Instructions Generalized Statement Instructions Financial Ratios 1. Based on the financial statements for Jackson Enterprises (income statement, statement of owner's equity, and balance sheet)

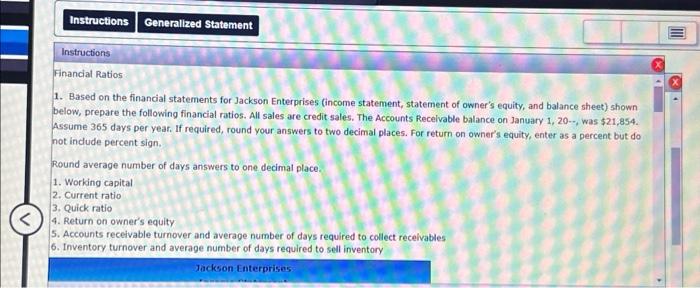

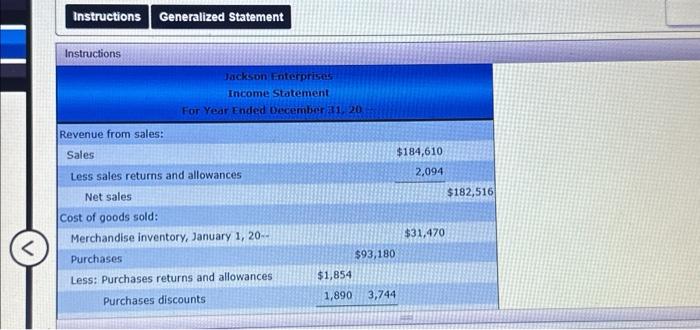

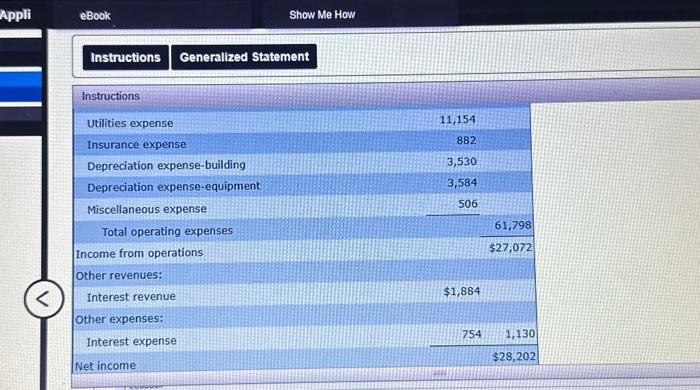

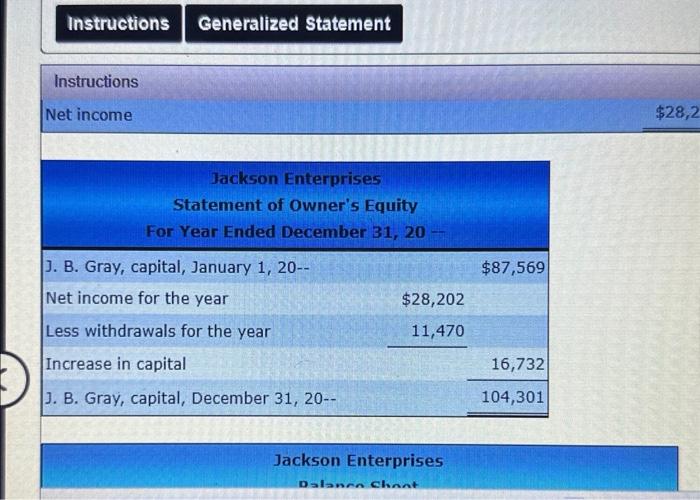

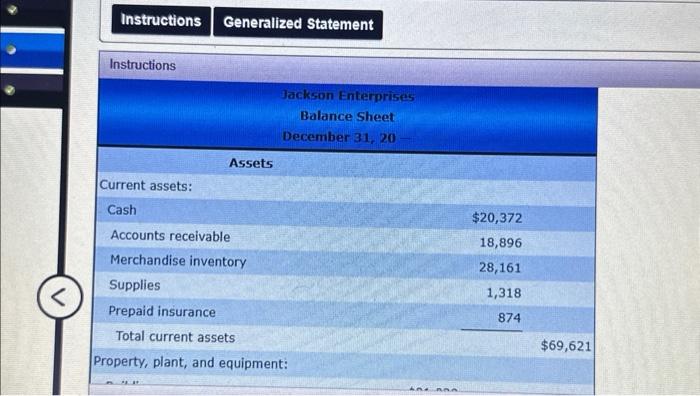

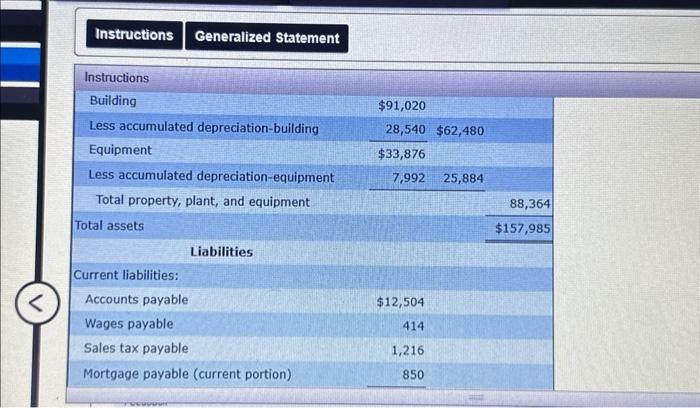

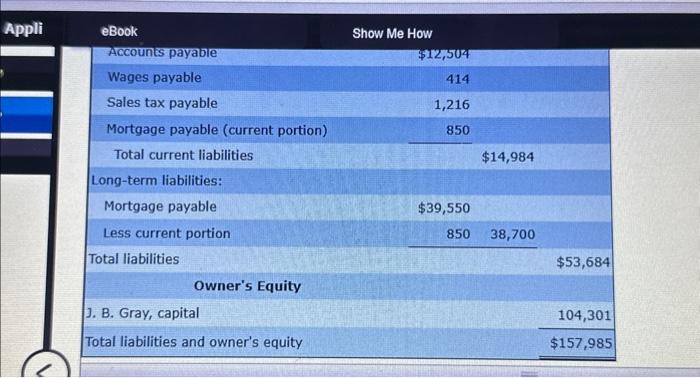

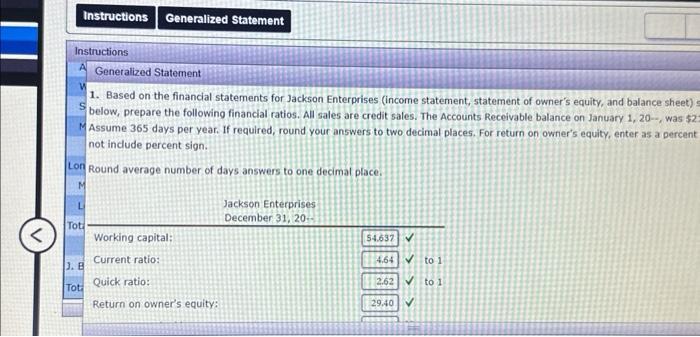

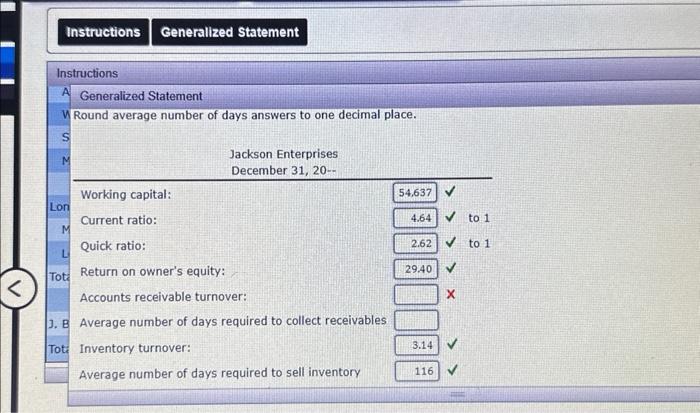

Instructions Generalized Statement Instructions Financial Ratios 1. Based on the financial statements for Jackson Enterprises (income statement, statement of owner's equity, and balance sheet) shown below, prepare the following financial ratios. All sales are credit sales. The Accounts Receivable balance on January 1, 20-, was $21,854. Assume 365 days per year. If required, round your answers to two decimal places. For return on owner's equity, enter as a percent but do not include percent sign. Round average number of days answers to one decimal place. 1. Working capital 2. Current ratio 3. Quick ratio 4. Return on owner's equity 5. Accounts receivable turnover and average number of days required to collect receivables 6. Inventory turnover and average number of days required to sell inventory Jackson Enterprises Instructions Generalized Statement Instructions Jackson Enterprises Income Statement For Year Ended December 31, 20 Revenue from sales: Sales Less sales returns and allowances Net sales $184,610 2,094 $182,516 Cost of goods sold: Merchandise inventory, January 1, 20-- Purchases $31,470 $93,180 Less: Purchases returns and allowances $1,854 Purchases discounts. 