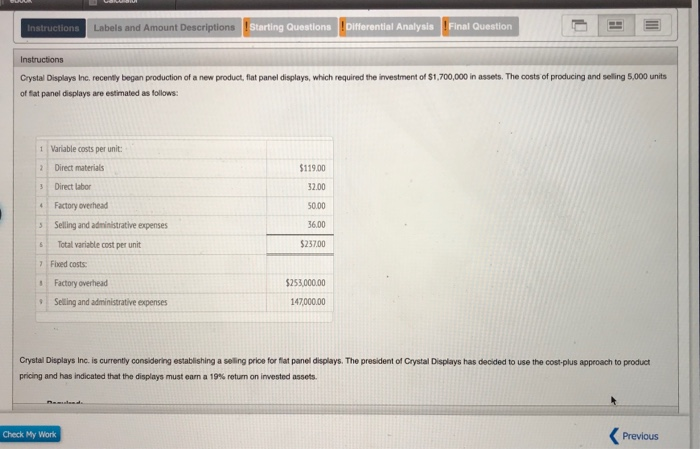

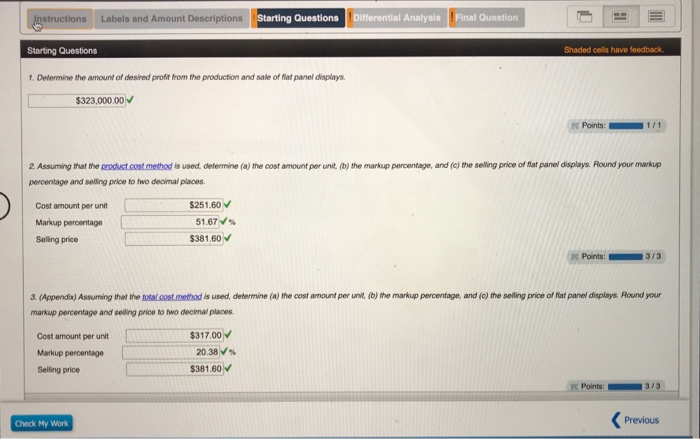

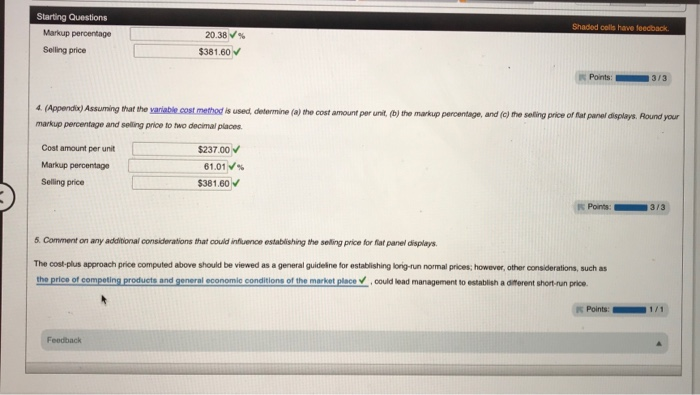

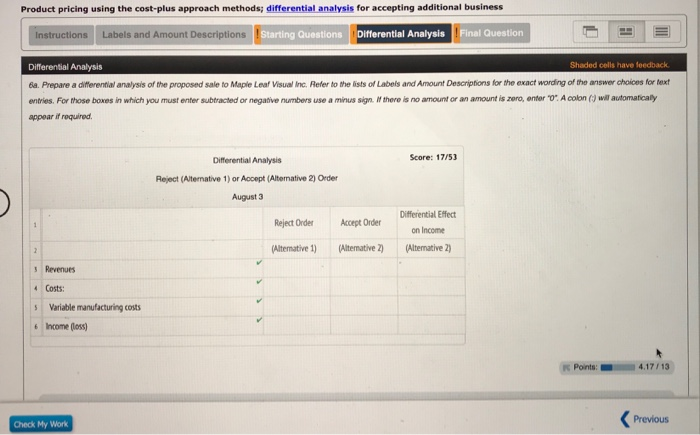

Instructions Labels and Amount Descriptions Starting Questions Differential Analysis Final Question HI Instructions Crystal Displays Inc. recently began production of a new product, flat panel displays, which required the investment of $1,700,000 in assets. The costs of producing and selling 5,000 units of flat panel displays are estimated as follows: 1 Variable costs per unit: 2 Direct materials $119.00 3 32.00 Direct labor Factory overhead 4 50.00 3 Selling and administrative expenses 36,00 5 Total variable cost per unit $237.00 1 Fixed costs Factory overhead $253.000.00 Selling and administrative expenses 147,000.00 Crystal Displays Inc. is currently considering establishing a selling price for flat panel displays. The president of Crystal Displays has decided to use the cost-plus approach to product pricing and has indicated that the displays must earn a 19% return on invested assets. Check My Work Previous Anstructions Labels and Amount Descriptions Starting Questions Differential Analysis Final Question Shaded cells have feedback. Starting Questions 1. Determine the amount of desired profit from the production and sale of flat panel displays. $323,000.00 Points: 1/1 2. Assuming that the product cost method is used, determine (a) the cost amount per unit, (b) the markup percentage, and (c) the selling price of flat panel displays, Round your markup percentage and selling price to two decimal places Cost amount per unit Markup percentage Selling price $251.60 51.67 $381.60 Points: 3/3 3. (Appendix) Assuming that the total cost method is used determine (a) the cost amount per unit, (b) the markup percentage, and (c) the selling price of Rat panel displays, Round your markup percentage and selling price to two decimal places Cost amount per unit Markup percentage Selling price $317.00 20.38% $381.60 Points: 3/3 Check My Work Previous Shaded cells have feedback. Starting Questions Markup percentage Selling price 20.38% $381.60 Points: 3/3 4. (Appendix) Assuming that the variable cost method is used, determine (a) the cost amount per unit, (b) the markup percentage, and (c) the selling price of far parial displays. Round your markup perceritage and selling price to wo decimal places Cost amount per unit $237.00 Markup percentage 61.01% Selling price $381.60 Points 3/3 6. Comment on any additional considerations that could intuence establishing the selling price for Rat panel displays. The cost-plus approach price computed above should be viewed as a general guideline for establishing long-run normal prices; however, other considerations, such as the price of competing products and general economic conditions of the market place could lead management to establish a different short-run price. Points: Feedback Product pricing using the cost.plus approach methods, differential analysis for accepting additional business Instructions Labels and Amount Descriptions Starting Questions Differential Analysis Final Question Differential Analysis Shaded cells have feedback ba. Prepare a differential anwysis of the proposed sale to Maple Leaf Visual Inc. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a mhus sign. If there is no amount or an amount is zero, ontor o". A colon () will automatically appear if required Score: 17/53 Differential Analysis Reject (Alternative 1) or Accept (Alternative 2) Order August 3 Reject Order Accept Order Differential Effect on Income (Alternative 2) 2 (Alternative 1) (Alternative 2) 3 Revenues 4 Costs: 5 Variable manufacturing costs 6 Income (loss Pointe 4.17/13