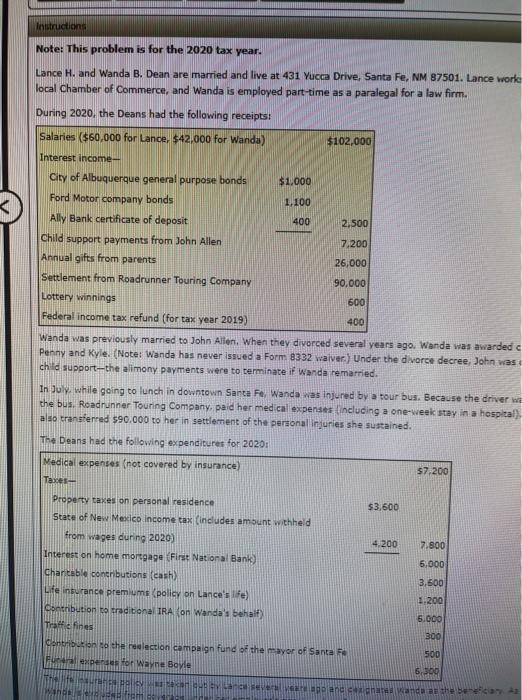

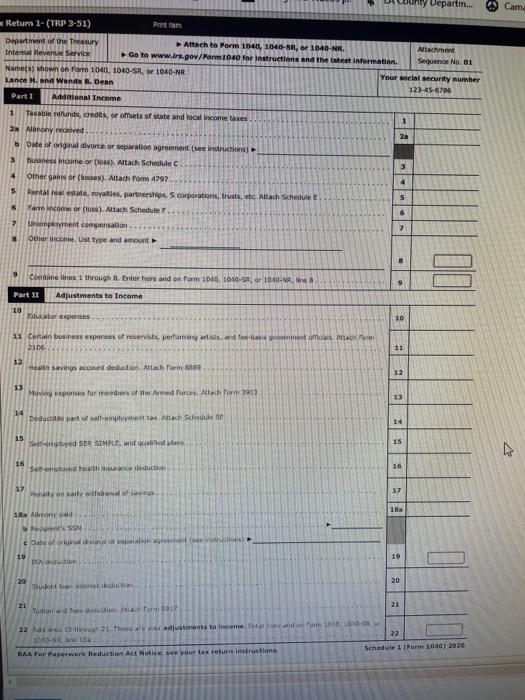

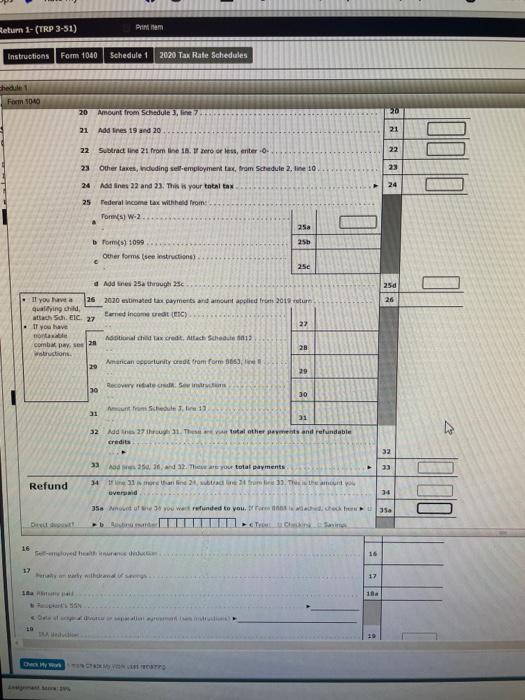

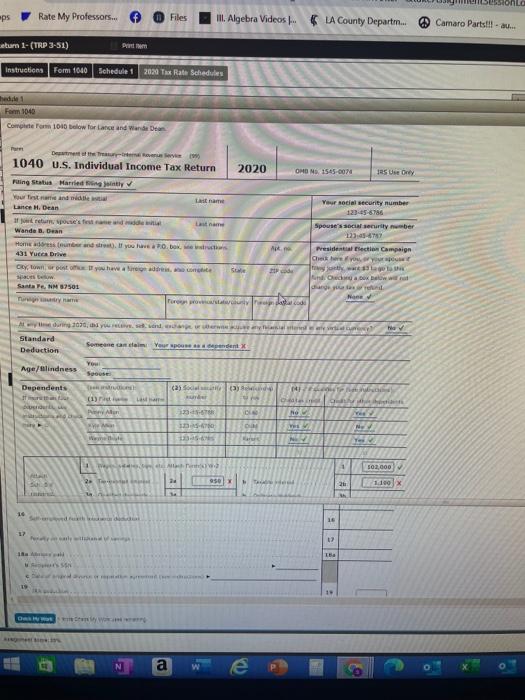

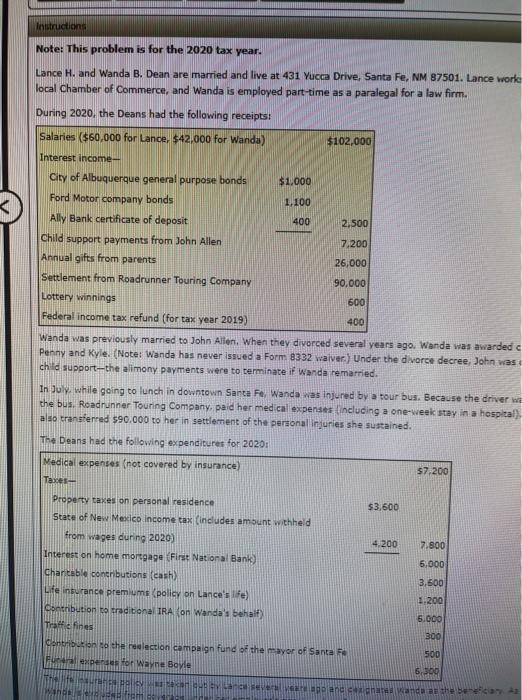

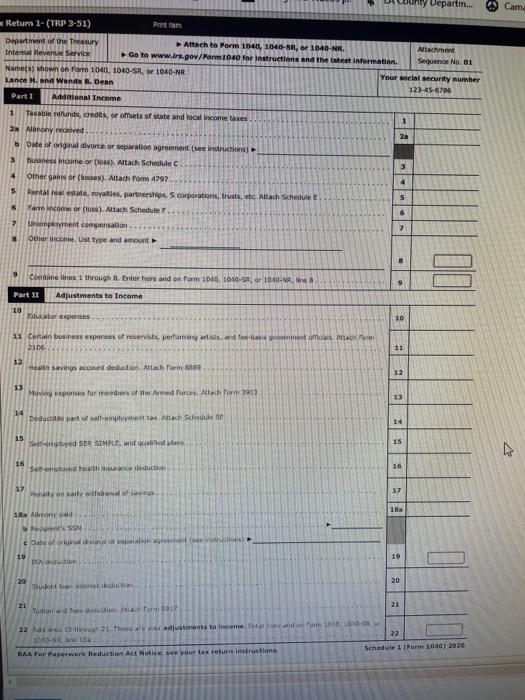

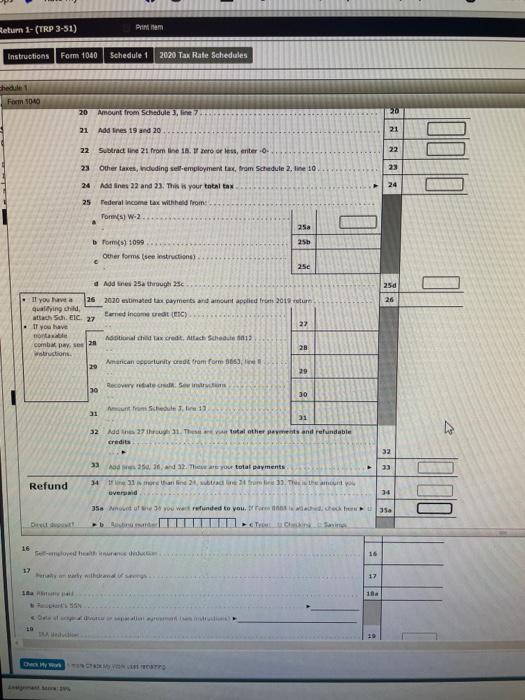

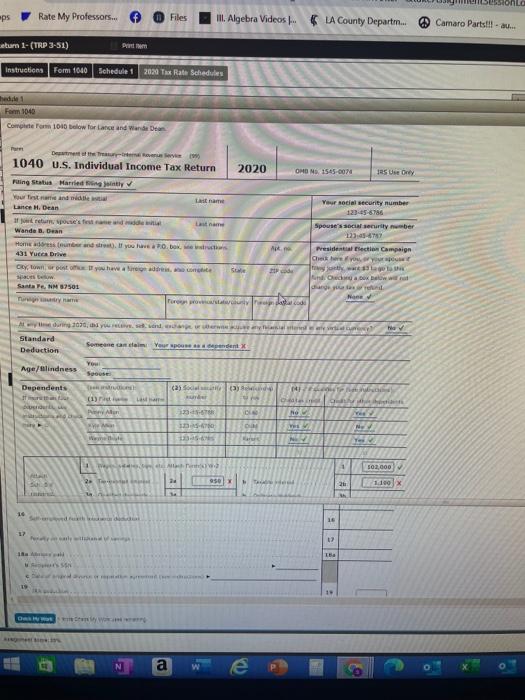

Instructions Note: This problem is for the 2020 tax year. Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance worla local Chamber of Commerce, and Wanda is employed part-time as a paralegal for a law firm. During 2020, the Deans had the following receipts: Salaries ($60,000 for Lance. $42,000 for Wanda) $102,000 $1.000 1.100 400 2,500 Interest income City of Albuquerque general purpose bonds Ford Motor company bonds Ally Bank certificate of deposit Child support payments from John Allen Annual gifts from parents Settlement from Roadrunner Touring Company Lottery winnings Federal income tax refund (for tax year 2019) 7,200 26,000 90,000 600 400 Wanda was previously married to John Allen. When they divorced several years ago. Wanda was awarded Penny and Kyle. (Note: Wanda has never issued a Form 8332 waiver.) Under the diverse decree, John was child support-the alimony payments were to terminate if Wanda remarried. In July, while going to lunch in downtown Santa Fe, Wanda was injured by a tour bus. Because the driver w the bus. Roadrunner Touring Company, paid her medical expenses including a one-week stay in a hospital) also transferred $90,000 to her in settlement of the personal injuries she sustained. The Deans had the following expenditures for 2020: Medical expenses (not covered by insurance) $7,200 Taxes Property taxes on personal residence $3,600 State of New Mexico income tax (includes amount withheld from wages during 2020) 4.200 7.800 Interest on home mortgage First National Bank) 6,000 Chants contributions (cash) 3,500 Life insurance premiums (policy on Lance's life 1.200 Contribution to traditional IRA on Wanda's behalt) 5.000 Ticines Contribution to the reaction campaign fund of the mayor of Santa Fe 500 Funeral expenses