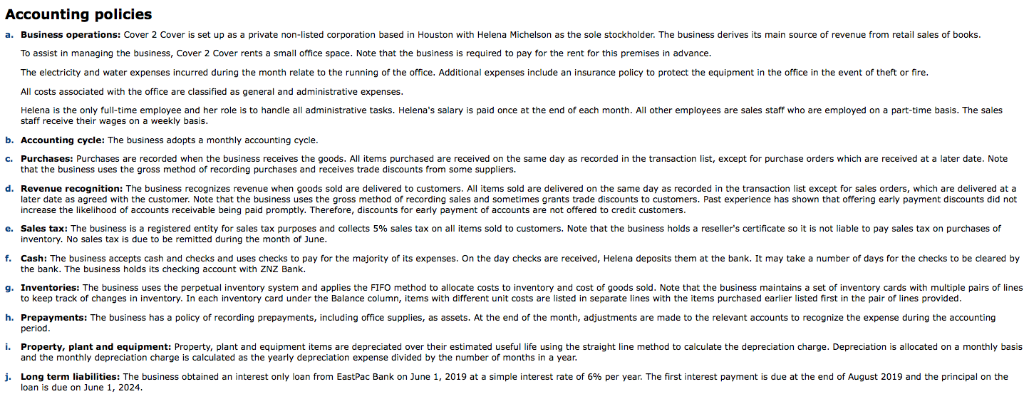

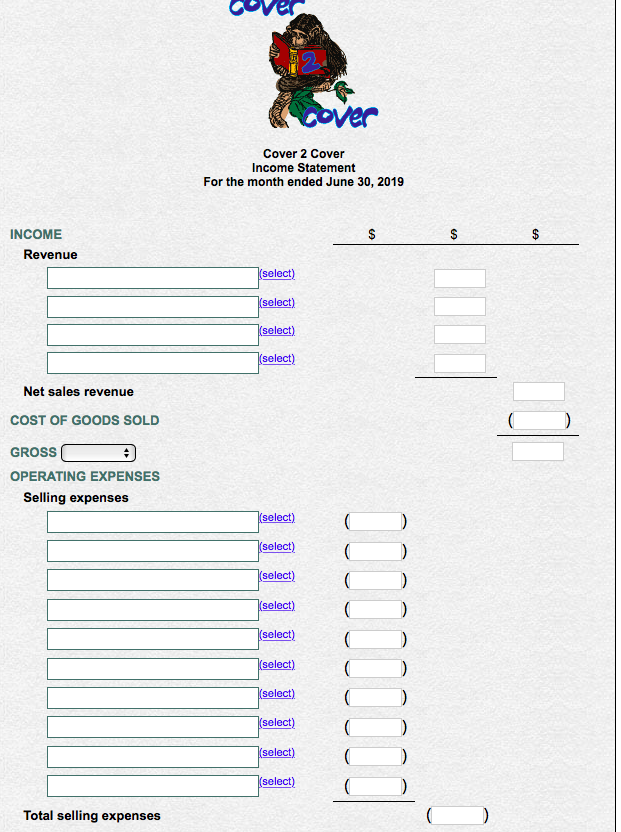

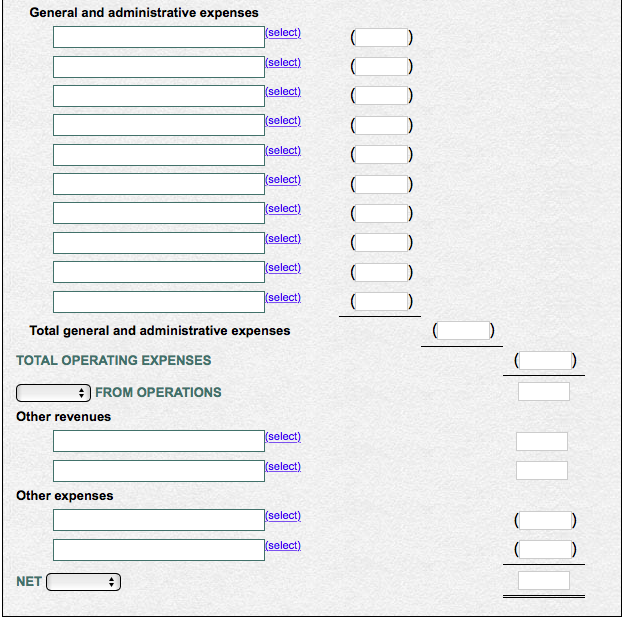

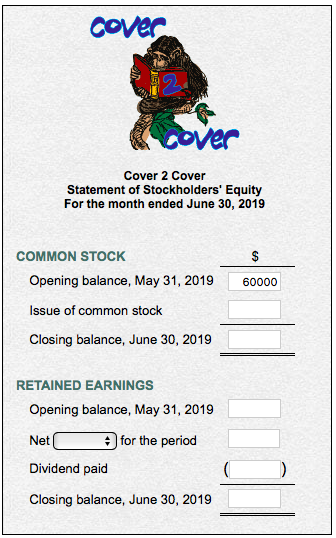

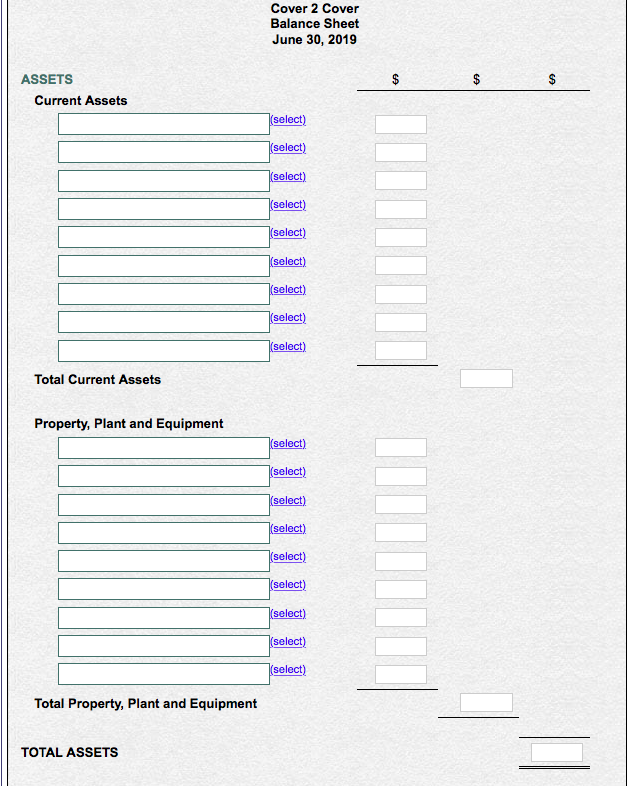

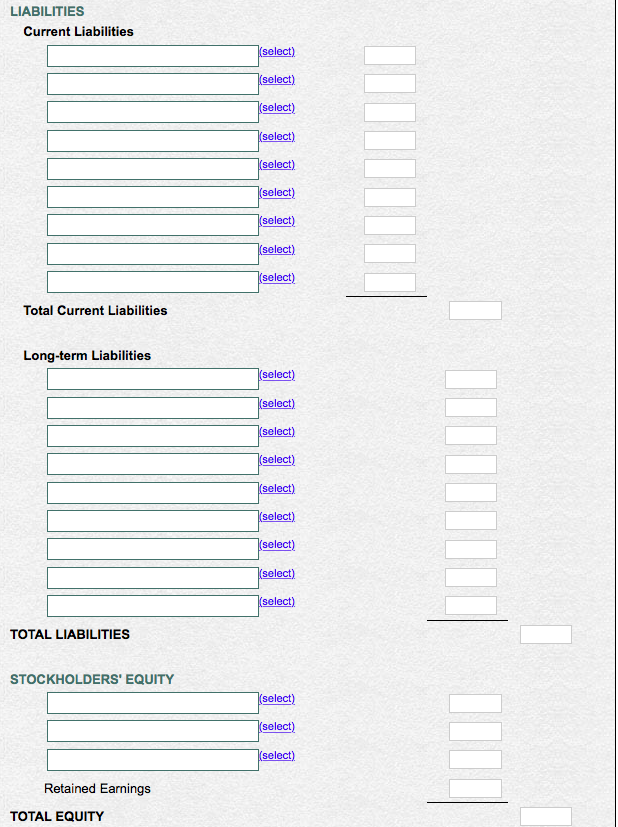

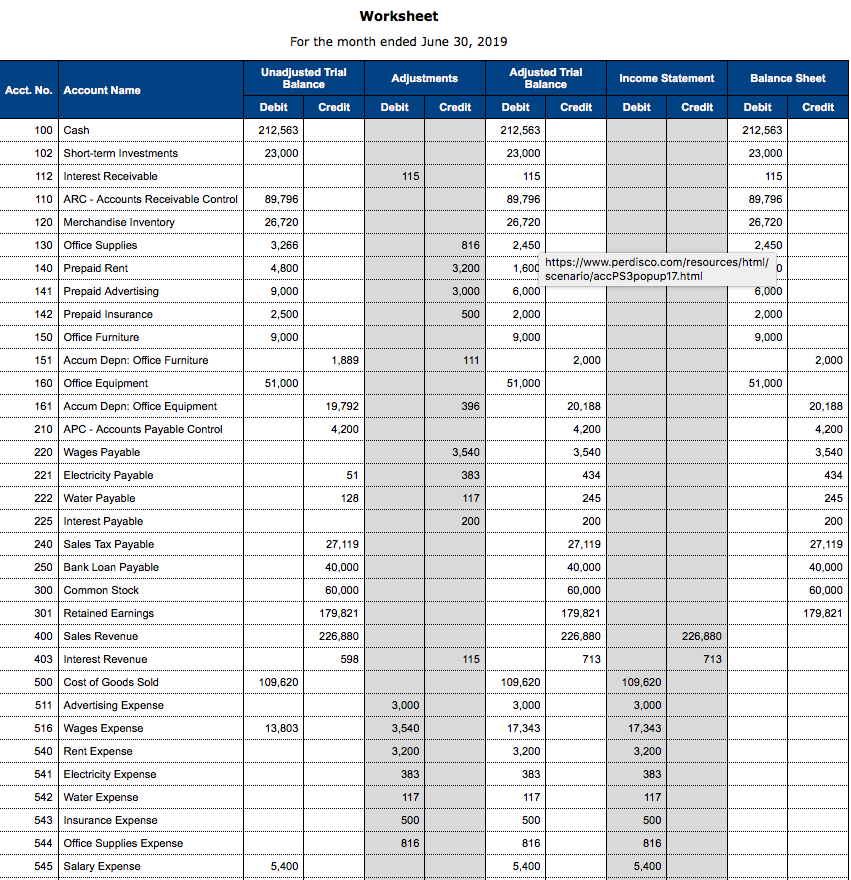

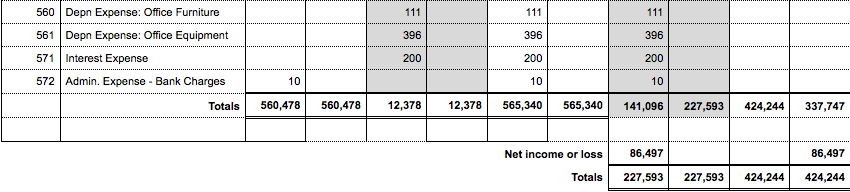

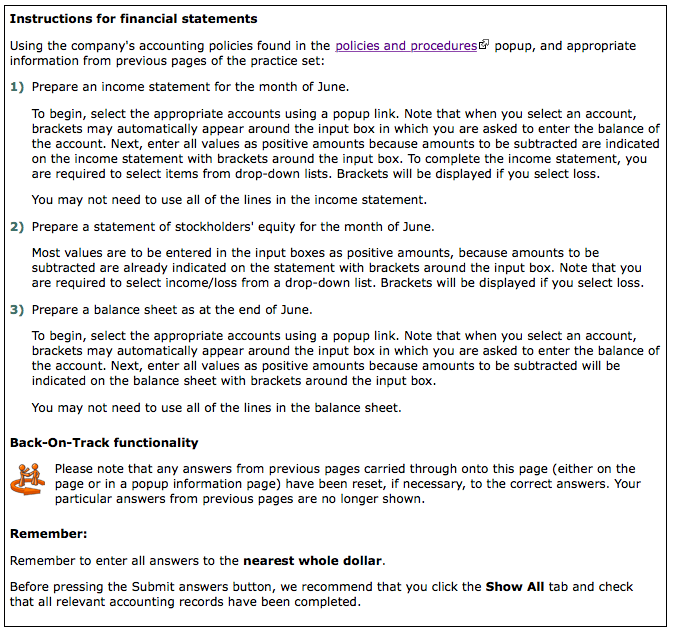

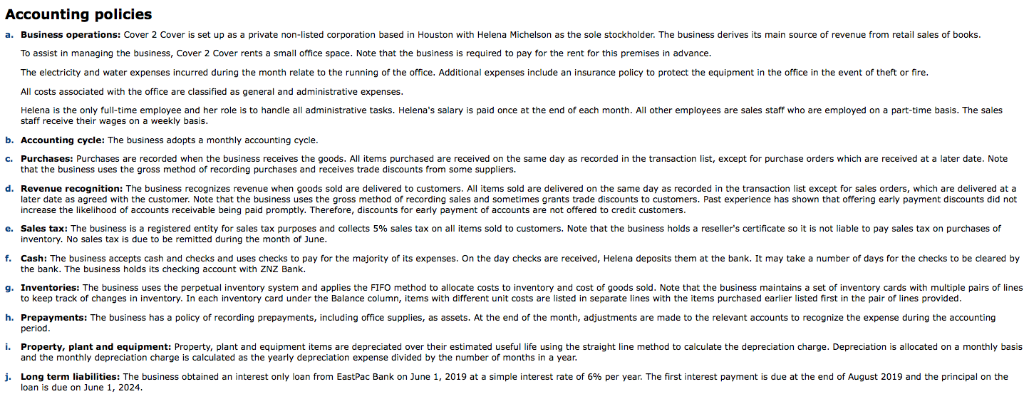

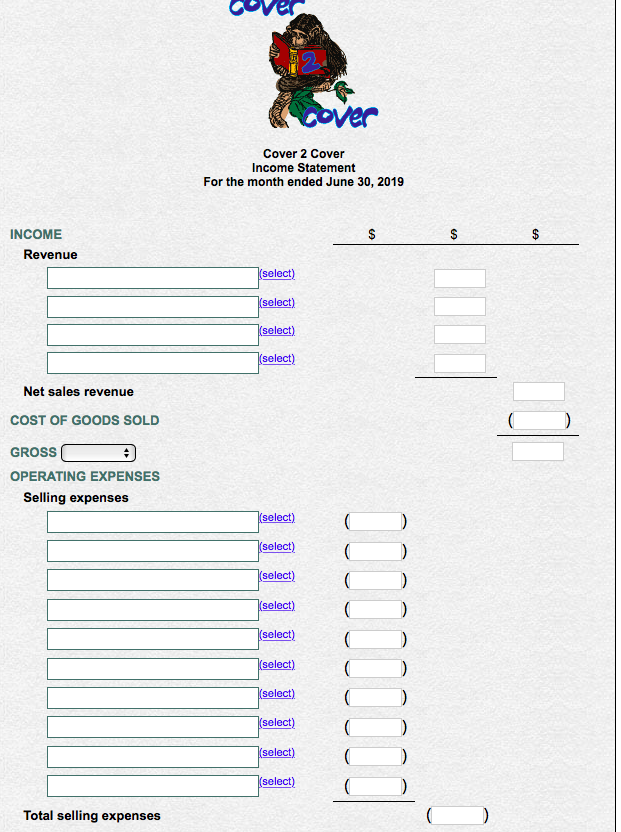

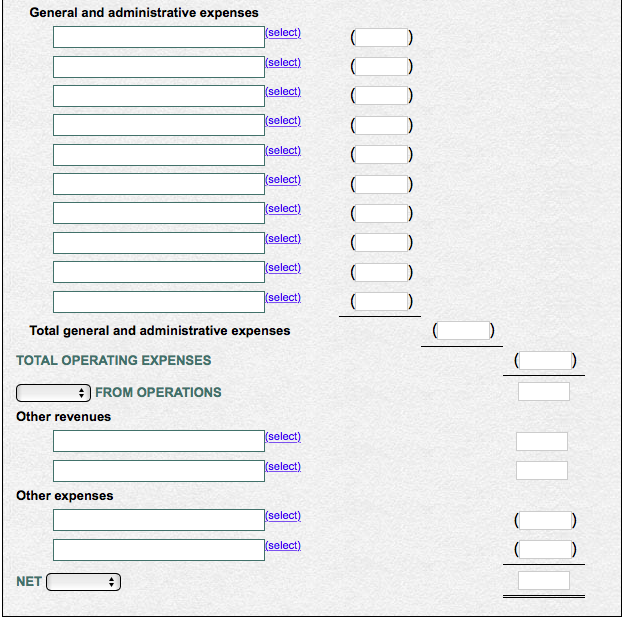

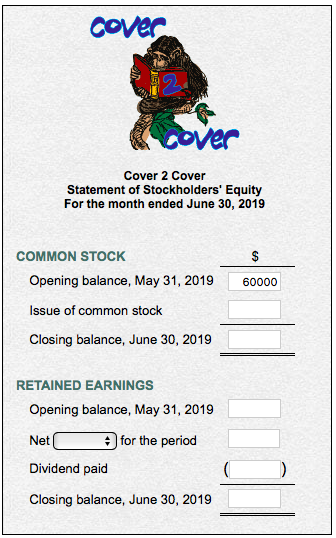

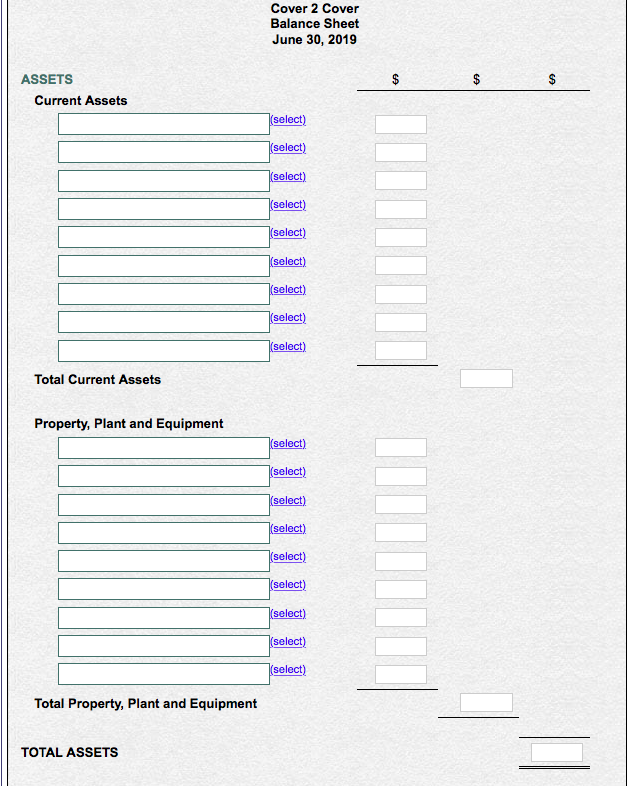

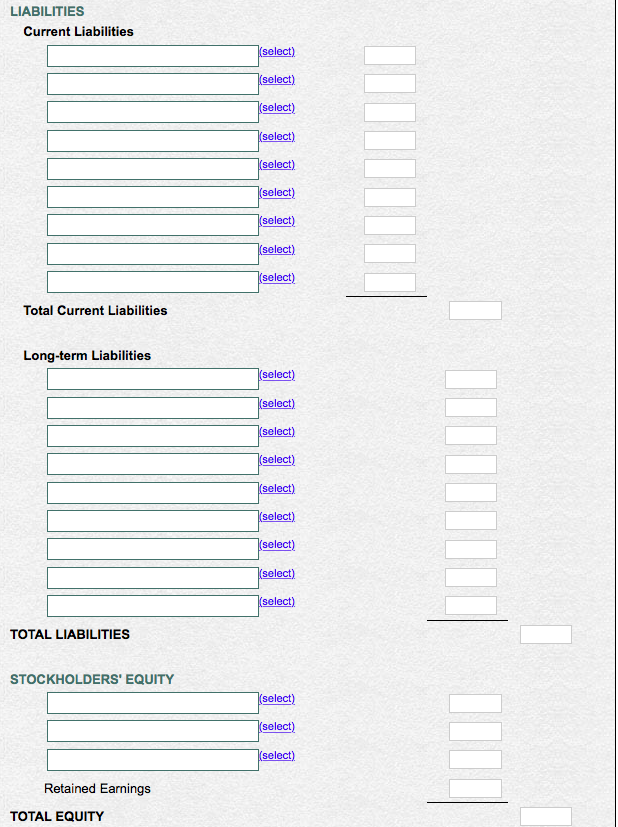

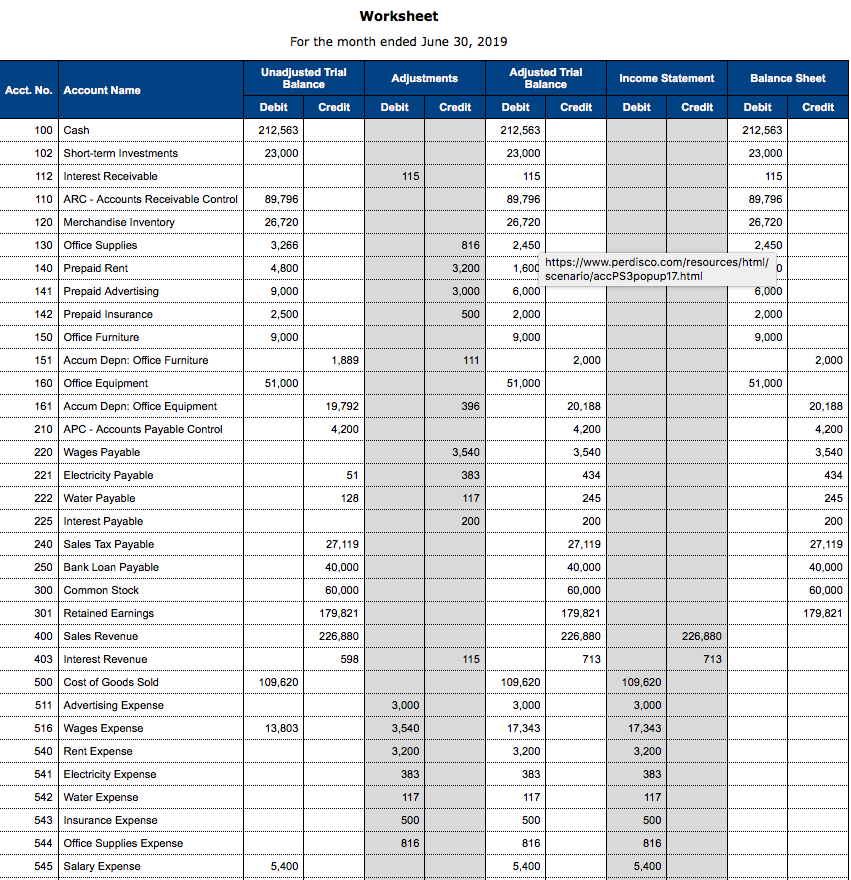

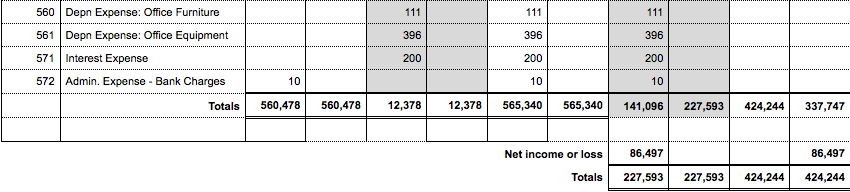

Instructions for financial statements Using the company's accounting policies found in the policies and procedurespopup, and appropriate information from previous pages of the practice set: 1) Prepare an income statement for the month of June To begin, select the appropriate accounts using a popup link. Note that when you select an account, brackets may automatically appear around the input box in which you are asked to enter the balance of the account. Next, enter all values as positive amounts because amounts to be subtracted are indicated on the income statement with brackets around the input box. To complete the income statement, you are required to select items from drop-down lists. Brackets will be displayed if you select loss You may not need to use all of the lines in the income statement. 2) Prepare a statement of stockholders' equity for the month of June Most values are to be entered in the input boxes as positive amounts, because amounts to be subtracted are already indicated on the statement with brackets around the input box. Note that you are required to select income/loss from a drop-down list. Brackets will be displayed if you