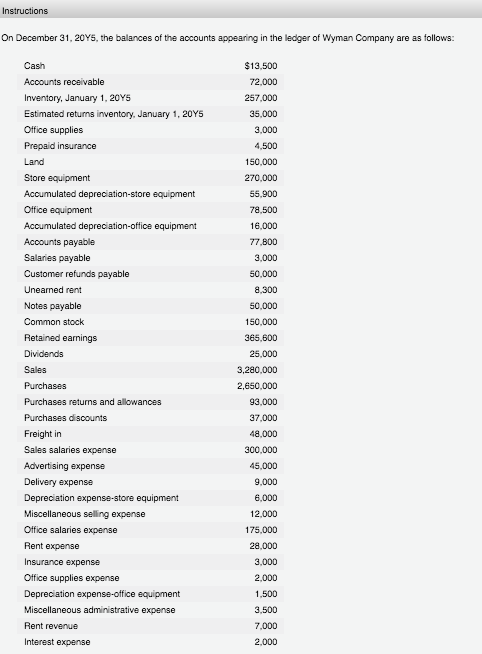

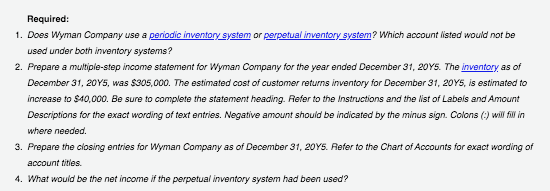

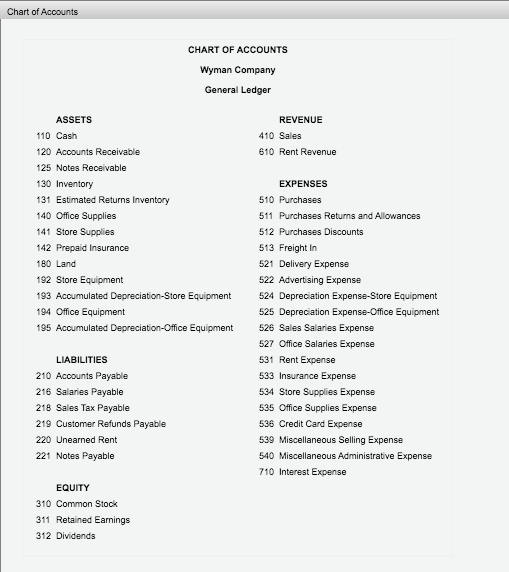

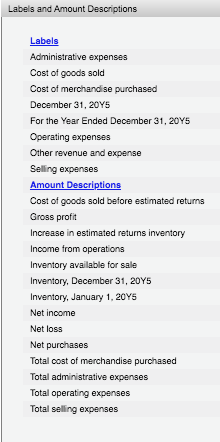

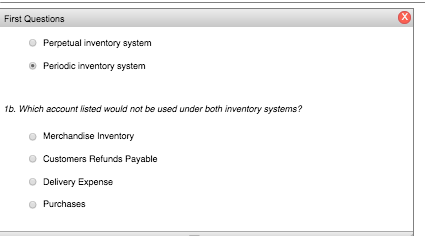

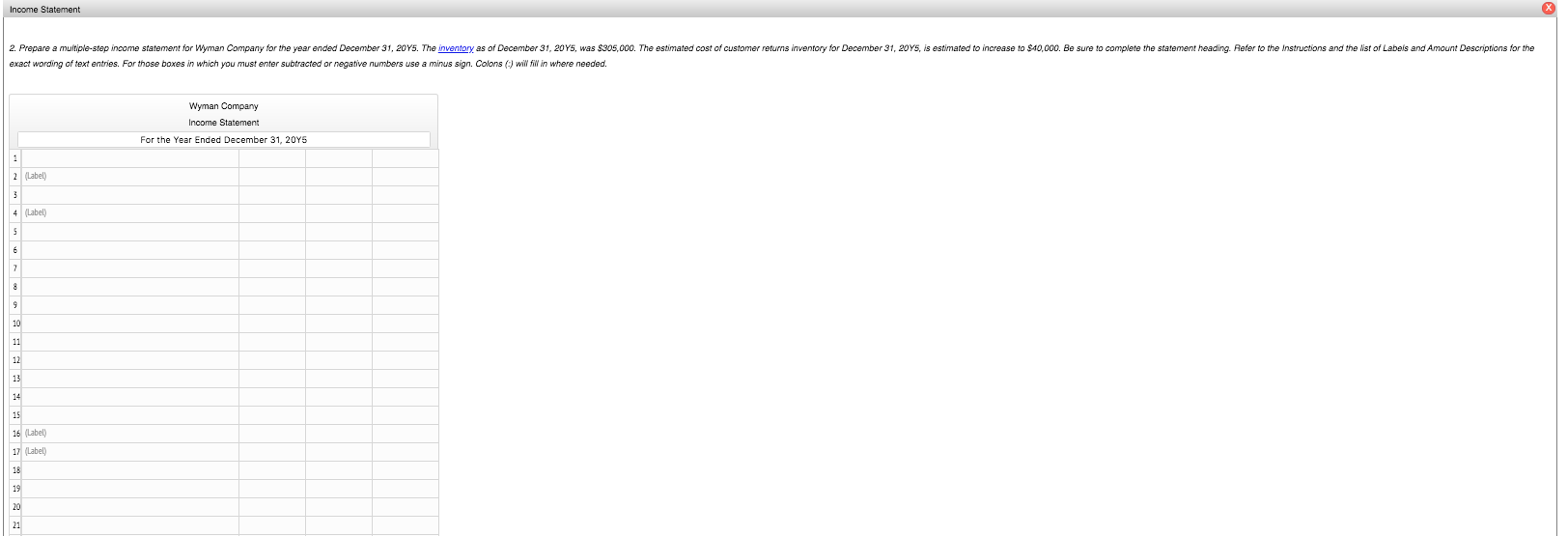

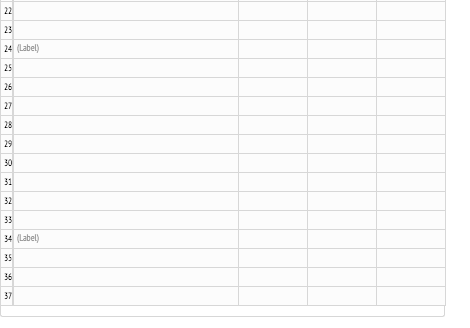

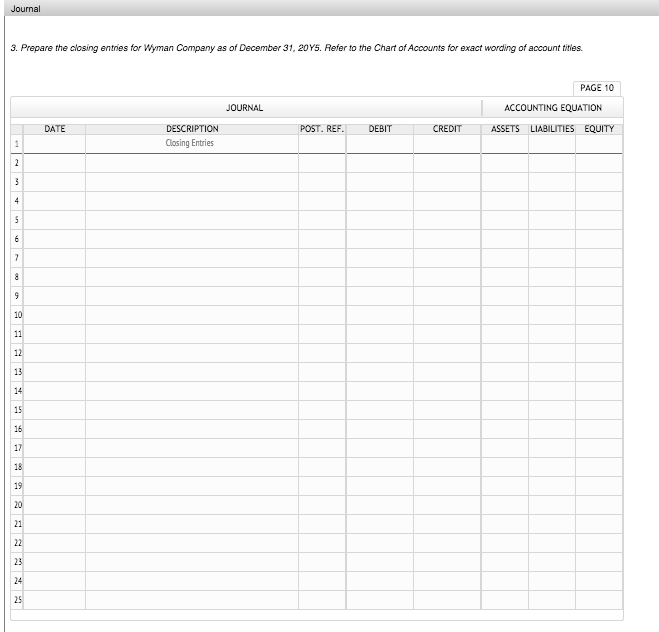

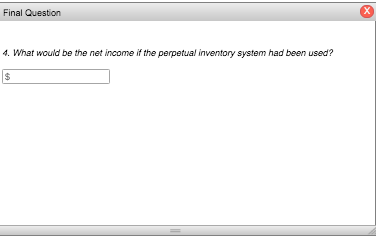

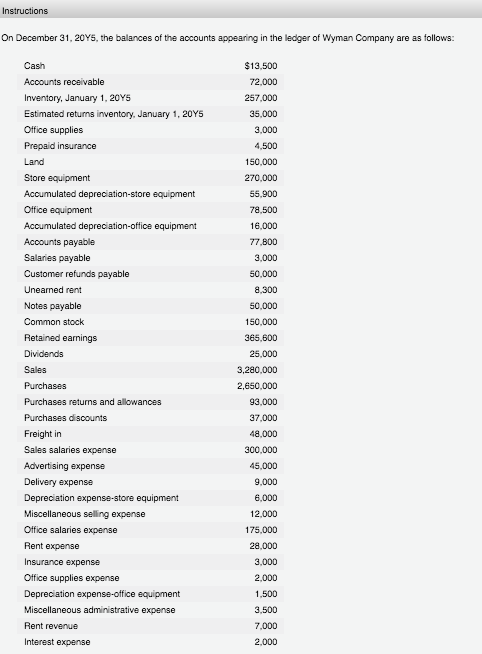

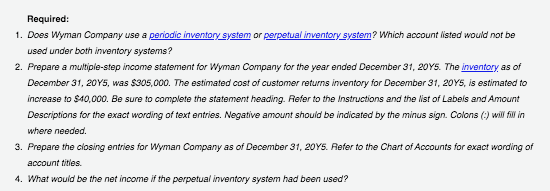

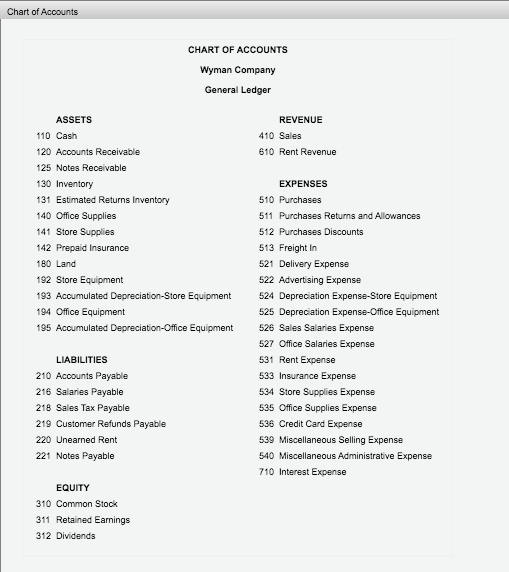

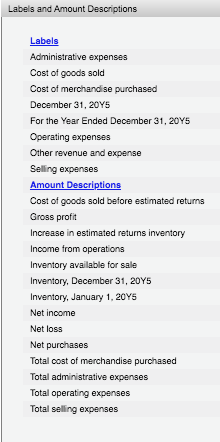

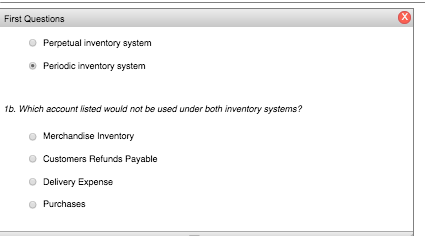

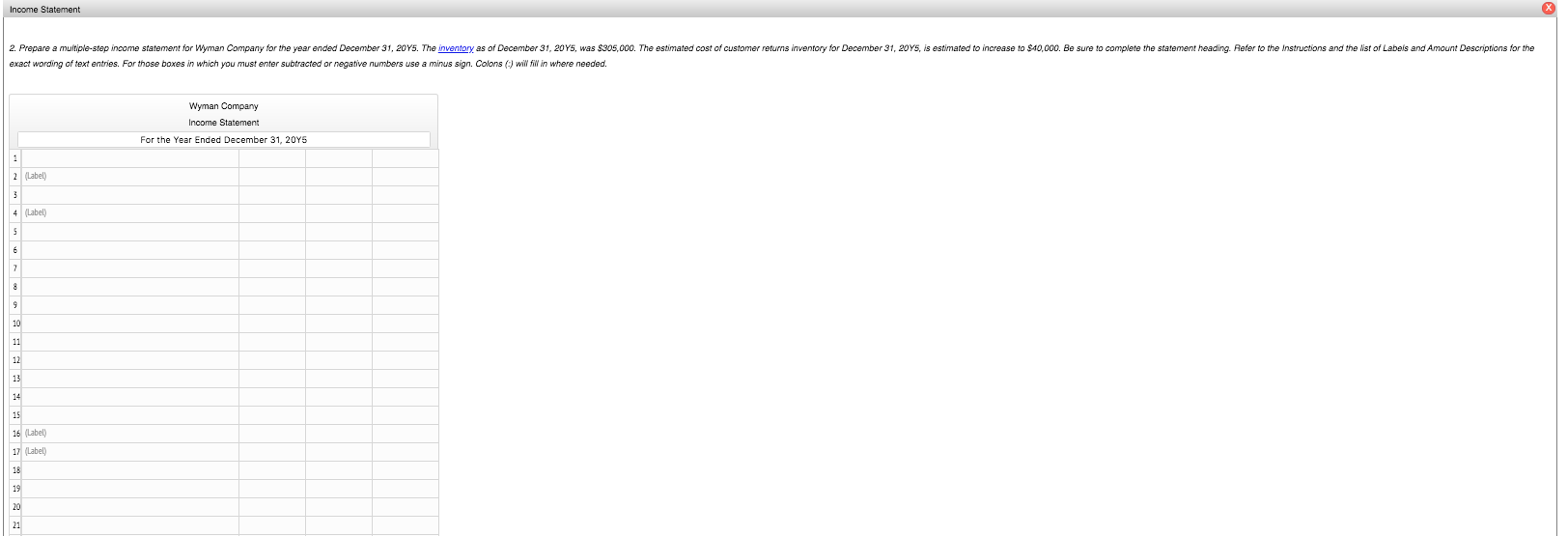

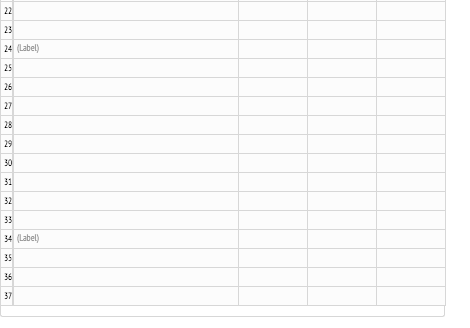

Instructions On December 31, 2045, the balances of the accounts appearing in the ledger of Wyman Company are as follows: Cash Accounts receivable Inventory, January 1, 2045 Estimated returns inventory, January 1, 2045 Office supplies Prepaid insurance Land Store equipment Accumulated depreciation-store equipment Office equipment Accumulated depreciation-office equipment Accounts payable Salaries payable Customer refunds payable Unearned