1,890 3,744 eBook Show Me How Instructions Generalized Statement Instructions Net purchases Add freight-in Cost of goods purchased Goods available for sale Less merchandise inventory, December 31, 20-- Cost of goods sold Gross profit Operating expenses: Wages expense Advertising expense Supplies expense Phone expense $89,436 901 90,337 $121,807 28,161 93,646 $88,870 $38,260 1,222 378 2,282 Appli eBook Show Me How Instructions Generalized Statement Instructions Utilities expense 11,154 Insurance expense 882 Depreciation expense-building 3,530 Depreciation expense-equipment 3,584 506 Miscellaneous expense Total operating expenses Income from operations Other revenues: < $1,884 Interest revenue Other expenses: Interest expense Net income 61,798 $27,072 754 1,130 $28,202 Instructions Generalized Statement Instructions Net income Jackson Enterprises Statement of Owner's Equity For Year Ended December 31, 20 J. B. Gray, capital, January 1, 20-- Net income for the year Less withdrawals for the year Increase in capital J. B. Gray, capital, December 31, 20-- $87,569 $28,202 11,470 16,732 104,301 Jackson Enterprises Dalance Chant $28,2 Instructions Generalized Statement Instructions Jackson Enterprises Balance Sheet December 31, 20 Assets Current assets: Cash Accounts receivable Merchandise inventory Supplies < Prepaid insurance Total current assets Property, plant, and equipment: $20,372 18,896 28,161 1,318 874 $69,621 Instructions Generalized Statement Instructions Building Less accumulated depreciation-building Equipment Less accumulated depreciation-equipment Total property, plant, and equipment Total assets $91,020 28,540 $62,480 $33,876 7,992 25,884 88,364 $157,985 Liabilities