select loss 3) Prepare a balance sheet as at the end of June To begin, select the appropriate accounts using a popup link. Note that when you select an account, brackets may automatically appear around the input box in which you are asked to enter the balance of the account. Next, enter all values as positive amounts because amounts to be subtracted will be indicated on the balance sheet with brackets around the input box You may not need to use all of the lines in the balance sheet. Back-on-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown Remember: Remember to enter all answers to the nearest whole dollar Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed Accounting policies a. Business operations: Cover 2 Cover is set up as a private non-listed corporation based in Houston with Helena Michelson as the sole stockholder. The business derives its main source of revenue from retail sales of books. To assist in managing the business, Cover 2 Cover rents a small ofmice space. Note that the business is required to pay for the rent for this premises in advance. The electricity and water expenses incurred during the month relate to the running of the office. Additional expenses include an insurance policy to protect the equipment in the office in the event of theft or fire. All costs associated with the office are classified as general and administrative expenses. Helena is the only full-time employee and her role is to handle all administrative tasks. Helena's salary is paid once at the end of each month. All other employees are sales staff who are employed on a part-time basis. The sales staff receive their wages on a weekly basis. b. Accounting cycle: The business adopts a monthly accounting cycle. c. Purchases: Purchases are recorded when the business receives the goods. All items purchased are received on the same day as recorded