rent Notes payable Common stock Retained earnings Dividends Sales $13,500 72,000 257,000 35,000 3,000 4,500 150,000 270,000 55.900 78,500 16,000 77,800 3,000 50.000 8,300 50,000 150,000 365,600 25,000 3,280,000 2,650,000 93,000 37,000 48,000 300,000 45,000 9,000 6,000 12,000 175,000 28,000 3,000 2,000 1,500 3,500 7.000 2,000 Purchases Purchases returns and allowances Purchases discounts Freight in Sales salaries expense Advertising expense Delivery expense Depreciation expense-store equipment Miscellaneous selling expense Office salaries expense Rent expense Insurance expense Office supplies expense Depreciation expense-office equipment Miscellaneous administrative expense Rent revenue Interest expense Required: 1. Does Wyman Company use a periodic inventory system or perpetual inventory system? Which account listed would not be used under both inventory systems? 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 20Y5. The inventory as of December 31, 2045, was $305,000. The estimated cost of customer returns inventory for December 31, 2045, is estimated to increase to $40,000. Be sure to complete the statement heading. Refer to the instructions and the list of Labels and Amount Descriptions for the exact wording of text entries. Negative amount should be indicated by the minus sign. Colons() will in where needed. 3. Prepare the closing entries for Wyman Company as of December 31, 20Y5. Refer to the Chart of Accounts for exact wording of account titles. 4. What would be the net income if the perpetual inventory system had been used? Chart of Accounts CHART OF ACCOUNTS Wyman Company General Ledger REVENUE 410 Sales 610 Rent Revenue ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Inventory 131 Estimated Returns Inventory 140 Office Supplies 141 Store Supplies 142 Prepaid Insurance 180 Land 192 Store Equipment 193 Accumulated Depreciation Store Equipment 194 Office Equipment 195 Accumulated Depreciation Office Equipment EXPENSES 510 Purchases 511 Purchases Returns and Allowances 512 Purchases Discounts 513 Freight in 521 Delivery Expense 522 Advertising Expense 524 Depreciation Expense-Store Equipment 525 Depreciation Expense-Office Equipment 526 Sales Salaries Expense 527 Office