Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: Determine a final numerical answer for each question. You will record your ANSWERS ONLY O THPS-1 Answer Submission Form on iCollege. For all

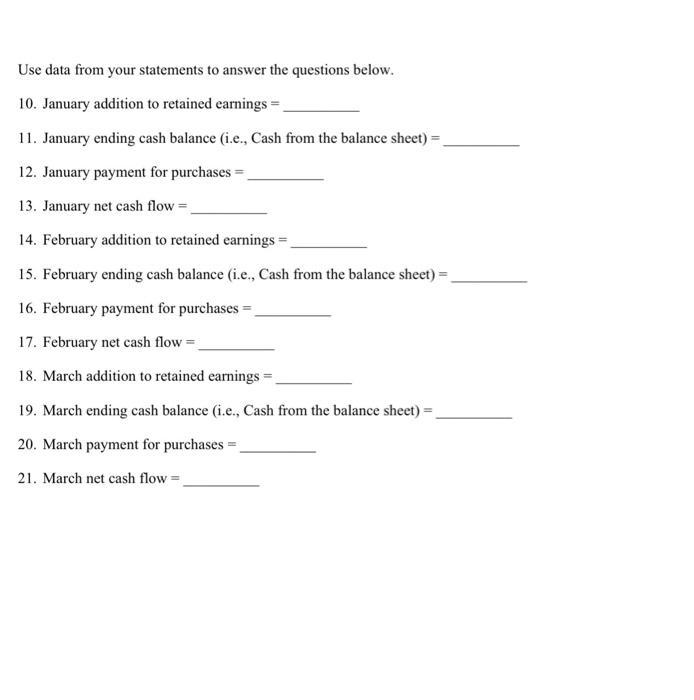

Instructions: Determine a final numerical answer for each question. You will record your ANSWERS ONLY O THPS-1 Answer Submission Form on iCollege. For all questions (unless otherwise specifically instructed) round (if necessary) all answers to whole dollar amounts (Le, zero decimal places), but you will NOT recort the dollar sign or any commas on iCollege. For example, round $24,302.84 to $24,303 and record this value or iCollege at 24303 USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS 10-21 Using the assumptions below concerning the Fast Growth Company, construct income statements, balance sheets and cash inflow-outflow statements for the company for the months of January, February, and March ASSUMPTIONS: Initial investment (made on January 1 when company begins operations) - $700,000 Selling price $60 per unit COGS-variable cost-$40 per unit Fixed costs $15,000 per month Credit policy- net 45 days (assume all sales are on credit) Inventory policy - 21-day supply (Note that this means inventory at the end of the month will be 21/30 of sales for that month. Thus, given that January sales 4,000 units (see below), January ending inventory will be 2,800 units). Inventory carried at cost (i.e., at $40 per unit) All bills are paid immediately (this implies that accounts payable and accruals - 50) . Dividends 20% of monthly net income . . There are 30 days in every month. All revenues, costs, cash inflows and cash outflows are evenly distributed through the month. If additional funds are needed, these will be in the form of debt (i.e., bank loans). The company will borrow money if cash - $0 on the balance sheet. The amount borrowed will be what is necessary to balance the balance sheet with cash-So. 14,000 units Monthly Sales: January 4,000 units, February - 8,000 units, March For each month, your statements should include the accounts shown below: "Month" Income Statement Cash Accounts receivable Inventory Total assets Revenue -COGS - Fixed costs Net income -Dividends Addition to retained earnings "Month" Balance Sheet Debt Equity Total liab. & equity "Month" Cash Inflow Outflow Statement Total Cash inflows Payment for purchases Payment of fixed costs Dividends paid Net cash flow Use data from your statements to answer the questions below. 10. January addition to retained earnings = 11. January ending cash balance (i.e., Cash from the balance sheet) =_ 12. January payment for purchases = 13. January net cash flow=_ 14. February addition to retained earnings = 15. February ending cash balance (i.e., Cash from the balance sheet) =_ 16. February payment for purchases =_ 17. February net cash flow = 18. March addition to retained earnings = 19. March ending cash balance (i.e., Cash from the balance sheet) = 20. March payment for purchases == 21. March net cash flow=

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER PART A 10 Income statements for the Fast Growth Company for the months of January February and March are shown below January Sales 4000 COGS 16...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started