in the transaction list, except for purchase orders which are received at a later date. Note that the business uses the gross method of recording purchases and receives trade discounts from some suppliers. d. Revenue recognition: The business recognizes revenue when goods sold are delivered to customers. All items sold are delivered on the same day as recorded in the transaction list except for sales orders, which are delivered at a later date as agreed with the customer. Note that the business uses the gross method of recording sales and sometimes grants trade discounts to customers. Past experience has shown that offering early payment discounts did not e sales tax: The business is a registered entity for sales tax purposes and collects 5% sales tax on all items sold to customers. Note that the business holds a reseller's certificate so it is not liable to pay sales tax on purchases of f. Cash: The business accepts cash and checks and uses checks to pay for the majority of its expenses. On the day checks are received, Helena deposits them at the bank. It may take a number of days for the checks to be dleared by g. Inventories: The business uses the perpetual inventory system and applies the FIFO method to allocate costs to inventory and cost of goods sold. Note that the business maintains a set of inventory cards with multiple pairs of lines h. Prepayments: The business has a policy of recording prepayments, including office supplies, as assets. At the end of the month, adjustments are made to the relevant accounts to recognize the expense during the accounting i. Property, plant and equipment: Property, plant and equipment items are depreciated over their estimated useful life using the straight line method to calculate the depreciation charge. Depreciation is allocated on a monthly basis j. Long term liabilities: The business obtained an