Current liabilities: Accounts payable $12,504 Wages payable 414 Sales tax payable 1,216 Mortgage payable (current portion) 850 Appli eBook Accounts payable Wages payable Sales tax payable Mortgage payable (current portion) Total current liabilities Long-term liabilities: Mortgage payable Less current portion Total liabilities Owner's Equity J. B. Gray, capital Total liabilities and owner's equity Show Me How $12,504 414 1,216 850 $14,984 $39,550 850 38,700 $53,684 104,301 $157,985 > Instructions Generalized Statement Instructions Generalized Statement 1. Based on the financial statements for Jackson Enterprises (income statement, statement of owner's equity, and balance sheet) s below, prepare the following financial ratios. All sales are credit sales. The Accounts Receivable balance on January 1, 20-, was $23 MAssume 365 days per year. If required, round your answers to two decimal places. For return on owner's equity, enter as a percent not include percent sign. Lon Round average number of days answers to one decimal place. M L Tot Working capital: Current ratio: J. B Quick ratio: Tot Return on owner's equity: Jackson Enterprises December 31, 20- $4.637 4.64 to 1 2.62 to 1 29.40 V Instructions Generalized Statement Instructions A Generalized Statement W Round average number of days answers to one decimal place. S M Working capital: Lon Current ratio: M Quick ratio: L Tot Return on owner's equity: Jackson Enterprises December 31, 20-- 54,637 V 4.64 to 1 2.62 to 1 29.40 X Accounts receivable turnover: 3. B Average number of days required to collect receivables Tot Inventory turnover: 3.14 Average number of days required to sell inventory 116

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started