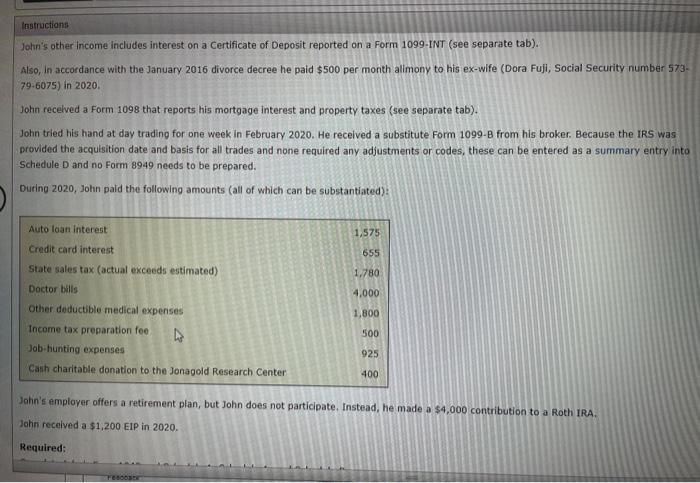

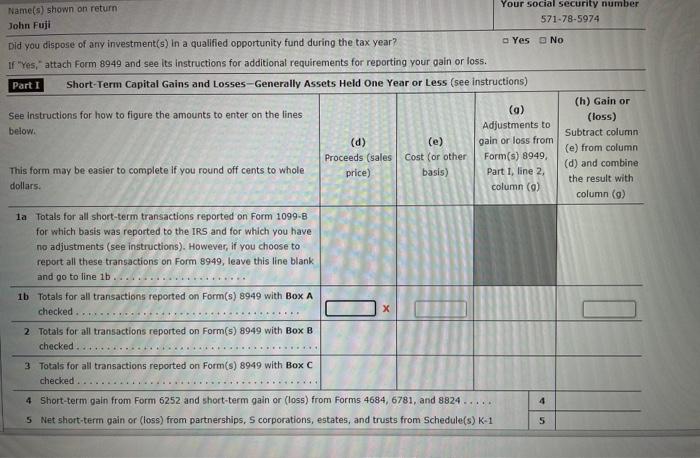

Instructions John's other Income includes interest on a Certificate of Deposit reported on a Form 1099 INT (see separate tab) Also, in accordance with the January 2016 divorce decree he paid $500 per month alimony to his ex-wife (Dora Fuji, Social Security number 573- 79-6075) in 2020. John recelved a Form 1098 that reports his mortgage Interest and property taxes (see separate tab). John tried his hand at day trading for one week in February 2020. He received a substitute Form 1099-B from his broker. Because the IRS was provided the acquisition date and basis for all trades and none required any adjustments or codes, these can be entered as a summary entry into Schedule D and no Form 8949 needs to be prepared. During 2020, John paid the following amounts (all of which can be substantiated): Auto loan interest 1.575 655 1.780 4.000 Credit card interest State sales tax (actual exceeds estimated) Doctor bills Other deductible medical expenses Income tax preparation fee Job-hunting expenses Cash charitable donation to the Jonagold Research Center 1,800 500 925 400 John's employer offers a retirement plan, but John does not participate. Instead, he made a $4,000 contribution to a Roth IRA John received a $1,200 EIP in 2020. Required: 766065 Name(s) shown on return Your social security number John Fuji 571-78-5974 Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes No If "Yes," attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part I Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) (h) Gain or See Instructions for how to figure the amounts to enter on the lines (0) (loss) below. Adjustments to Subtract column (d) (e) gain or loss from (e) from column Proceeds (sales | Cost (or other Form(s) 8949 This form may be easier to complete if you round off cents to whole (d) and combine price) basis) Part 1, line 2 the result with dollars. column (9) column (9) 1a Totals for all short-term transactions reported on Form 1099-8 for wh basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 1b Totals for all transactions reported on Form(s) 8949 with Box A checked. 2 Totals for all transactions reported on Form(s) 8949 with Box B checked. 3 Totals for all transactions reported on Form(s) 8949 with Box C checked.. x 4 4 Short-term gain from Form 6252 and short-term gain or loss) from Forms 4684, 6781, and 8824..... 5 Net short-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 S Instructions John's other Income includes interest on a Certificate of Deposit reported on a Form 1099 INT (see separate tab) Also, in accordance with the January 2016 divorce decree he paid $500 per month alimony to his ex-wife (Dora Fuji, Social Security number 573- 79-6075) in 2020. John recelved a Form 1098 that reports his mortgage Interest and property taxes (see separate tab). John tried his hand at day trading for one week in February 2020. He received a substitute Form 1099-B from his broker. Because the IRS was provided the acquisition date and basis for all trades and none required any adjustments or codes, these can be entered as a summary entry into Schedule D and no Form 8949 needs to be prepared. During 2020, John paid the following amounts (all of which can be substantiated): Auto loan interest 1.575 655 1.780 4.000 Credit card interest State sales tax (actual exceeds estimated) Doctor bills Other deductible medical expenses Income tax preparation fee Job-hunting expenses Cash charitable donation to the Jonagold Research Center 1,800 500 925 400 John's employer offers a retirement plan, but John does not participate. Instead, he made a $4,000 contribution to a Roth IRA John received a $1,200 EIP in 2020. Required: 766065 Name(s) shown on return Your social security number John Fuji 571-78-5974 Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes No If "Yes," attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part I Short-Term Capital Gains and Losses-Generally Assets Held One Year or Less (see instructions) (h) Gain or See Instructions for how to figure the amounts to enter on the lines (0) (loss) below. Adjustments to Subtract column (d) (e) gain or loss from (e) from column Proceeds (sales | Cost (or other Form(s) 8949 This form may be easier to complete if you round off cents to whole (d) and combine price) basis) Part 1, line 2 the result with dollars. column (9) column (9) 1a Totals for all short-term transactions reported on Form 1099-8 for wh basis was reported to the IRS and for which you have no adjustments (see instructions). However, if you choose to report all these transactions on Form 8949, leave this line blank and go to line 1b 1b Totals for all transactions reported on Form(s) 8949 with Box A checked. 2 Totals for all transactions reported on Form(s) 8949 with Box B checked. 3 Totals for all transactions reported on Form(s) 8949 with Box C checked.. x 4 4 Short-term gain from Form 6252 and short-term gain or loss) from Forms 4684, 6781, and 8824..... 5 Net short-term gain or loss) from partnerships, S corporations, estates, and trusts from Schedule(s) K-1 S