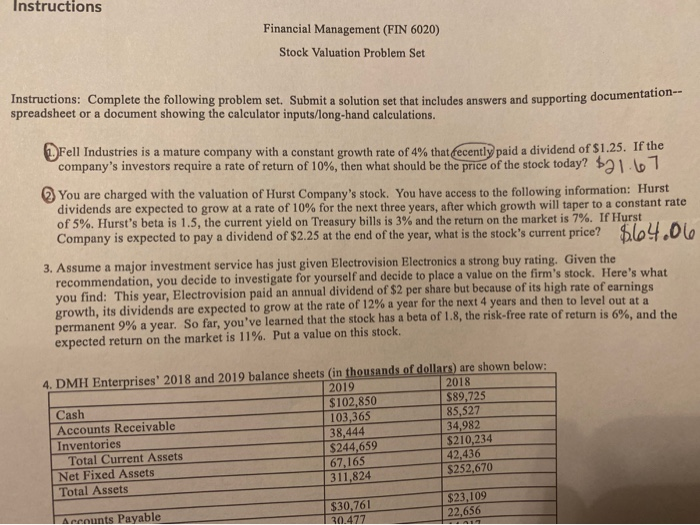

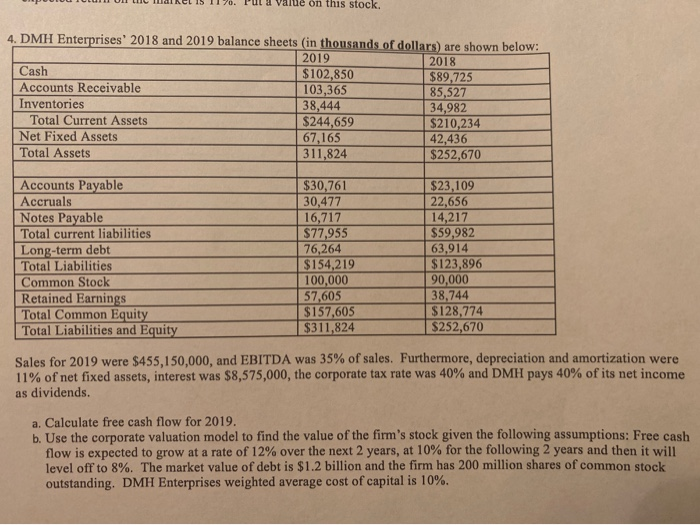

Instructions Financial Management (FIN 6020) Stock Valuation Problem Set Instructions: Complete the following problem set. Submit a solution set that includes answers and supporting documentation -- spreadsheet or a document showing the calculator inputs/long-hand calculations. Fell Industries is a mature company with a constant growth rate of 4% that fecently paid a dividend of $1.25. If the company's investors require a rate of return of 10%, then what should be the price of the stock today? $21.67 You are charged with the valuation of Hurst Company's stock. You have access to the following information: Hurst dividends are expected to grow at a rate of 10% for the next three years, after which growth will taper to a constant rate of 5%. Hurst's beta is 1.5, the current yield on Treasury bills is 3% and the return on the market is 7%. If Hurst Company is expected to pay a dividend of $2.25 at the end of the year, what is the stock's current price? $64.06 3. Assume a major investment service has just given Electrovision Electronics a strong buy rating. Given the recommendation, you decide to investigate for yourself and decide to place a value on the firm's stock. Here's what you find: This year, Electrovision paid an annual dividend of $2 per share but because of its high rate of earnings growth, its dividends are expected to grow at the rate of 12% a year for the next 4 years and then to level out at a permanent 9% a year. So far, you've learned that the stock has a beta of 1.8, the risk-free rate of return is 6%, and the expected return on the market is 11%. Put a value on this stock, 4. DMH Enterprises' 2018 and 2019 balance sheets (in thousands of dollars) are shown below: 2019 2018 Cash $102,850 $89,725 Accounts Receivable 103,365 85,527 Inventories 38,444 34,982 Total Current Assets $244,659 $210,234 Net Fixed Assets 67,165 42,436 Total Assets 311,824 $252,670 $30,761 30.477 $23,109 22,656 Accounts Payable a value on this stock. 4. DMH Enterprises' 2018 and 2019 balance sheets (in thousands of dollars) are shown below: 2019 2018 Cash $102,850 $89,725 Accounts Receivable 103,365 85,527 Inventories 38,444 34,982 Total Current Assets $244,659 $210,234 Net Fixed Assets 67,165 42,436 Total Assets 311,824 $252,670 Accounts Payable Accruals Notes Payable Total current liabilities Long-term debt Total Liabilities Common Stock Retained Earnings Total Common Equity Total Liabilities and Equity $30,761 30,477 16,717 $77,955 76,264 $154,219 100,000 57,605 $157,605 $311,824 $23,109 22,656 14,217 $59,982 63,914 $123,896 90,000 38,744 $128,774 $252,670 Sales for 2019 were $455,150,000, and EBITDA was 35% of sales. Furthermore, depreciation and amortization were 11% of net fixed assets, interest was $8,575,000, the corporate tax rate was 40% and DMH pays 40% of its net income as dividends. a. Calculate free cash flow for 2019. b. Use the corporate valuation model to find the value of the firm's stock given the following assumptions: Free cash flow is expected to grow at a rate of 12% over the next 2 years, at 10% for the following 2 years and then it will level off to 8%. The market value of debt is $1.2 billion and the firm has 200 million shares of common stock outstanding. DMH Enterprises weighted average cost of capital is 10%