interest only loan from East ac Bank on June 1, 2019 at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2019 and the principal on the increase the likelihood of accounts receivable being paid promptly. Therefore, discounts for early payment of accounts are not offered to credit customers. inventory. No sales tax is due to be remitted during the month of June. the bank. The business holds its checking account with ZNZ Bank. to keep track of changes in inventory. In each inventory card under the Balance column, items with different unit costs are listed in separate lines with the items purchased earlier listed first in the pair of lines provided period. and the monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year loan is due on June 1, 2024. Cover 2 Cover Income Statement For the month ended June 30, 2019 INCOME Revenue select select se select Net sales revenue COST OF GOODS SOLD GROSS OPERATING EXPENSES Selling expenses select) select) select select select se select) Total selling expenses cover Cover 2 Cover Statement of Stockholders' Equity For the month ended June 30, 2019 COMMON STOCK Issue of common stock Closing balance, June 30, 2019 RETAINED EARNINGS Opening balance, May 31, 2019 Netfor the period Dividend paid Closing balance, June 30, 2019 Cover 2 Cover Balance Sheet June 30, 2019 ASSETS Current Assets select select select select select select Total Current Assets Property, Plant and Equipment select se select select select select select) Total Property, Plant and Equipment TOTAL ASSETS LIABILITIES Current Liabilities select select select) select Total Current Liabilities Long-term Liabilities select se select select) select TOTAL LIABILITIES STOCKHOLDERS' EQUITY select select Retained Earnings TOTAL EQUITY 560 Depn Expense: Office Furniture 561 Depn Expense: Office Equipment 571 Interest Expense 572 Admin. Expense Bank