for Wayne Boyle 6.300 fintunes alte aneshara wanca as the can tem 300 Departm... Cam Return 1. (TRP 3-51) Ponte Department of the Tremur Attach to Form 1040, 1040-SR, of 1040-NR. Attachment Internal Revenue Service Go to www.br.gov/Farm 1040 for instructions and the intest Information. Sequence No. 01 Name() shown on Form 1040 1040-SR, or 1040-NR Your social security number Lance H. and Wanda B. Denn 125-45-6786 Part 1 Additional Income 1 20 3 Taxable rounds, crediks, or offsets of state and local income taxes 2 Alumny received b Date of original divorce or separation agreement (see instructions 3 Duess income or loss. Altach Schedule other gains or losses), Allan Porn 4797 5 Rental estate, royales, partnerships, corporation, trusts, etc. Attach Schedule 6 Farrencone or (os). Altach Schedule 7 Uployment compensation Other income List type and amount 4 5 6 7 8 Combine lines 1 through 8 Enterher and on Form 1040,1010-SR 1040-NR In 9 Adjustments to Income Part II 10 expenses 10 11 Certain business expenses of reservist performing artists and fee-basement offices Mach form 2106 11 12 Her savings acorded Attach form 12 13 Mavi ponusturembers of the med forces, Atachrom 1903 13 14 Didactitle part of it. Mad Sche 14 15 loyd SIMPLE, and quali 15 16 16 17 Po wally want Ba 18 Amy said RSSN cabello 19 SA 19 20 20 21 23 Tutores ML 22 Now The adjustments to income 1010 1010.5 14 let 22 BA For Paperwork Reduction Act Notice, see your taken instructions Schedule Turn 1040) 2020 Printem Return 1- (TRP 3-51) Instructions Form 1040 Schedule 1 2020 Tax Rate Schedules chedule Form 5040 20 Amount froen Schedule 3, line 20 21 Address 19 and 20 21 22 Subtract line 21 from line 18. roles anterio 22 23 Other taxes, including self-employment tax, from Schedule 2 line 10 23 24 Add lines 22 and 23. This is your total tax 24 250 26 25 Tederal income tax withheld from Tom W2 258 broms) 1099 250 Other forms (see instructions) 25 Add 25 through 25 If you have a 26 2020 estimated tax payments and around applied from 2014 turn qualifying child attach Sch. c. 27 Earned Income (EC) If you have 22 no