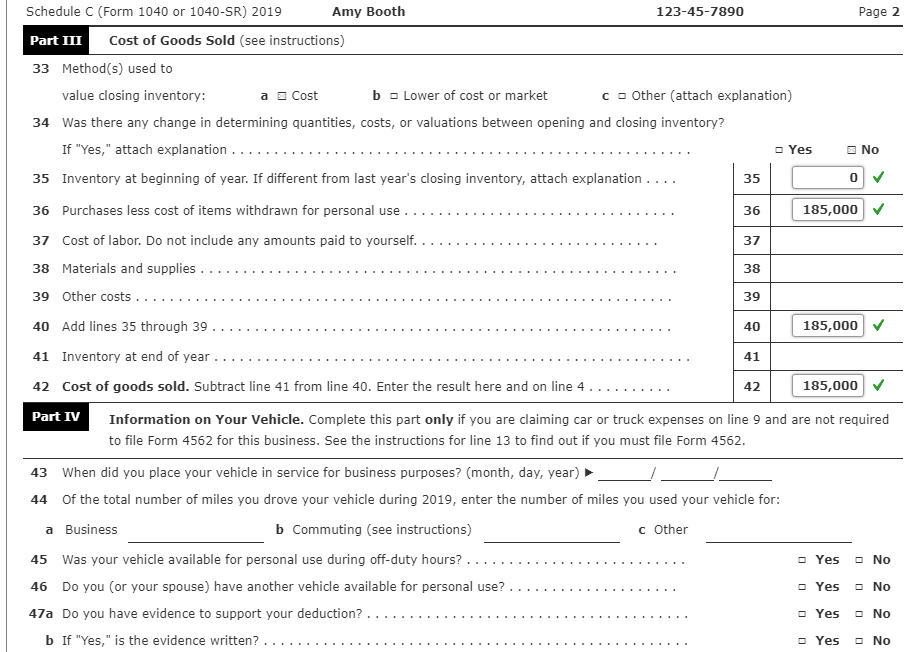

Instructions Comprehensive Problem 3-1 Ken (birthdate July 1, 1988) and Amy (birthdate July 4, 1990) Booth have brought you the following information regarding their income, expenses, and withholding for the year. They are unsure which of these items must be used to calculate taxable income. Income: Ken's salary (salesman) $28,500 Amy's wages (part-time nurse) 17,500 Insurance reimbursement for repairs from an auto accident 500 Gift from Uncle George 2,000 Interest income from Lodge State Bank 840 Federal income taxes withheld: From Ken's salary 2,600 From Amy's wages 650 Amy owns and operates a computer bookstore named "The Disk Drive". The store is located at 2000 Broadway Street, Menomonie, WI 54751. During 2019, Amy had the following income and expenses: Sales of books $321,000 Expenses Store rental 16,000 Office expense 6,000 Advertising 11,700 City business license 1,020 Payroll 83,550 Payroll taxes 8,400 Utilities 8,050 Other 3,000 Cost of inventory sold 185,000 Amy treats inventory as non-incidental materials and supplies. This year, Amy loaned a friend $10,000 so that he could make an investment. Instead of making the investment, the friend lost all the money gambling and left for parts unknown. Amy has no hope of ever collecting on this bad debt. Ken, who ordinarily never gambles, won $20,000 at a casino birthday party for one of his friends. The Booths provide the sole support for Ken's parents, Rod (Social Security number 124-80-9050) and Mary (Social Security number 489-37-6676) Booth, who live in their own home. Ken and Amy live at 2345 Wilson Avenue, Menomonie, WI, 54751, and their Social Security numbers are 343- 75-3456 (Ken) and 123-45-7890 (Amy). Ken and Amy can claim a $500 other dependent credit for each parent. Required: Complete the Booth's Form 1040 and the related schedules and forms provided. Assume the taxpayers had full-year health coverage and neither taxpayer wants to contribute to the presidential election campaign. A statement is required to be attached to a return for a nonbusiness bad debt, but this requirement may be ignored for this problem. You may ignore any related self-employment taxes. Assume no 1099-B is filed in association with the bad debt when filling out Form 8949. You may need to complete the other forms before completing the Form 1040. If an amount box does not require an entry or the answer is zero, enter "0". If required, round amounts to the nearest dollar. Enter all amounts as positive numbers. However, if required, use the minus sign to enter a "loss". Schedule C Complete Amy Booth's Schedule C. Profit or Loss From Business SCHEDULE OMB No. 1545-0074 (Form 1040 or 1040-SR) (Sole Proprietorship) 2019 Go to www.irs.gov/Schedule for instructions and the latest information. Department of the Treasury Attachment Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally Internal Revenue Service (99) must file Form 1065. Sequence No. 09 Name of proprietor Social security number (SSN) Amy Booth 123-45-7890 A Principal business or profession, including product or service (see instructions) B Enter code from instructions Computer Bookstore 451211 Business name. If no separate business name, leave blank. D Employer ID number (EIN) (see instr.) The Disk Drive 271-23-4567 E Business address (including suite or room no.) 2000 Broadway Street. City, town or post office, state, and ZIP code Menomonie, WI 54751 Accounting method: (1) Cash (2) - Accrual (3) - Other (specify) Did you "materially participate in the operation of this business during 2019? If "No," see instructions for limit on Yes losses If you started or acquired this business during 2019, check here ..... I Did you make any payments in 2019 that would require you to file Form(s) 1099? (see instructions). Yes If "Yes," did you or will you file required Forms 1099?... F G O No H E No J Yes No 1 321,000 2. 2 3 321,000 4 185,000 5 136,000 6 6 7 136,000 18 18 6,000 Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. 2 Returns and allowances.. 3 Subtract line 2 from line 1 4 Cost of goods sold (from line 42).. 5 Gross profit. Subtract line 4 from line 3 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) .... 7 Gross income. Add lines 5 and 6... Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising ... 8 11,700 Office expense (see instructions) ... 9 Car and truck expenses (see 19 Pension and profit-sharing plans... instructions) .. 