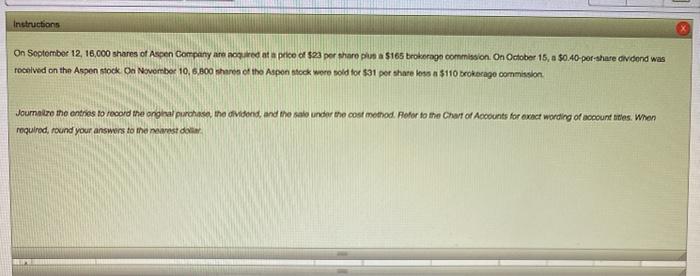

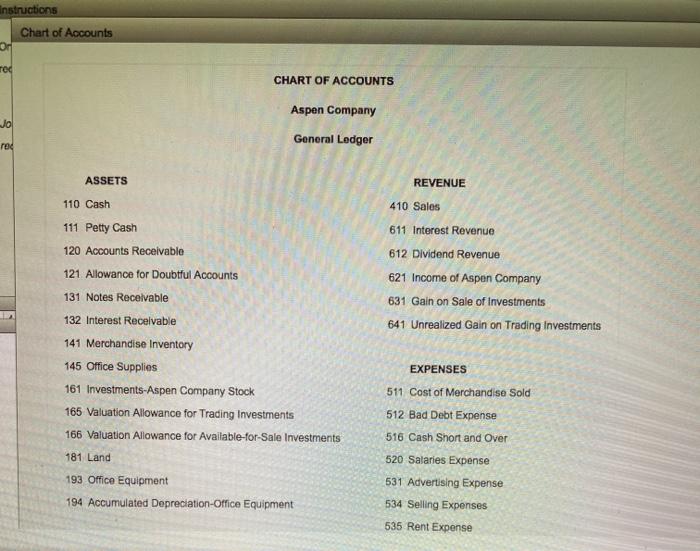

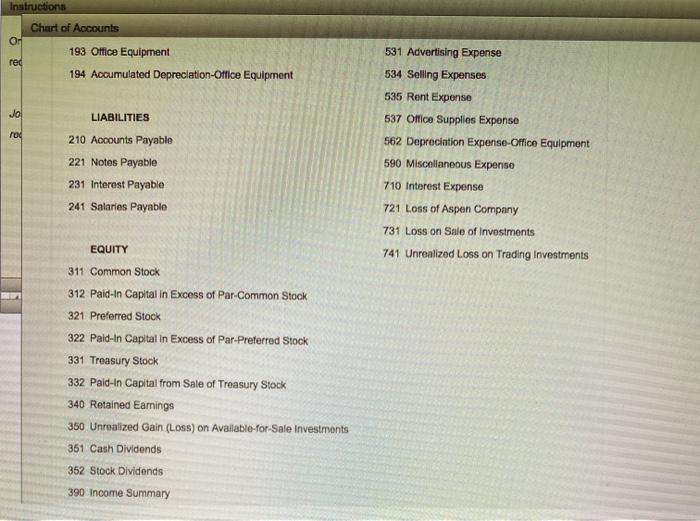

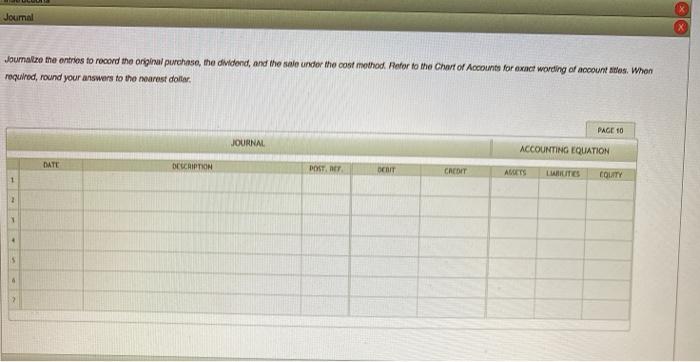

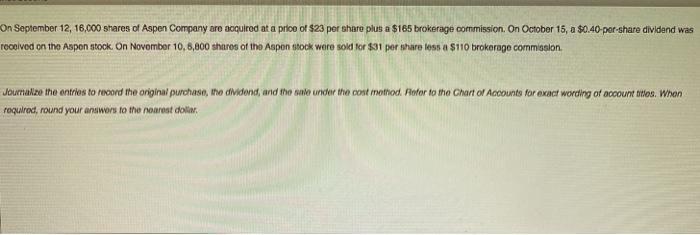

Instructions On September 12, 16,000 shares of Aspen Company argued at a price of $23 por sharoplus a $165 brokerage commission On October 15, a $0.40-por-share dividend was rocelved on the Aspen stock On November 10, 5,800 shares of the Aspon stock were sold for $31 per share los 5110 Brokerage commission Journire the entries to record the engine purchase the vidond, and the stato under the cost method. Motor to the Chart of Accounts for exact wording of account titles. When required, round your answers to the newest instructions Chart of Accounts Or red CHART OF ACCOUNTS Aspen Company Jo General Ledger red ASSETS REVENUE 110 Cash 410 Sales 611 Interest Revenue 612 Dividend Revenue 621 Income of Aspen Company 631 Gain on Sale of Investments 111 Petty Cash 120 Accounts Receivable 121 Allowance for Doubtful Accounts 131 Notes Receivable 132 Interest Recelvable 141 Merchandise Inventory 145 Office Supplies 161 Investments-Aspen Company Stock 165 Valuation Allowance for Trading Investments 166 Valuation Allowance for Available-for-Sale Investments 641 Unrealized Gain on Trading Investments EXPENSES 511 Cost of Merchandise Sold 512 Bad Debt Expense 516 Cash Short and Over 181 Land 193 Office Equipment 194 Accumulated Depreciation Office Equipment 520 Salaries Expense 531 Advertising Expense 534 Selling Expenses 535 Rent Expense Instructions On Chart of Accounts 193 Office Equipment 194 Accumulated Depreciation Office Equipment red LIABILITIES rod 210 Accounts Payable 221 Notes Payable 231 Interest Payable 241 Salaries Payable 531 Advertising Expense 534 Soling Expenses 535 Rent Expense 537 Office Supplies Expense 562 Depreciation Expense-Office Equipment 590 Miscellaneous Expense 710 Interest Expense 721 Loss of Aspen Company 731 Loss on Sale of Investments 741 Unrealized Loss on Trading Investments EQUITY 311 Common Stock 312 Paid-In Capital in Excess of Par-Common Stock 321 Preferred Stock 322 Paid-In Capital in Excess of Par-Preferred Stock 331 Treasury Stock 332 Paid-in Capital from Sale of Treasury Stock 340 Retained Earnings 360 Unrealized Gain (Loss) on Available-for-Sale investmonts 361 Cash Dividends 352 Stock Dividends 390 Income Summary Journal Joumalize the entries to record the original purchase, the dividend, and the sale under the cost method Petor to the Chart of Accounts for exact wording of account thes. When required, round your answers to the nearest dotter, PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION DOST, BET OCIT CREDIT ALOETS LATES 1 COUNTY On September 12, 16,000 shares of Aspen Company are acquired at a price of $23 per share plus a $165 brokerage commission. On October 15, a $0.40-per-share dividend was received on the Aspon stock. On November 10,8,800 shares of the Aspon stock were sold for $31 per share less a $110 brokerage commission Jour 20 the entries to record the original purchase, who didend, and the sente under the cont mothod fotor to the Chart of Accounts for exact worting of account thes. When required, round your answers to the nearest dollar