Aastal tax credit. Attache Schedule 2013 comb pay, ses20 28 Wistront American pornit red rom for 1663 29 29 Recorded in 30 30 Antramedule 11 31 31 32 Ada 2731. The stal other parts and refundable credits 32 23 Refund 13.25 3. Anda. There You total payments 34 fline 22 ali 3 Tamu overnd 14 35e Moto 3 vower refunded to you, o 35 000 16 Teloved 16 12 17 18 COM 29 COTTO aps Rate My Professors.. Files III. Algebra Videos LA County Departm... Camaro Parts.l! - au eturn 1-(TRP 3-51) Part Instructions Form 1040 Schedule 1 2020 Tax Rate Schedules hed Farm 1040 Comitetom 1010 below for Lance and Wandern De there 1040 U.S. Individual Income Tax Return 2020 OMON 1545-00 as Us Oy name Your social security number 123456786 Pling States Married Your Torstand nie Lance H. Dean If repouse's fest Wanda Dean Home and if you have a PO BOX 431 Yuce Drive Clown to have a brigade name Apt Spouse's so suriyer 12.45-4747 Presidentialection Campaign Chery 31 Oda kwa age as Hone code Santa Fe, NM 82501 Free power Ay , .. Standard Someone can Deduction Your spendent You Age/Blindness Suose Dependents (2) Soda further (1) DO PA 12345678 NO 13.7 13.5 ws Ya ON 1 1 102,000 1.100) 950 x 20 16 16 17 ald Ia 1 12 Oy a e Instructions Note: This problem is for the 2020 tax year. Lance H. and Wanda B. Dean are married and live at 431 Yucca Drive, Santa Fe, NM 87501. Lance worla local Chamber of Commerce, and Wanda is employed part-time as a paralegal for a law firm. During 2020, the Deans had the following receipts: Salaries ($60,000 for Lance. $42,000 for Wanda) $102,000 $1.000 1.100 400 2,500 Interest income City of Albuquerque general purpose bonds Ford Motor company bonds Ally Bank certificate of deposit Child support payments from John Allen Annual gifts from parents Settlement from Roadrunner Touring Company Lottery winnings Federal income tax refund (for tax year 2019) 7,200 26,000 90,000 600 400 Wanda was previously married to John Allen. When they divorced several years ago. Wanda was awarded Penny and Kyle. (Note: Wanda has never issued a Form 8332 waiver.) Under the diverse decree, John was child