Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions: For calculation questions the final answer should be formatted in dollars too the nearest cent and percentage to two (2) decimal places. No rounding

| Instructions: | For calculation questions the final answer should be formatted in dollars too the nearest cent and percentage to two (2) decimal places. No rounding of intermediate work. |

|---|

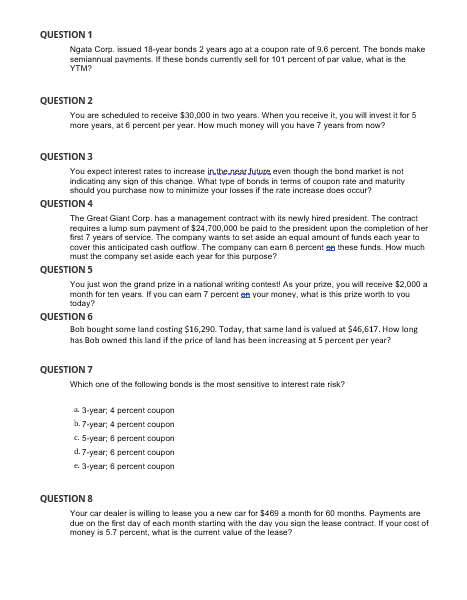

QUESTION 1 Ngata Corp. issued 18 -year bonds 2 years ago at a coupon rate of 9.6 percent. The bonds make semiannual payments. If these bonds currently sell for 101 percent of par value, what is the YTM? QUESTION 2 You are scheduled to receive $30,000 in two years. When you receive it, you will invest it for 5 more years, at 6 percent per year. How much money will you have 7 years from now? QUESTION 3 You expect interest rates to increase inthenes future even though the bond market is not indicating any sign of this chanpe. What type of bonds in terms of coupon rate and maturity should you purchase now to minimize your losses if the rate increase does occur? QUESTION 4 The Great Giant Corp. has a management contract with its newly hired president. The contract requires a lump sum payment of $24,700,000 be paid to the president upon the completion of her first 7 years of service. The company wants to set aside an equal amount of funds each year to cover this anticipated cash outflow. The company can eam 6 percent an these funds. How much must the company set aside each year for this purpose? QUESTION 5 You just won the grand prize in a national writing contest! As your prize, you will receive $2,000 a month for ten vears. If you can earn 7 percent efl your money, what is this prize worth to you today? QUESTION 6 Bob bought same land costing $16,290. Today, that same land is valued at $46,617. How long has Bob owned this land if the price of land has been increasing at 5 percent per year? QUESTION 7 Which one of the following bonds is the most sensitive to interest rate risk? a. 3-year; 4 percent coupon b. 7 -year; 4 percent coupon c. 5 -year; 6 percent coupon d. 7 -year; 6 percent coupon e. 3-year; 6 percent coupon QUESTION 8 Your car dealer is willing to lease you a new car for $469 a month for 60 months. Payments are due on the first day of each month starting with the day vou sipn the lease contract. If your cost of maney is 5.7 percent, what is the current value of the lease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started