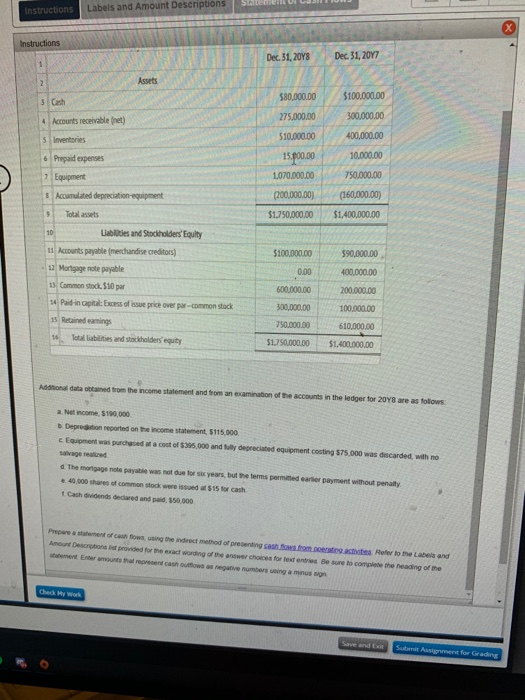

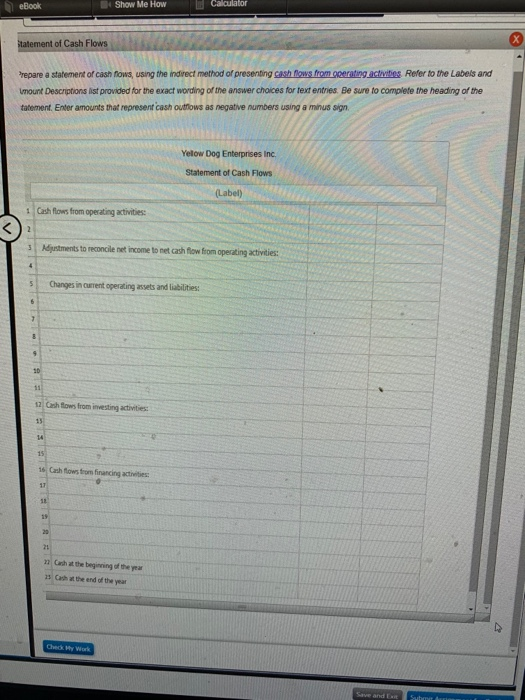

Instructions Labels and Amount Descriptions SAMEN Instructions Dec 31, 20Y8 Dec 31, 2017 1 2 Assets $80,000.00 $100,000.00 3 Cash 4 Accounts receivable (net) 275.000.00 300.000.00 5 Inventories 400,000.00 10,000.00 6 Prepaid expenses 7 Equipment 8 Acomated depreciation equipment 510.000,00 15.000.00 1,070,000.00 (200.000.00) $1,750,000.00 750,000.00 (160,000.00) 9 Total assets $1,400,000.00 $100,000.00 390,000.00 10 Labilities and Stockholders' Equity 11 Accounts payable (merchandise creditors) 12 Mortgage note payable 13 Common stock. $10 par 0.00 400,000.00 600,000.00 200,000.00 300,000.00 14 Paid in capital: Excess of issue price over pr-common stock 15 Retained eaming Total abilities and stockholders equity 750,000.00 $1.750,000.00 100.000,00 610.000.00 $1,400.000,00 Additional data obtained from the income statement and from an examination of the accounts in the leder for 2018 are as follows a Net income, 5190.000 Deprecation reported on the income statement $115.000 Equipment was purchased at a cost of $395.000 and depreciated equipment Corting 575.000 was discarded with no Salvage read The mariage note payable was not for six years, but the terms permited earlier payment without penalty 40.000 shares of common stock were $15 for cash Cash didends declared and paid $50,000 Prostament of cash flowing the direct method of presenting a format Refer to the Label and Amount Descroto provided for the act wording of the answer choices for referries Be sure to complete the reading of me wment Enter the cash outflows a negative numbers wing a minus sign Sub Assignment for Grading eBook Show Me How Calculator Statement of Cash Flows Prepare a statement of cash flows, using the indirect method of presenting cash flows from operating activities. Refer to the Labels and mount Descriptions list provided for the exact wording of the answer choices for text entries. Be sure to complete the heading of the tatement. Enter amounts that represent cash outflows as negative numbers using a minus sign Yelow Dog Enterprises Inc. Statement of Cash Flows (Label) 1 Cash flows from operating activities: 3Mjustments to reconcile net income to net cash flow from operating activities: 4 S Changes in current operating assets and liabilities: 6 10 11 12 Cash flows from investing activities 13 15 16 Cashflows to financing activities 17 11 15 20 21 nash the beginning of the 23 the end of the year Save and Su