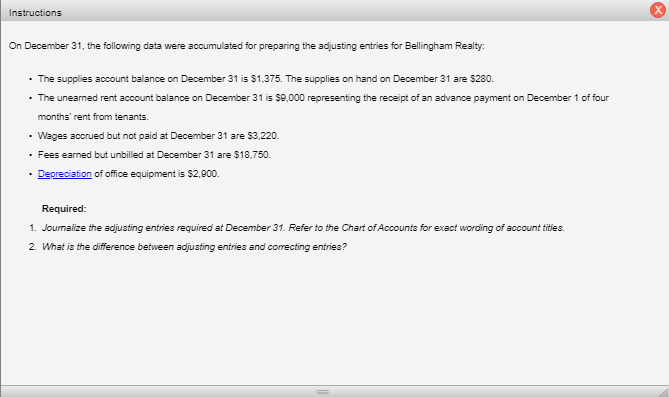

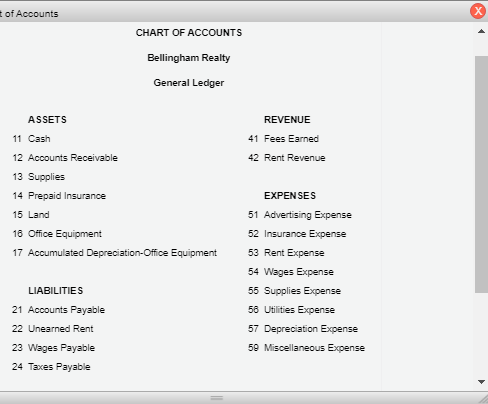

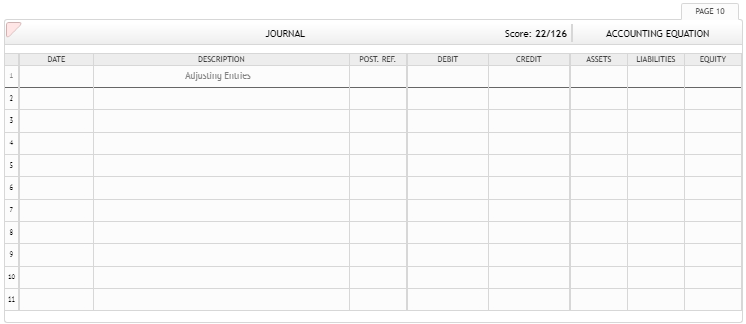

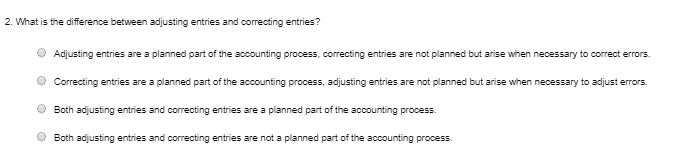

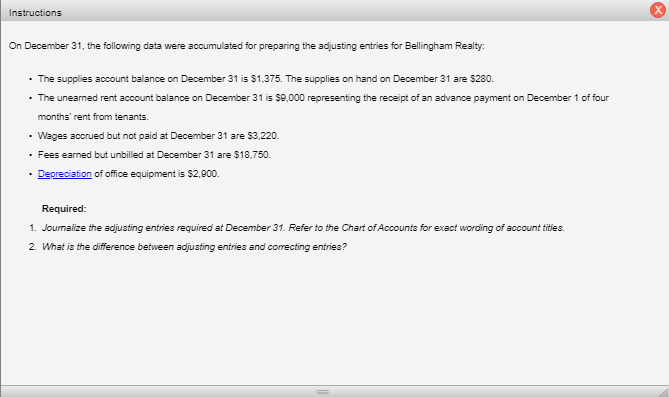

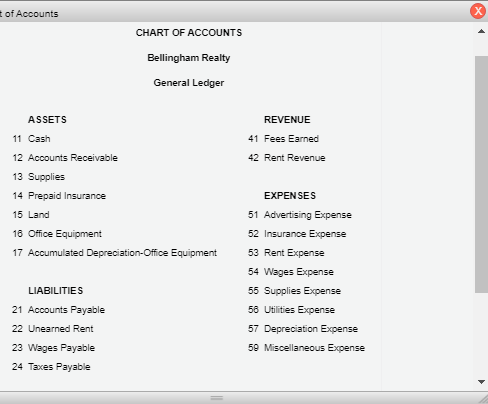

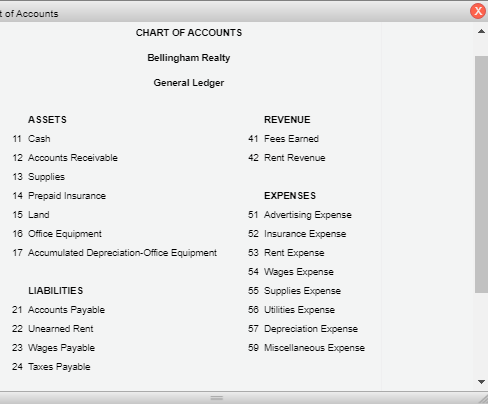

Instructions On December 31, the following data were accumulated for preparing the adjusting entries for Bellingham Realty The supplies account balance on December 31 is $1,375. The supplies on hand on December 31 are $280. The unearned rent account balance on December 31 is 89,000 representing the receipt of an advance payment on December 1 of four months' rent from tenants. . Wages accrued but not paid at December 31 are $3.220. Fees earned but unbilled at December 31 are $18.750. Depreciation of office equipment is $2,900. Required: 1. Journalize the adjusting entries required at December 31. Refer to the Chart of Accounts for exact wording of account titles. 2. What is the difference between adjusting entries and correcting entries? of Accounts CHART OF ACCOUNTS Bellingham Realty General Ledger ASSETS REVENUE 41 Fees Earned 42 Rent Revenue 11 Cash 12 Accounts Receivable 13 Supplies 14 Prepaid Insurance 15 Land 16 Office Equipment 17 Accumulated Depreciation Office Equipment EXPENSES 51 Advertising Expense 52 Insurance Expense 53 Rent Expense 54 Wages Expense 55 Supplies Expense 56 Utilities Expense 57 Depreciation Expense 59 Miscellaneous Expense LIABILITIES 21 Accounts Payable 22 Unearned Rent 23 Wages Payable 24 Taves Payable of Accounts CHART OF ACCOUNTS Bellingham Realty General Ledger ASSETS REVENUE 41 Fees Earned 42 Rent Revenue 11 Cash 12 Accounts Receivable 13 Supplies 14 Prepaid Insurance 15 Land 16 Office Equipment 17 Accumulated Depreciation Office Equipment EXPENSES 51 Advertising Expense 52 Insurance Expense 53 Rent Expense 54 Wages Expense 55 Supplies Expense 56 Utilities Expense 57 Depreciation Expense 59 Miscellaneous Expense LIABILITIES 21 Accounts Payable 22 Unearned Rent 23 Wages Payable 24 Taves Payable PAGE 10 JOURNAL Score: 22/126 ACCOUNTING EQUATION DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY Aujusliny Embie 2. What is the difference between adjusting entries and correcting entries? Adjusting entries are a planned part of the accounting process, correcting entries are not planned but arise when necessary to correct errors. Correcting entries are a planned part of the accounting process, adjusting entries are not planned but arise when necessary to adjust errors. Both adjusting entries and correcting entries are a planned part of the accounting process. Both adjusting entries and correcting entries are not a planned part of the accounting process