9 Rent or lease see instructions): .... 10 Commissions and fees a Vehicles, machinery, and equipment 11 Contract labor (see instructions) b Other business property ... 12 Depletion. Repairs and maintenance ... 13 Depreciation and section 179 22 Supplies (not included in Part III) .. expense deduction (not included 23 Taxes and licenses in Part III) (see instructions) 13 Travel and meals: 14 Employee benefit programs a Travel .. (other than on line 19)..... b Deductible meals (see 15 Insurance (other than health) instructions) .... 19 20 20a 10 11 20b 16,000 12 21 21 22 23 9,420 24 24a 14 15 24b Yes 36 37 38 39 Schedule C (Form 1040 or 1040-SR) 2019 Amy Booth 123-45-7890 Page 2 Part III Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: a Cost b - Lower of cost or market C - Other (attach explanation) 34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanation ... No 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation ... 35 o 36 Purchases less cost of items withdrawn for personal use. 185,000 37 Cost of labor. Do not include any amounts paid to yourself. 38 Materials and supplies .. 39 Other costs. 40 Add lines 35 through 39. 185,000 41 Inventory at end of year .... 41 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4. 42 185,000 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month, day, year) 44 of the total number of miles you drove your vehicle during 2019, enter the number of miles you used your vehicle for: a Business b Commuting (see instructions) c Other 45 Was your vehicle available for personal use during off-duty hours? Yes No 46 Do you (or your spouse) have another vehicle available for personal use? 47a Do you have evidence to support your deduction?.. b If "Yes," is the evidence written?... 40 Yes No Yes No Yes No Part V Other Expenses. List below business expenses not included on lines 8-26 or line 30. Other 48 Total other expenses. Enter here and on line 27a 48 Schedule C (Form 1040 or 1040-SR) 2019 Instructions Comprehensive Problem 3-1 Ken (birthdate July 1, 1988) and Amy (birthdate July 4, 1990) Booth have brought you the following information regarding their income, expenses, and withholding for the year. They are unsure which of these items must be used to calculate taxable income. Income: Ken's salary (salesman) $28,500 Amy's wages (part-time nurse) 17,500 Insurance reimbursement for repairs from an auto accident 500 Gift from Uncle George 2,000 Interest income from Lodge State Bank 840 Federal income taxes withheld: From Ken's salary 2,600 From Amy's wages 650 Amy owns and operates a computer bookstore named "The Disk Drive". The store is located at 2000 Broadway Street, Menomonie, WI 54751. During 2019, Amy had the following income and expenses: Sales of books $321,000 Expenses Store rental 16,000 Office expense 6,000 Advertising 11,700 City business license 1,020 Payroll 83,550 Payroll taxes 8,400 Utilities 8,050 Other 3,000 Cost of inventory sold 185,000 Amy treats inventory as non-incidental materials and supplies. This year, Amy loaned a friend $10,000 so that he could make an investment. Instead of making the investment, the friend lost all the money gambling and left for parts unknown. Amy has no hope of ever collecting on this bad debt. Ken, who ordinarily never gambles, won $20,000 at a casino birthday party for one of his friends. The Booths provide the sole support for Ken's parents, Rod (Social Security number 124-80-9050) and Mary (Social Security number 489-37-6676) Booth, who live in their own home. Ken and Amy live at 2345 Wilson Avenue, Menomonie, WI, 54751, and their Social Security numbers are 343- 75-3456 (Ken) and 123-45-7890 (Amy). Ken and Amy can claim a $500 other dependent credit for each parent. Required: Complete the Booth's Form 1040 and the related schedules and forms provided. Assume the taxpayers had full-year health coverage and neither taxpayer wants to contribute to the presidential election campaign. A statement is required to be attached to a return for a nonbusiness bad debt, but this requirement may be ignored for this problem. You may ignore any related self-employment taxes. Assume no 1099-B is filed in association with the bad debt when filling out Form 8949. You may need to complete the other forms before completing the Form 1040. If an amount box does not require an entry or the answer is zero, enter "0". If required, round