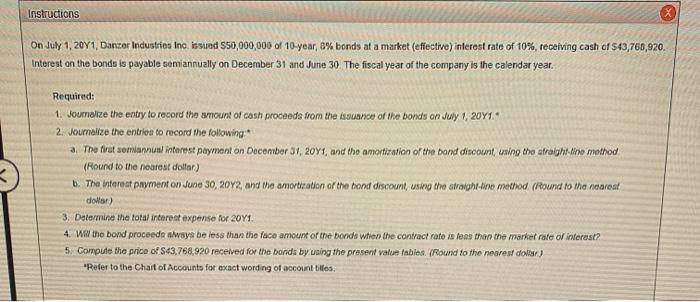

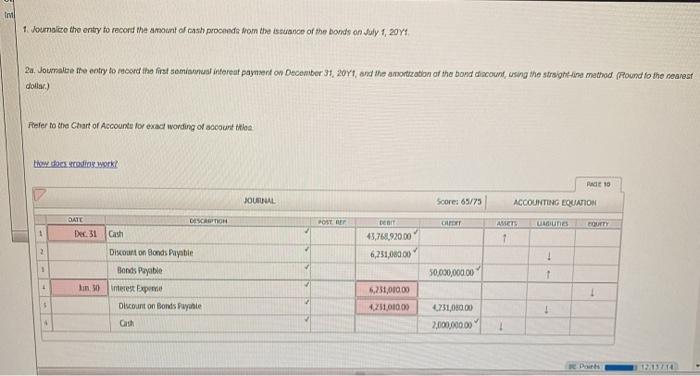

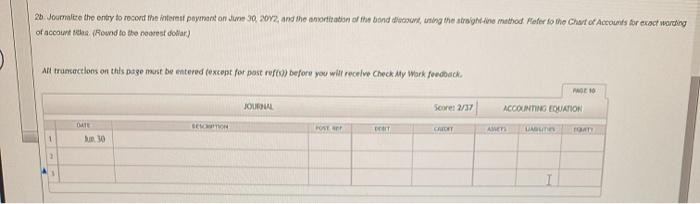

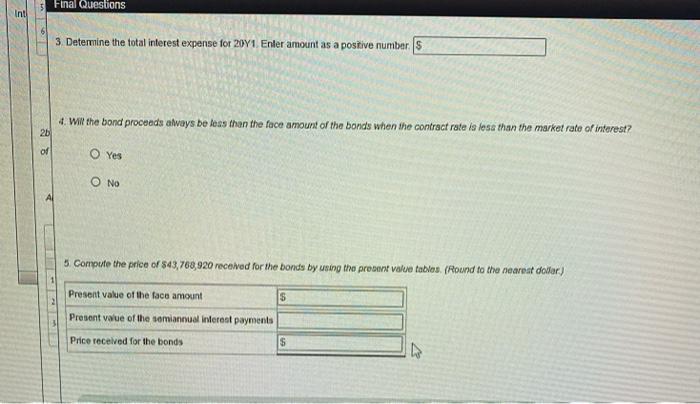

Instructions On July 1, 2011, Danzer Industries Inc. issued 550,000,000 of 10-year, 8% bonds at a market (effective) interest rate of 10%, receiving cash of S43,768,920 Interest on the bonds is payable semiannually on December 31 and June 30 The fiscal year of the company is the calendar year. Required: 1. Journalize the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, 2011 2. Journalize the entries to record the following a. The firat senamus interest payment on December 31, 20Y1, and tho amortisation of the band discount, using the straight line method (Round to the nearest dollar) b. The interest payment on June 30, 2012, and the amortization of the bond discount, using the straight we method (Round to the nearest dollar) 3. Determine the total interest expense for 2011 4. Wil the bond proceede always be less than the face amount of the bovids when the contract rate is less than the market rate of interest? 5. Compute the price of S43,768,920 received for the bands by using the present value tables. (Round to the nearest dolar) Refer to the Chart of Accounts for exact wording of accountilles im 1 Joumice the entry to record the amount of cash proceeds from the issuance of the bonds on July 1, 2011 21. Journalte the entry to record the first somewwal interest payment on December 31, 2071, and the aniontzation of the bond discount, using me straight line method (Pound to the nearest dollar) Prefer to the Chart of Accounts for exact wording of account there two sodios work DE 10 MOURAL Score: 65/75 ACCOUNTING EQUATION POST BET DET CLOT dnes BOUT 1 45,764,920.00 6,251,080.00 ! 1 DESCRIPTION Dec. 31 Cash Discount on Bonds Payable Bands Payable In 30 interest Expert Discount on Bonds Pynte Gh 50,000,000.00 4 6,257,000.00 421,010,00 $ 0251,080.00 2.000.000,00 12/1371 20. Journalize the entry to record the internet payment on June 30, 2012, and the envortisation of the bond dumine, uning the straight Ano method Meter to the Chart of Accounts for exact warating of account the Rowd to the nearest dolar) All trumactions on this page must be entered (wxcopt for post (9) before you will receive Check My Work foudback, PAGE 10 JOUR Score: 2/37 ACCOUNTING EQUATION BE DATE un T GET Un TOT Final Questions Intl 3. Determine the total interest expense for 20Y1 Enter amount as a positive numbers 4. Will the bond proceeds always be less than the face amount of the bonds when the contract rate is less than the market rate of interest? 26 of O Yes O No 5. Compute the price of $43,768,920 received for the bonds by using the pret value tables (Round to the nearest do for) Present value of the face amount S Present value of the semiannual interest payments Price received for the bonds 5