Answered step by step

Verified Expert Solution

Question

1 Approved Answer

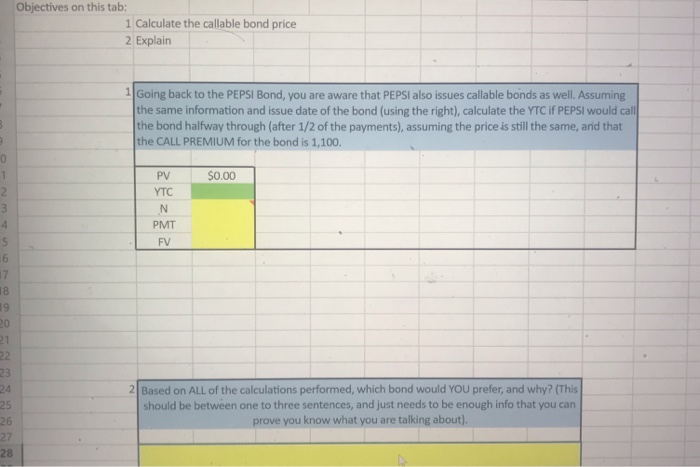

Instructions in photos Objectives on this tab: 1 Calculate the callable bond price 2 Explain 1Going back to the PEPSI Bond, you are aware that

Instructions in photos

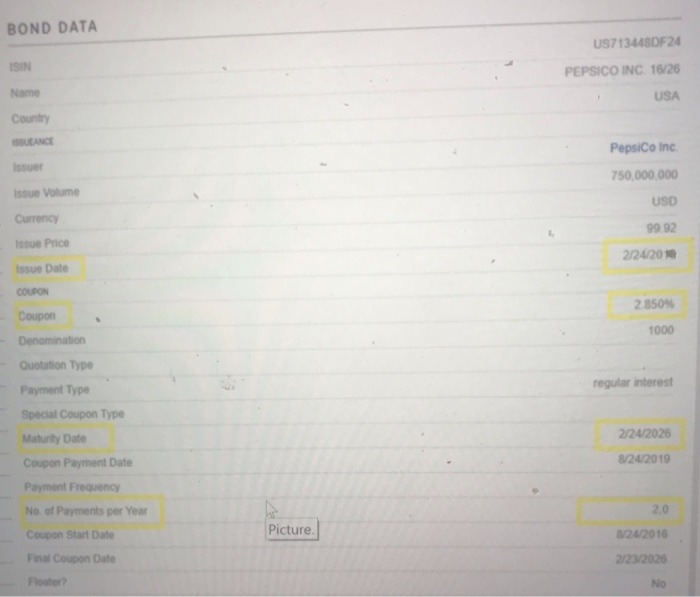

Objectives on this tab: 1 Calculate the callable bond price 2 Explain 1Going back to the PEPSI Bond, you are aware that PEPSI also issues callable bonds as well. Assuming the same information and issue date of the bond (using the right), calculate the YTC if PEPSI would call the bond halfway through (after 1/2 of the payments), assuming the price is still the same, arid that the CALL PREMIUM for the bond is 1,100. PV $0.00 YTC FV 19 23 24 25 26 27 28 2 Based on ALL of the calculations performed, which bond would YOU prefer, and why? (This should be between one to three sentences, and just needs to be enough info that you carn prove you know what you are talking about). BOND DATA US713448DF24 PEPSICO INC. 16/26 USA PepsiCo Inc 750,000 000 Issue Volume 99 92 Issue Price 2/24/20 Issue Date 2.850% 1000 Quotation Type Payment Type Special Coupon Type Maturity Date Coupon Payment Date Payment Frequency No of Payments per Year Coupon Start Date Final Coupon Date regular interest 2/24/2026 8/24/2019 2.0 24/2016 2/23/2026 No Picture

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started