Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions in bold! - are these the correct order to be able to do all 4 statements in the end? Dec 27 JR completed the

Instructions in bold! - are these the correct order to be able to do all 4 statements in the end?

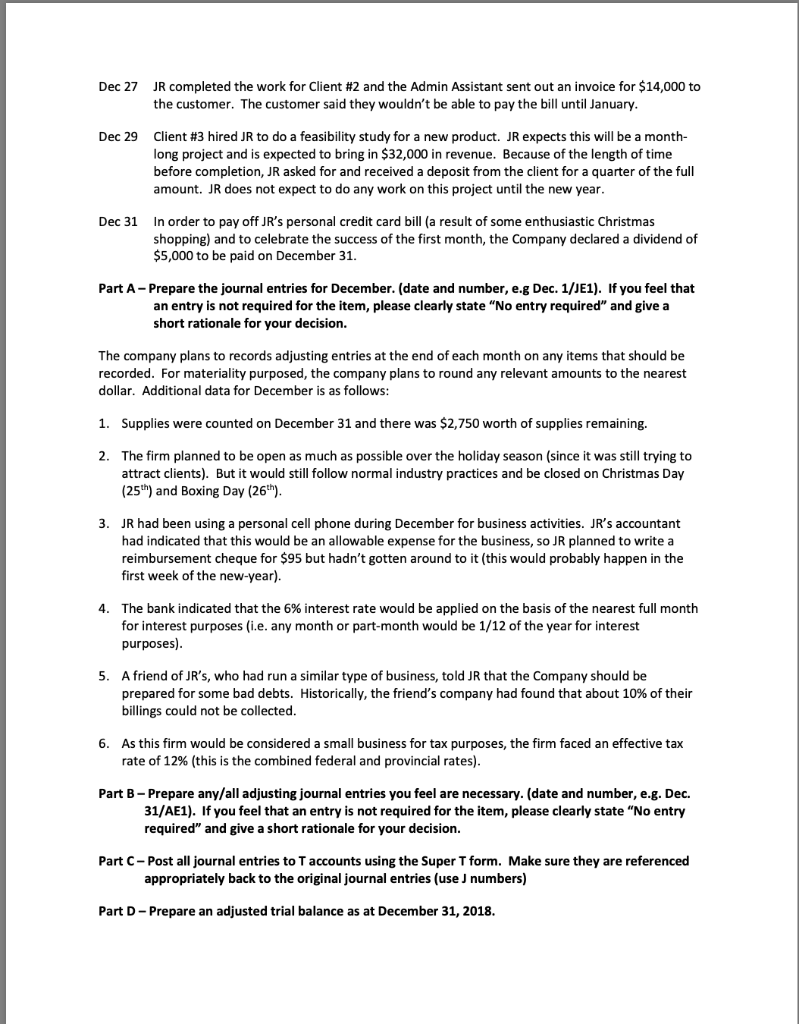

Dec 27 JR completed the work for Client #2 and the Admin Assistant sent out an invoice for $14,000 to the customer. The customer said they wouldn't be able to pay the bill until January. Dec 29 Client #3 hired JR to do a feasibility study for a new product. JR expects this will be a month- long project and is expected to bring in $32,000 in revenue. Because of the length of time before completion, JR asked for and received a deposit from the client for a quarter of the full amount. JR does not expect to do any work on this project until the new year. Dec 31 In order to pay off JR's personal credit card bill (a result of some enthusiastic Christmas shopping) and to celebrate the success of the first month, the Company declared a dividend of $5,000 to be paid on December 31. Part A - Prepare the journal entries for December. (date and number, e.g Dec. 1/JE1). If you feel that an entry is not required for the item, please clearly state "No entry required" and give a short rationale for your decision. The company plans to records adjusting entries at the end of each month on any items that should be recorded. For materiality purposed, the company plans to round any relevant amounts to the nearest dollar. Additional data for December is as follows: 1. Supplies were counted on December 31 and there was $2,750 worth of supplies remaining. 2. The firm planned to be open as much as possible over the holiday season (since it was still trying to attract clients). But it would still follow normal industry practices and be closed on Christmas Day (25th) and Boxing Day (26th). 3. JR had been using a personal cell phone during December for business activities. JR's accountant had indicated that this would be an allowable expense for the business, so JR planned to write a reimbursement cheque for $95 but hadn't gotten around to it (this would probably happen in the first week of the new-year). 4. The bank indicated that the 6% interest rate would be applied on the basis of the nearest full month for interest purposes (.e. any month or part-month would be 1/12 of the year for interest purposes). 5. A friend of JR's, who had run a similar type of business, told JR that the Company should be prepared for some bad debts. Historically, the friend's company had found that about 10% of their billings could not be collected. 6. As this firm would be considered a small business for tax purposes, the firm faced an effective tax rate of 12% (this is the combined federal and provincial rates). Part B - Prepare any/all adjusting journal entries you feel are necessary. (date and number, e.g. Dec. 31/AE1). If you feel that an entry is not required for the item, please clearly state "No entry required" and give a short rationale for your decision. Part C-Post all journal entries to accounts using the Super T form. Make sure they are referenced appropriately back to the original journal entries (use J numbers) Part D-Prepare an adjusted trial balance as at December 31, 2018. Dec 27 JR completed the work for Client #2 and the Admin Assistant sent out an invoice for $14,000 to the customer. The customer said they wouldn't be able to pay the bill until January. Dec 29 Client #3 hired JR to do a feasibility study for a new product. JR expects this will be a month- long project and is expected to bring in $32,000 in revenue. Because of the length of time before completion, JR asked for and received a deposit from the client for a quarter of the full amount. JR does not expect to do any work on this project until the new year. Dec 31 In order to pay off JR's personal credit card bill (a result of some enthusiastic Christmas shopping) and to celebrate the success of the first month, the Company declared a dividend of $5,000 to be paid on December 31. Part A - Prepare the journal entries for December. (date and number, e.g Dec. 1/JE1). If you feel that an entry is not required for the item, please clearly state "No entry required" and give a short rationale for your decision. The company plans to records adjusting entries at the end of each month on any items that should be recorded. For materiality purposed, the company plans to round any relevant amounts to the nearest dollar. Additional data for December is as follows: 1. Supplies were counted on December 31 and there was $2,750 worth of supplies remaining. 2. The firm planned to be open as much as possible over the holiday season (since it was still trying to attract clients). But it would still follow normal industry practices and be closed on Christmas Day (25th) and Boxing Day (26th). 3. JR had been using a personal cell phone during December for business activities. JR's accountant had indicated that this would be an allowable expense for the business, so JR planned to write a reimbursement cheque for $95 but hadn't gotten around to it (this would probably happen in the first week of the new-year). 4. The bank indicated that the 6% interest rate would be applied on the basis of the nearest full month for interest purposes (.e. any month or part-month would be 1/12 of the year for interest purposes). 5. A friend of JR's, who had run a similar type of business, told JR that the Company should be prepared for some bad debts. Historically, the friend's company had found that about 10% of their billings could not be collected. 6. As this firm would be considered a small business for tax purposes, the firm faced an effective tax rate of 12% (this is the combined federal and provincial rates). Part B - Prepare any/all adjusting journal entries you feel are necessary. (date and number, e.g. Dec. 31/AE1). If you feel that an entry is not required for the item, please clearly state "No entry required" and give a short rationale for your decision. Part C-Post all journal entries to accounts using the Super T form. Make sure they are referenced appropriately back to the original journal entries (use J numbers) Part D-Prepare an adjusted trial balance as at December 31, 2018Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started