Instructions: For numbers 2 and 3, save them in an excel spreadsheet document.

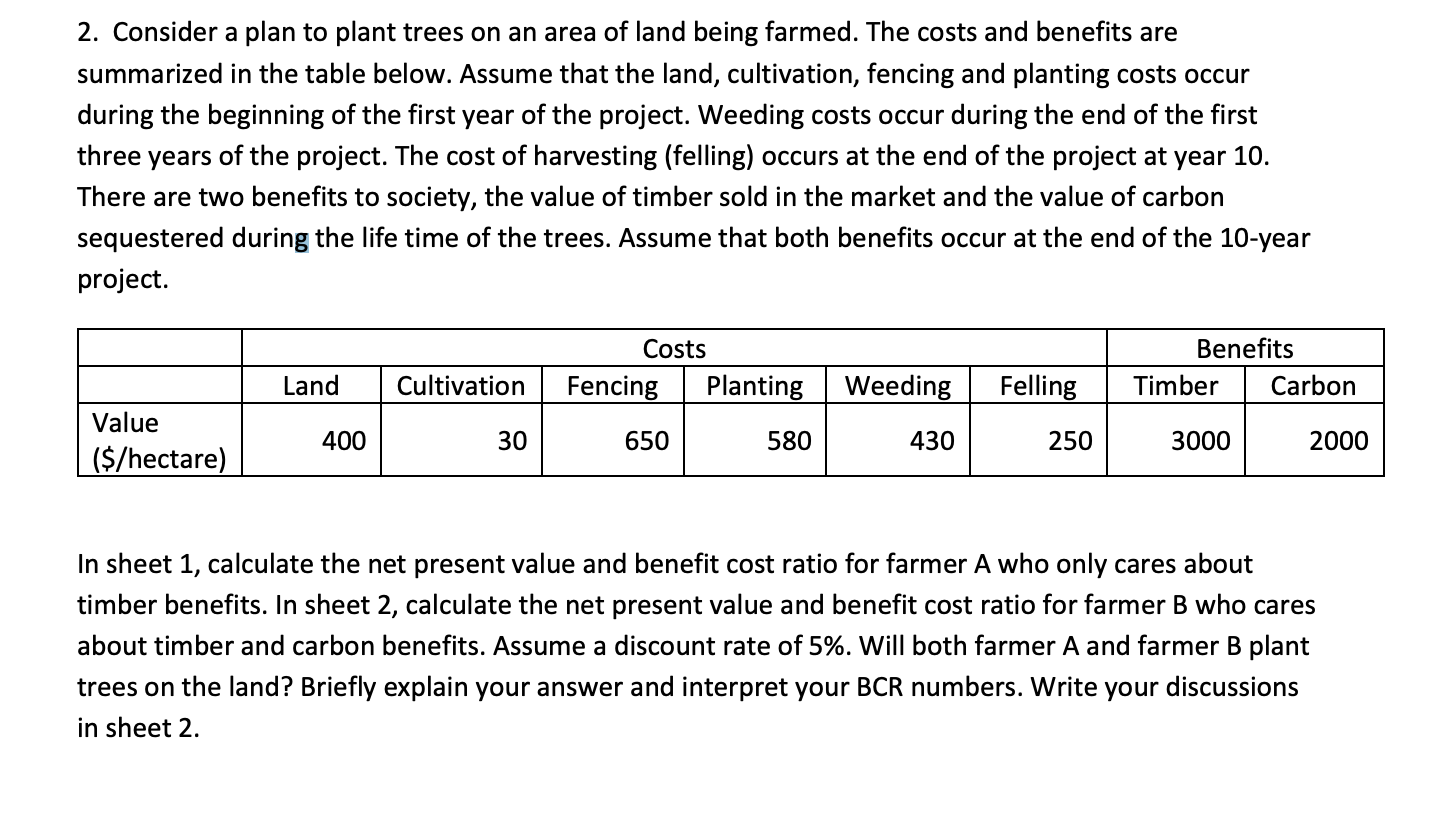

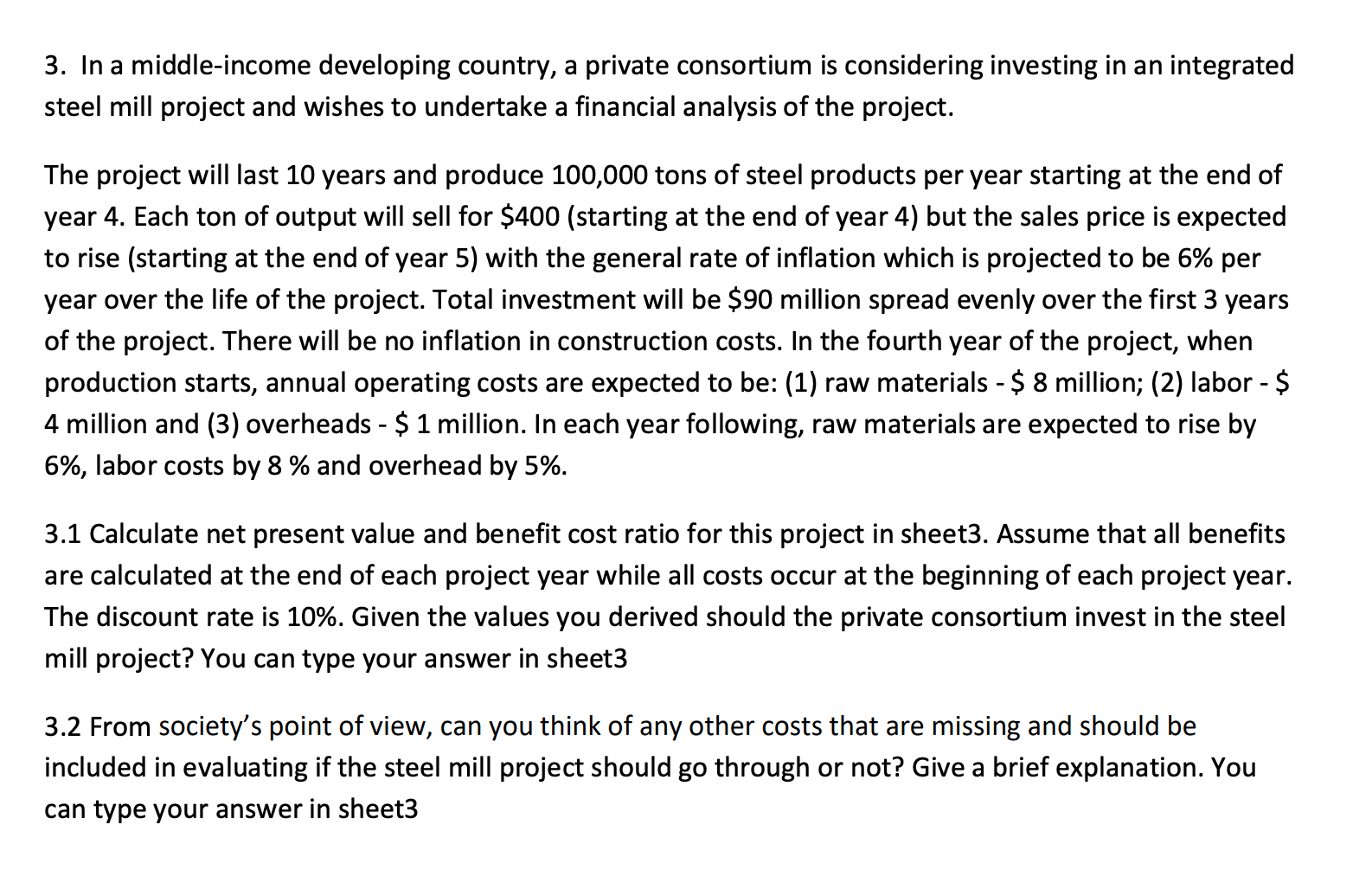

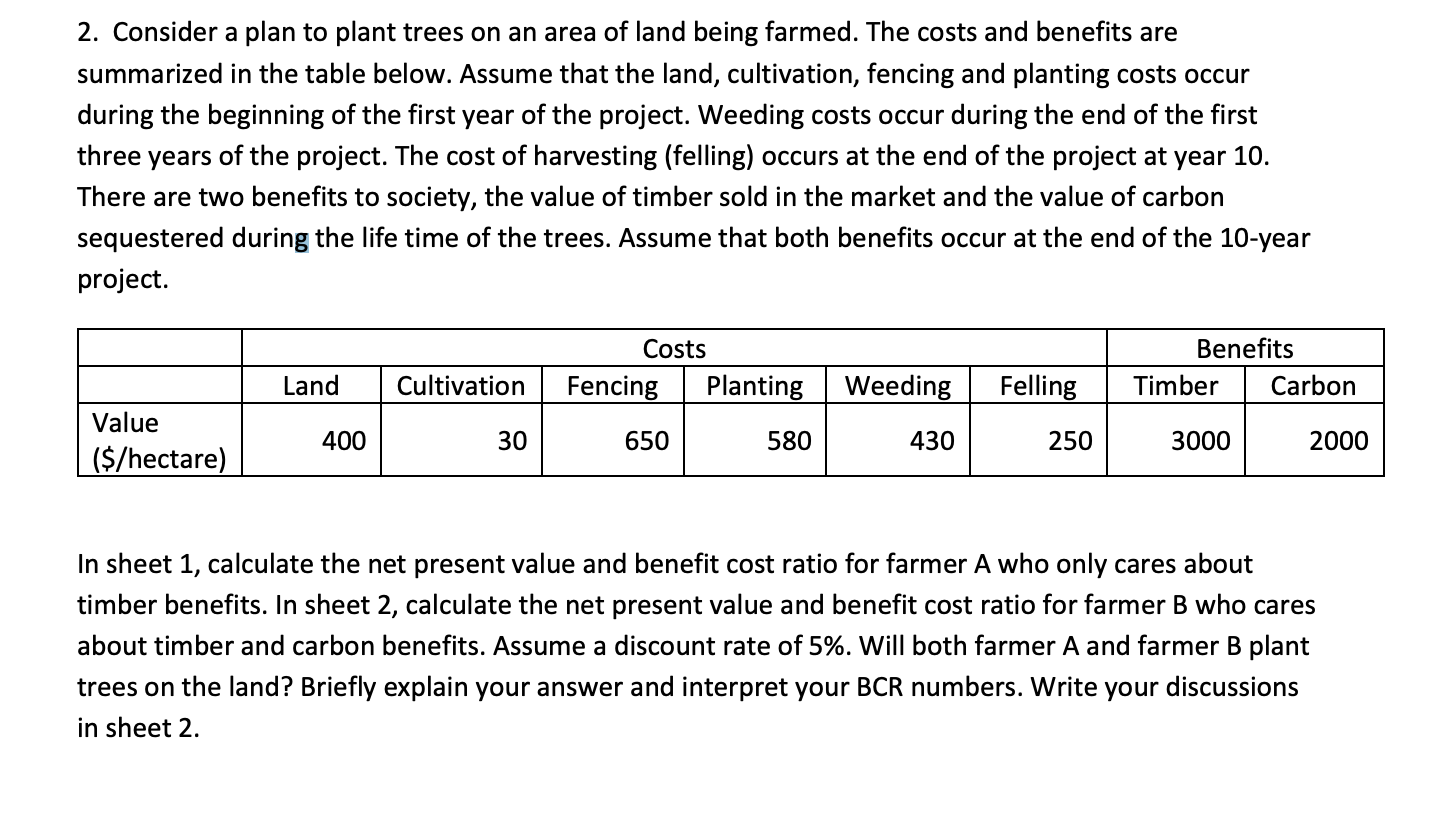

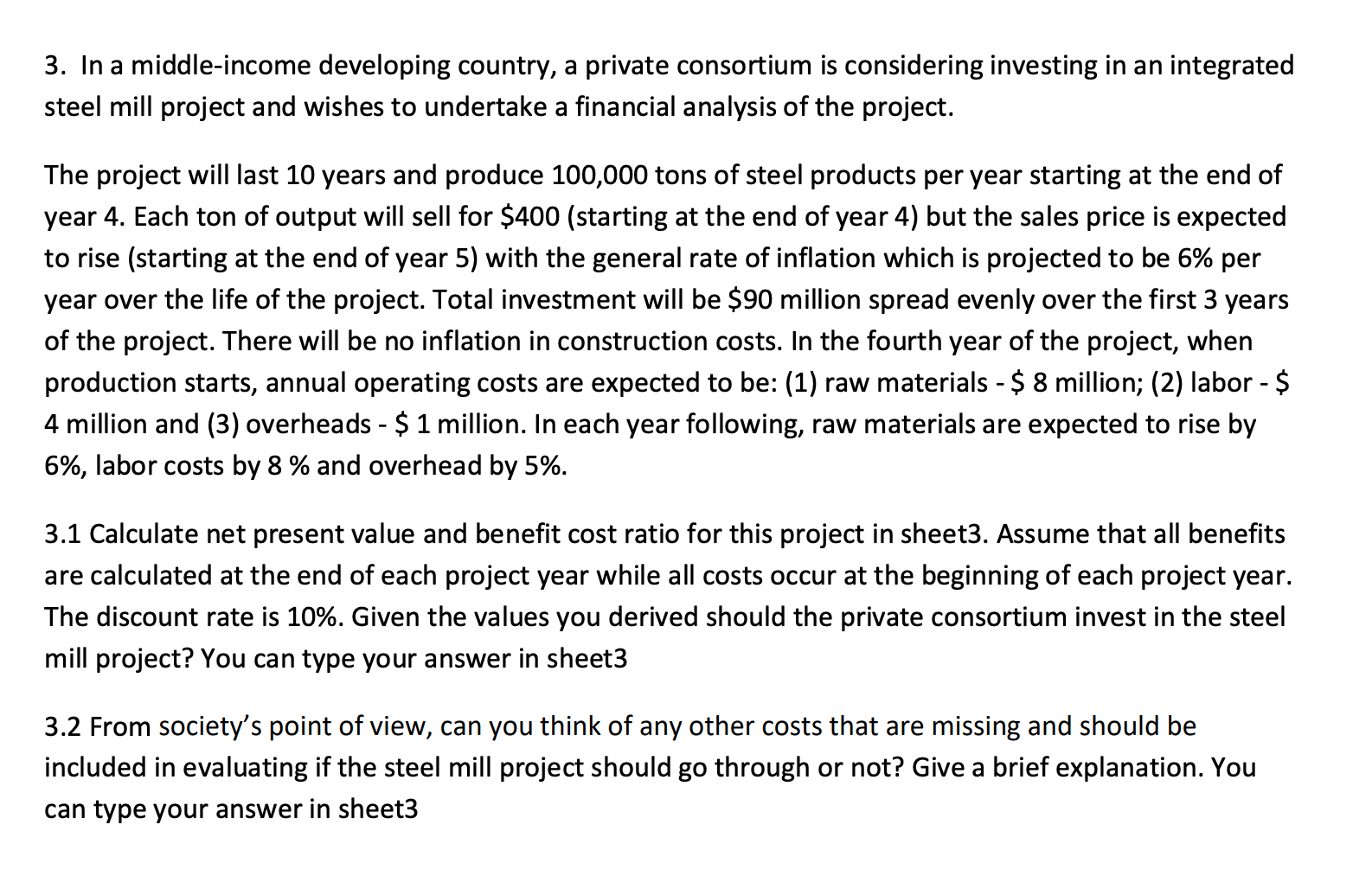

2. Consider a plan to plant trees on an area of land being farmed. The costs and benefits are summarized in the table below. Assume that the land, cultivation, fencing and planting costs occur during the beginning of the first year of the project. Weeding costs occur during the end of the first three years of the project. The cost of harvesting (felling) occurs at the end of the project at year 10. There are two benefits to society, the value of timber sold in the market and the value of carbon sequestered during the life time of the trees. Assume that both benefits occur at the end of the 10-year project. Costs Fencing Planting Benefits Timber Carbon Land Cultivation Weeding Felling Value ($/hectare) 400 30 650 580 430 250 3000 2000 In sheet 1, calculate the net present value and benefit cost ratio for farmer A who only cares about timber benefits. In sheet 2, calculate the net present