Salaries Expense 531 Rent Expense 533 Insurance Expense 534 Store Supplies Expense 535 Office Supplies Expense 536 Credit Card Expense 539 Miscellaneous Selling Expense 540 Miscellaneous Administrative Expense 710 Interest Expense LIABILITIES 210 Accounts Payable 216 Salaries Payable 218 Sales Tax Payable 219 Customer Refunds Payable 220 Unearned Rent 221 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends Labels and Amount Descriptions Labels Administrative expenses Cost of goods sold Cost of merchandise purchased December 31, 2045 For the Year Ended December 31, 2045 Operating expenses Other revenue and expense Selling expenses Amount Descriptions Cost of goods sold before estimated returns Gross profit Increase in estimated returns inventory Income from operations Inventory available for sale Inventory, December 31, 2045 Inventory, January 1, 20YS Net income Net loss Net purchases Total cost of merchandise purchased Total administrative expenses Total operating expenses Total selling expenses First Questions Perpetual inventory system Periodic inventory system 1b. Which account listed would not be used under both inventory systems? Merchandise Inventory Customers Refunds Payable Delivery Expense Purchases Income Statement 2. Prepare a multiple-step income statement for Wyman Company for the year ended December 31, 20Y5. The inventory as of December 31, 2045, was $305,000. The estimated cost of customer returns inventory for December 31, 2045, is estimated to increase to $10,000. Be sure to complete the statement heading. Refer to the instructions and the list of Labels and Amount Descriptions for the exact wording of text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. Colons() will fill in where needed. Wyman Company Income Statement For the Year Ended December 31, 2015 (Label) 16 Label) 17 (Label 24 Label) Labell Journal 3. Prepare the closing entries for Wyman Company as of December 31, 20Y5. Refer to the Chart of Accounts for exact wording of account titles. PAGE 10 JOURNAL ACCOUNTING EQUATION ASSETS LIABILITIES EQUITY DATE DESCRIPTION Closing Entries POST. REF. DEBIT CREDIT Final Question 1. What would be the net income if the perpetual inventory system had been used