Answered step by step

Verified Expert Solution

Question

1 Approved Answer

instructions: explain the financial reporting adjustment required for the year ended 31 december 2020 in respect of the issues identified in Larsen's handover notes(exhibit 3).

instructions: explain the financial reporting adjustment required for the year ended 31 december 2020 in respect of the issues identified in Larsen's handover notes(exhibit 3). Include journal entries for each adjustment

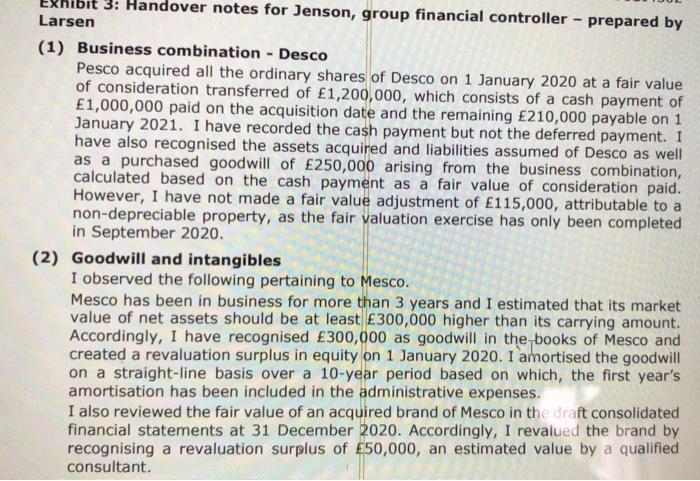

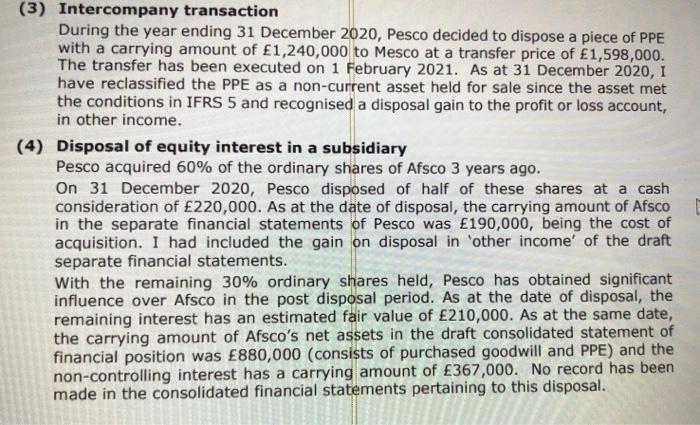

3: Handover notes for Jenson, group financial controller - prepared by Larsen (1) Business combination - Desco Pesco acquired all the ordinary shares of Desco on 1 January 2020 at a fair value of consideration transferred of 1,200,000, which consists of a cash payment of 1,000,000 paid on the acquisition date and the remaining 210,000 payable on 1 January 2021. I have recorded the cash payment but not the deferred payment. I have also recognised the assets acquired and liabilities assumed of Desco as well as a purchased goodwill of 250,000 arising from the business combination, calculated based on the cash payment as a fair value of consideration paid. However, I have not made a fair value adjustment of 115,000, attributable to a non-depreciable property, as the fair valuation exercise has only been completed in September 2020. (2) Goodwill and intangibles I observed the following pertaining to Mesco. Mesco has been in business for more than 3 years and I estimated that its market value of net assets should be at least 300,000 higher than its carrying amount. Accordingly, I have recognised 300,000 as goodwill in the books of Mesco and created a revaluation surplus in equity on 1 January 2020. I amortised the goodwill on a straight-line basis over a 10-year period based on which, the first year's amortisation has been included in the administrative expenses. I also reviewed the fair value of an acquired brand of Mesco in the draft consolidated financial statements at 31 December 2020. Accordingly, I revalued the brand by recognising a revaluation surplus of 50,000, an estimated value by a qualified consultant.

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

3 Inventory I noted that there was an overstatement of inventory in the draft financial statements of Mesco by E20000 as at 31 December 2020 I have therefore made the necessary adjustment in the finan...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started