amounts to the nearest dollar. Enter all amounts as positive numbers. However, if required, use the minus sign to enter a "loss". Schedule C Complete Amy Booth's Schedule C. Profit or Loss From Business SCHEDULE OMB No. 1545-0074 (Form 1040 or 1040-SR) (Sole Proprietorship) 2019 Go to www.irs.gov/Schedule for instructions and the latest information. Department of the Treasury Attachment Attach to Form 1040, 1040-SR, 1040-NR, or 1041; partnerships generally Internal Revenue Service (99) must file Form 1065. Sequence No. 09 Name of proprietor Social security number (SSN) Amy Booth 123-45-7890 A Principal business or profession, including product or service (see instructions) B Enter code from instructions Computer Bookstore 451211 Business name. If no separate business name, leave blank. D Employer ID number (EIN) (see instr.) The Disk Drive 271-23-4567 E Business address (including suite or room no.) 2000 Broadway Street. City, town or post office, state, and ZIP code Menomonie, WI 54751 Accounting method: (1) Cash (2) - Accrual (3) - Other (specify) Did you "materially participate in the operation of this business during 2019? If "No," see instructions for limit on Yes losses If you started or acquired this business during 2019, check here ..... I Did you make any payments in 2019 that would require you to file Form(s) 1099? (see instructions). Yes If "Yes," did you or will you file required Forms 1099?... F G O No H E No J Yes No 1 321,000 2. 2 3 321,000 4 185,000 5 136,000 6 6 7 136,000 18 18 6,000 Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked. 2 Returns and allowances.. 3 Subtract line 2 from line 1 4 Cost of goods sold (from line 42).. 5 Gross profit. Subtract line 4 from line 3 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) .... 7 Gross income. Add lines 5 and 6... Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising ... 8 11,700 Office expense (see instructions) ... 9 Car and truck expenses (see 19 Pension and profit-sharing plans... instructions) .. 9 Rent or lease see instructions): .... 10 Commissions and fees a Vehicles, machinery, and equipment 11 Contract labor (see instructions) b Other business property ... 12 Depletion. Repairs and maintenance ... 13 Depreciation and section 179 22 Supplies (not included in Part III) .. expense deduction (not included 23 Taxes and licenses in Part III) (see instructions) 13 Travel and meals: 14 Employee benefit programs a Travel .. (other than on line 19)..... b Deductible meals (see 15 Insurance (other than health) instructions) .... 19 20 20a 10 11 20b 16,000 12 21 21 22 23 9,420 24 24a 14 15 24b Yes 36 37 38 39 Schedule C (Form 1040 or 1040-SR) 2019 Amy Booth 123-45-7890 Page 2 Part III Cost of Goods Sold (see instructions) 33 Method(s) used to value closing inventory: a Cost b - Lower of cost or market C - Other (attach explanation) 34 Was there any change in determining quantities, costs, or valuations between opening and closing inventory? If "Yes," attach explanation ... No 35 Inventory at beginning of year. If different from last year's closing inventory, attach explanation ... 35 o 36 Purchases less cost of items withdrawn for personal use. 185,000 37 Cost of labor. Do not include any amounts paid to yourself. 38 Materials and supplies .. 39 Other costs. 40 Add lines 35 through 39. 185,000 41 Inventory at end of year .... 41 42 Cost of goods sold. Subtract line 41 from line 40. Enter the result here and on line 4. 42 185,000 Part IV Information on Your Vehicle. Complete this part only if you are claiming car or truck expenses on line 9 and are not required to file Form 4562 for this business. See the instructions for line 13 to find out if you must file Form 4562. 43 When did you place your vehicle in service for business purposes? (month, day, year) 44 of the total number of miles you drove your vehicle during 2019, enter the number of miles you used your vehicle for: a Business b Commuting (see instructions) c Other 45 Was your vehicle available for personal use during off-duty hours? Yes No 46 Do you (or your spouse) have another vehicle available for personal use? 47a Do you have evidence to support your deduction?.. b If "Yes," is the evidence written?... 40 Yes No Yes No Yes No Part V Other Expenses. List below business expenses not included on lines 8-26 or line 30. Other 48 Total other expenses. Enter here and on line 27a 48 Schedule C (Form 1040 or 1040-SR) 2019