Charges 396 396 200 10 396 200 10 200 10 Totals 560,478560,478,37812,378565,340 565,340141,096 227,593 424,244 337,747 Net income or loss 86,497 Totals227,593 227,593 424,244424,244 Instructions for financial statements Using the company's accounting policies found in the policies and procedurespopup, and appropriate information from previous pages of the practice set: 1) Prepare an income statement for the month of June To begin, select the appropriate accounts using a popup link. Note that when you select an account, brackets may automatically appear around the input box in which you are asked to enter the balance of the account. Next, enter all values as positive amounts because amounts to be subtracted are indicated on the income statement with brackets around the input box. To complete the income statement, you are required to select items from drop-down lists. Brackets will be displayed if you select loss You may not need to use all of the lines in the income statement. 2) Prepare a statement of stockholders' equity for the month of June Most values are to be entered in the input boxes as positive amounts, because amounts to be subtracted are already indicated on the statement with brackets around the input box. Note that you are required to select income/loss from a drop-down list. Brackets will be displayed if you select loss 3) Prepare a balance sheet as at the end of June To begin, select the appropriate accounts using a popup link. Note that when you select an account, brackets may automatically appear around the input box in which you are asked to enter the balance of the account. Next, enter all values as positive amounts because amounts to be subtracted will be indicated on the balance sheet with brackets around the input box You may not need to use all of the lines in the balance sheet. Back-on-Track functionality Please note that