support-the alimony payments were to terminate if Wanda remarried. In July, while going to lunch in downtown Santa Fe, Wanda was injured by a tour bus. Because the driver w the bus. Roadrunner Touring Company, paid her medical expenses including a one-week stay in a hospital) also transferred $90,000 to her in settlement of the personal injuries she sustained. The Deans had the following expenditures for 2020: Medical expenses (not covered by insurance) $7,200 Taxes Property taxes on personal residence $3,600 State of New Mexico income tax (includes amount withheld from wages during 2020) 4.200 7.800 Interest on home mortgage First National Bank) 6,000 Chants contributions (cash) 3,500 Life insurance premiums (policy on Lance's life 1.200 Contribution to traditional IRA on Wanda's behalt) 5.000 Ticines Contribution to the reaction campaign fund of the mayor of Santa Fe 500 Funeral expenses for Wayne Boyle 6.300 fintunes alte aneshara wanca as the can tem 300 Departm... Cam Return 1. (TRP 3-51) Ponte Department of the Tremur Attach to Form 1040, 1040-SR, of 1040-NR. Attachment Internal Revenue Service Go to www.br.gov/Farm 1040 for instructions and the intest Information. Sequence No. 01 Name() shown on Form 1040 1040-SR, or 1040-NR Your social security number Lance H. and Wanda B. Denn 125-45-6786 Part 1 Additional Income 1 20 3 Taxable rounds, crediks, or offsets of state and local income taxes 2 Alumny received b Date of original divorce or separation agreement (see instructions 3 Duess income or loss. Altach Schedule other gains or losses), Allan Porn 4797 5 Rental estate, royales, partnerships, corporation, trusts, etc. Attach Schedule 6 Farrencone or (os). Altach Schedule 7 Uployment compensation Other income List type and amount 4 5 6 7 8 Combine lines 1 through 8 Enterher and on Form 1040,1010-SR 1040-NR In 9 Adjustments to Income Part II 10 expenses 10 11 Certain business expenses of reservist performing artists and fee-basement offices Mach form 2106 11 12 Her savings acorded Attach form 12 13 Mavi ponusturembers of the med forces, Atachrom 1903 13 14 Didactitle