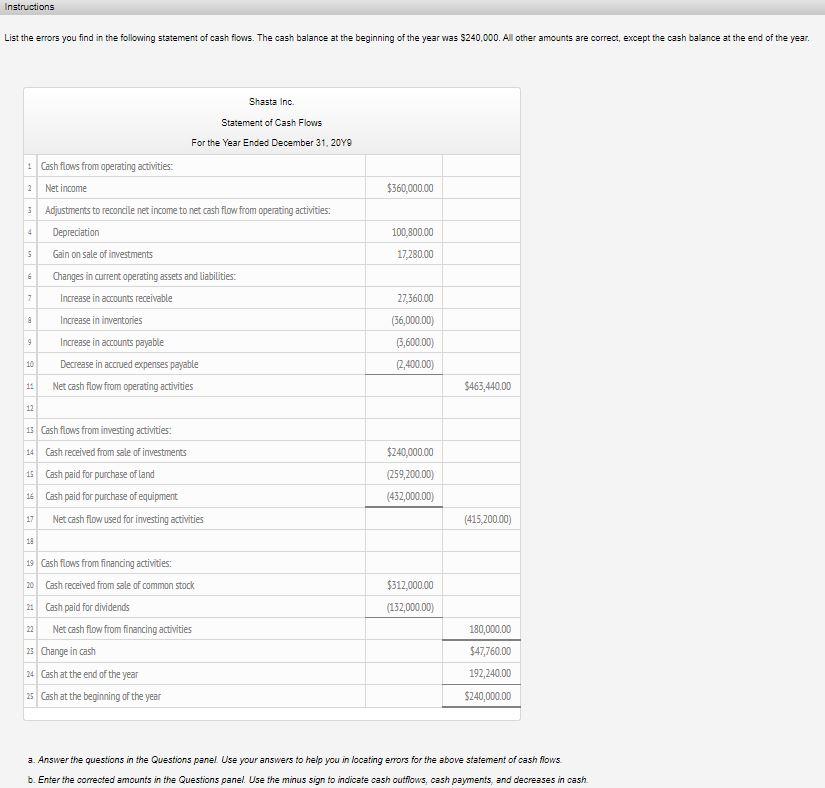

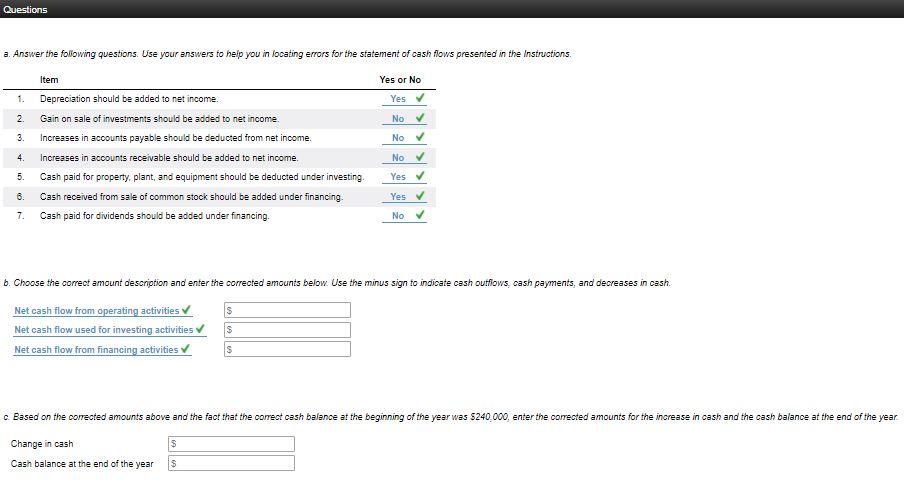

Instructions List the errors you find in the following statement of cash flows. The cash balance at the beginning of the year was $240,000. All other amounts are correct, except the cash balance at the end of the year. Shasta Inc. Statement of Cash Flows For the Year Ended December 31, 2019 2 $360,000.00 4 100,800.00 17.280.00 5 6 : Cash flows from operating activities: Net income 3 Adjustments to reconcile net income to net cash flow from operating activities: Depreciation Gain on sale of investments Changes in current operating assets and liabilities: 7 Increase in acounts receivable Increase in inventories Increase in accounts payable Decrease in accrued expenses payable Net cash flow from operating activities 8 27,360.00 (36,000.00) 3,600.00) 2,400.00) 9 10 14 $463,440.00 12 3 Cash flows from investing activities: 14 Cash received from sale of investments 15 Cash paid for purchase of land * Cash paid for purchase of equipment Net cash flow used for investing activities $240,000.00 (259,200.00) (432,000.00) 17 (415,200.00) 18 $312,000.00 (132,000.00) 19 Cash flows from financing activities: 20 Cash received from sale of common stock 21 Cash paid for dividends Net cash flow from financing activities 23 Change in cash 24 Cash at the end of the year 25 Cash at the beginning of the year 22 180,000.00 $47,760.00 192,240.00 $240,000.00 a. Answer the questions in the Questions panel Use your answers to help you in locating errors for the above statement of cash flows b. Enter the corrected amounts in the Questions panel. Use the minus sign to indicate cash outflows, cash payments and decreases in cash Questions a. Answer the following questions. Use your answers to help you in locating errors for the statement of cash flows presented in the Instructions Item Yes or No 1. Yes 2. No 3. No Depreciation should be added to net income. Gain on sale of investments should be added to net income. Increases in accounts payable should be deducted from net income. Increases in accounts receivable should be added to net income. Cash paid for property, plant, and equipment should be deducted under investing Cash received from sale of common stock should be added under financing Cash paid for dividends should be added under financing. 4. 5. No Yes 8. Yes 7. No 6. Choose the correct amount description and enter the corrected amounts below. Use the minus sign to indicate cash outflows, cash payments, and decreases in cash. Net cash flow from operating activities Net cash flow used for investing activities Net cash flow from financing activities $ S c Based on the corrected amounts above and the fact that the correct cash balance at the beginning of the year was $240.000, enter the corrected amounts for the increase in cash and the cash balance at the end of the year Change in cash $ Cash balance at the end of the year $