any answers from previous pages carried through onto this page (either on the page or in a popup information page) have been reset, if necessary, to the correct answers. Your particular answers from previous pages are no longer shown Remember: Remember to enter all answers to the nearest whole dollar Before pressing the Submit answers button, we recommend that you click the Show All tab and check that all relevant accounting records have been completed Accounting policies a. Business operations: Cover 2 Cover is set up as a private non-listed corporation based in Houston with Helena Michelson as the sole stockholder. The business derives its main source of revenue from retail sales of books. To assist in managing the business, Cover 2 Cover rents a small ofmice space. Note that the business is required to pay for the rent for this premises in advance. The electricity and water expenses incurred during the month relate to the running of the office. Additional expenses include an insurance policy to protect the equipment in the office in the event of theft or fire. All costs associated with the office are classified as general and administrative expenses. Helena is the only full-time employee and her role is to handle all administrative tasks. Helena's salary is paid once at the end of each month. All other employees are sales staff who are employed on a part-time basis. The sales staff receive their wages on a weekly basis. b. Accounting cycle: The business adopts a monthly accounting cycle. c. Purchases: Purchases are recorded when the business receives the goods. All items purchased are received on the same day as recorded in the transaction list, except for purchase orders which are received at a later date. Note that the business uses the gross method of recording purchases and receives trade discounts from some suppliers. d. Revenue