part of it. Mad Sche 14 15 loyd SIMPLE, and quali 15 16 16 17 Po wally want Ba 18 Amy said RSSN cabello 19 SA 19 20 20 21 23 Tutores ML 22 Now The adjustments to income 1010 1010.5 14 let 22 BA For Paperwork Reduction Act Notice, see your taken instructions Schedule Turn 1040) 2020 Printem Return 1- (TRP 3-51) Instructions Form 1040 Schedule 1 2020 Tax Rate Schedules chedule Form 5040 20 Amount froen Schedule 3, line 20 21 Address 19 and 20 21 22 Subtract line 21 from line 18. roles anterio 22 23 Other taxes, including self-employment tax, from Schedule 2 line 10 23 24 Add lines 22 and 23. This is your total tax 24 250 26 25 Tederal income tax withheld from Tom W2 258 broms) 1099 250 Other forms (see instructions) 25 Add 25 through 25 If you have a 26 2020 estimated tax payments and around applied from 2014 turn qualifying child attach Sch. c. 27 Earned Income (EC) If you have 22 no Aastal tax credit. Attache Schedule 2013 comb pay, ses20 28 Wistront American pornit red rom for 1663 29 29 Recorded in 30 30 Antramedule 11 31 31 32 Ada 2731. The stal other parts and refundable credits 32 23 Refund 13.25 3. Anda. There You total payments 34 fline 22 ali 3 Tamu overnd 14 35e Moto 3 vower refunded to you, o 35 000 16 Teloved 16 12 17 18 COM 29 COTTO aps Rate My Professors.. Files III. Algebra Videos LA County Departm... Camaro Parts.l! - au eturn 1-(TRP 3-51) Part Instructions Form 1040 Schedule 1 2020 Tax Rate Schedules hed Farm 1040 Comitetom 1010 below for Lance and Wandern De there 1040 U.S. Individual Income Tax Return 2020 OMON 1545-00 as Us Oy name Your social security number 123456786 Pling States Married Your Torstand nie Lance H. Dean If repouse's fest Wanda Dean Home and if you have a PO BOX 431 Yuce Drive Clown to have a brigade name Apt Spouse's so suriyer 12.45-4747 Presidentialection Campaign Chery 31 Oda kwa age as Hone code Santa Fe, NM 82501 Free power Ay , .. Standard Someone can Deduction Your spendent You Age/Blindness Suose Dependents (2) Soda further (1) DO PA 12345678 NO 13.7 13.5 ws Ya ON 1 1 102,000 1.100) 950 x 20 16 16 17 ald Ia 1 12 Oy a e