value and benefit cost ratio for farmer B who cares about timber and carbon benefits. Assume a discount rate of 5%. Will both farmer A and farmer B plant trees on the land? Briefly explain your answer and interpret your BCR numbers. Write your discussions in sheet 2. 3. In a middle-income developing country, a private consortium is considering investing in an integrated steel mill project and wishes to undertake a financial analysis of the project. The project will last 10 years and produce 100,000 tons of steel products per year starting at the end of year 4. Each ton of output will sell for $400 (starting at the end of year 4) but the sales price is expected to rise (starting at the end of year 5) with the general rate of inflation which is projected to be 6% per year over the life of the project. Total investment will be $90 million spread evenly over the first 3 years of the project. There will be no inflation in construction costs. In the fourth year of the project, when production starts, annual operating costs are expected to be: (1) raw materials - $ 8 million; (2) labor - $ 4 million and (3) overheads - $ 1 million. In each year following, raw materials are expected to rise by 6%, labor costs by 8 % and overhead by 5%. 3.1 Calculate net present value and benefit cost ratio for this project in sheet3. Assume that all benefits are calculated at the end of each project year while all costs occur at the beginning of each project year. The discount rate is 10%. Given the values you derived should the private consortium invest in the steel mill project? You can type your answer in sheet3 3.2 From society's point of view, can you think of any other costs that are missing and should be included in evaluating if the steel mill project should go through or not? Give a brief explanation. You can type your answer in sheet3 2. Consider a plan to plant trees on an area of land being farmed. The costs and benefits are summarized in the table below. Assume that the land, cultivation, fencing and planting costs occur during the beginning of the first year of the project. Weeding costs occur during the end of the first three years of the project. The cost of harvesting (felling) occurs at the end of the project at year 10. There are two benefits to society, the value of