recognition: The business recognizes revenue when goods sold are delivered to customers. All items sold are delivered on the same day as recorded in the transaction list except for sales orders, which are delivered at a later date as agreed with the customer. Note that the business uses the gross method of recording sales and sometimes grants trade discounts to customers. Past experience has shown that offering early payment discounts did not e sales tax: The business is a registered entity for sales tax purposes and collects 5% sales tax on all items sold to customers. Note that the business holds a reseller's certificate so it is not liable to pay sales tax on purchases of f. Cash: The business accepts cash and checks and uses checks to pay for the majority of its expenses. On the day checks are received, Helena deposits them at the bank. It may take a number of days for the checks to be dleared by g. Inventories: The business uses the perpetual inventory system and applies the FIFO method to allocate costs to inventory and cost of goods sold. Note that the business maintains a set of inventory cards with multiple pairs of lines h. Prepayments: The business has a policy of recording prepayments, including office supplies, as assets. At the end of the month, adjustments are made to the relevant accounts to recognize the expense during the accounting i. Property, plant and equipment: Property, plant and equipment items are depreciated over their estimated useful life using the straight line method to calculate the depreciation charge. Depreciation is allocated on a monthly basis j. Long term liabilities: The business obtained an interest only loan from East ac Bank on June 1, 2019 at a simple interest rate of 6% per year. The first interest payment is due at the end of August 2019 and the principal on the increase the likelihood of accounts receivable