Answered step by step

Verified Expert Solution

Question

1 Approved Answer

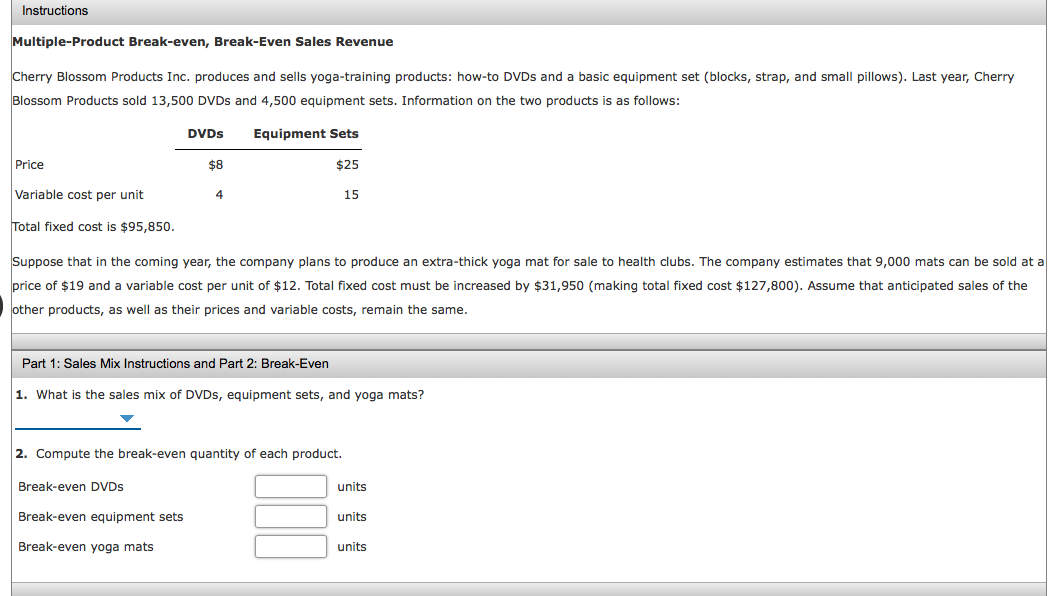

Instructions Multiple-Product Break-even, Break-Even Sales Revenue Cherry Blossom Products Inc. produces and sells yoga-training products: how-to DVDS and a basic equipment set (blocks, strap,

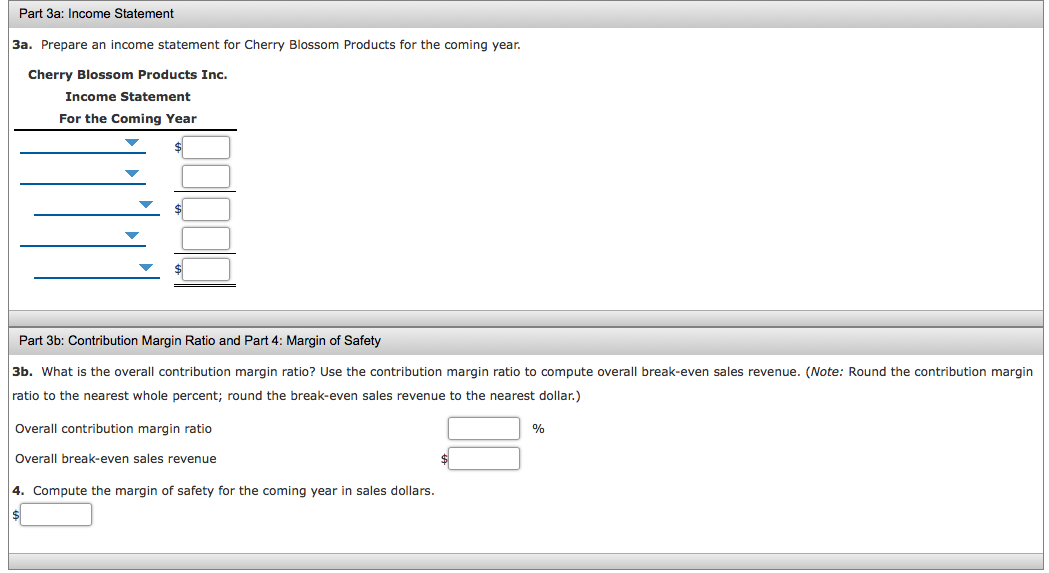

Instructions Multiple-Product Break-even, Break-Even Sales Revenue Cherry Blossom Products Inc. produces and sells yoga-training products: how-to DVDS and a basic equipment set (blocks, strap, and small pillows). Last year, Cherry Blossom Products sold 13,500 DVDS and 4,500 equipment sets. Information on the two products is as follows: DVDS Equipment Sets Price $8 $25 Variable cost per unit 15 Total fixed cost is $95,850. Suppose that in the coming year, the company plans to produce an extra-thick yoga mat for sale to health clubs. The company estimates that 9,000 mats can be sold at a price of $19 and a variable cost per unit of $12. Total fixed cost must be increased by $31,950 (making total fixed cost $127,800). Assume that anticipated sales of the other products, as well as their prices and variable costs, remain the same. Part 1: Sales Mix Instructions and Part 2: Break-Even 1. What is the sales mix of DVDS, equipment sets, and yoga mats? 2. Compute the break-even quantity of each product. Break-even DVDS units Break-even equipment sets units Break-even yoga mats units Part 3a: Income Statement 3a. Prepare an income statement for Cherry Blossom Products for the coming year. Cherry Blossom Products Inc. Income Statement For the Coming Year Part 3b: Contribution Margin Ratio and Part 4: Margin of Safety 3b. What is the overall contribution margin ratio? Use the contribution margin ratio to compute overall break-even sales revenue. (Note: Round the contribution margin ratio to the nearest whole percent; round the break-even sales revenue to the nearest dollar.) Overall contribution margin ratio Overall break-even sales revenue 4. Compute the margin of safety for the coming year in sales dollars.

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

salutn equipmet sets Sal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started