timber sold in the market and the value of carbon sequestered during the life time of the trees. Assume that both benefits occur at the end of the 10-year project. Costs Fencing Planting Benefits Timber Carbon Land Cultivation Weeding Felling Value ($/hectare) 400 30 650 580 430 250 3000 2000 In sheet 1, calculate the net present value and benefit cost ratio for farmer A who only cares about timber benefits. In sheet 2, calculate the net present value and benefit cost ratio for farmer B who cares about timber and carbon benefits. Assume a discount rate of 5%. Will both farmer A and farmer B plant trees on the land? Briefly explain your answer and interpret your BCR numbers. Write your discussions in sheet 2. 3. In a middle-income developing country, a private consortium is considering investing in an integrated steel mill project and wishes to undertake a financial analysis of the project. The project will last 10 years and produce 100,000 tons of steel products per year starting at the end of year 4. Each ton of output will sell for $400 (starting at the end of year 4) but the sales price is expected to rise (starting at the end of year 5) with the general rate of inflation which is projected to be 6% per year over the life of the project. Total investment will be $90 million spread evenly over the first 3 years of the project. There will be no inflation in construction costs. In the fourth year of the project, when production starts, annual operating costs are expected to be: (1) raw materials - $ 8 million; (2) labor - $ 4 million and (3) overheads - $ 1 million. In each year following, raw materials are expected to rise by 6%, labor costs by 8 % and overhead by 5%. 3.1 Calculate net present value and benefit cost ratio for this project in sheet3. Assume that all benefits are calculated at the end of each project year while all costs occur at the beginning of each project year. The discount rate is 10%. Given the values you derived should the private consortium invest in the steel mill project? You can type your answer in sheet3 3.2 From society's point of view, can you think of any other costs that are missing and should be included in evaluating if the steel mill project should go through or not? Give a brief explanation. You can type your answer in sheet3