being paid promptly. Therefore, discounts for early payment of accounts are not offered to credit customers. inventory. No sales tax is due to be remitted during the month of June. the bank. The business holds its checking account with ZNZ Bank. to keep track of changes in inventory. In each inventory card under the Balance column, items with different unit costs are listed in separate lines with the items purchased earlier listed first in the pair of lines provided period. and the monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year loan is due on June 1, 2024. Cover 2 Cover Income Statement For the month ended June 30, 2019 INCOME Revenue select select se select Net sales revenue COST OF GOODS SOLD GROSS OPERATING EXPENSES Selling expenses select) select) select select select se select) Total selling expenses cover Cover 2 Cover Statement of Stockholders' Equity For the month ended June 30, 2019 COMMON STOCK Issue of common stock Closing balance, June 30, 2019 RETAINED EARNINGS Opening balance, May 31, 2019 Netfor the period Dividend paid Closing balance, June 30, 2019 Cover 2 Cover Balance Sheet June 30, 2019 ASSETS Current Assets select select select select select select Total Current Assets Property, Plant and Equipment select se select select select select select) Total Property, Plant and Equipment TOTAL ASSETS LIABILITIES Current Liabilities select select select) select Total Current Liabilities Long-term Liabilities select se select select) select TOTAL LIABILITIES STOCKHOLDERS' EQUITY select select Retained Earnings TOTAL EQUITY 560 Depn Expense: Office Furniture 561 Depn Expense: Office Equipment 571 Interest Expense 572 Admin. Expense Bank Charges 396 396 200 10 396 200 10 200 10 Totals 560,478560,478,37812,378565,340 565,340141,096 227,593 424,244 337,747 Net income or loss 86,497 Totals227,593 227,593 424,244424,244