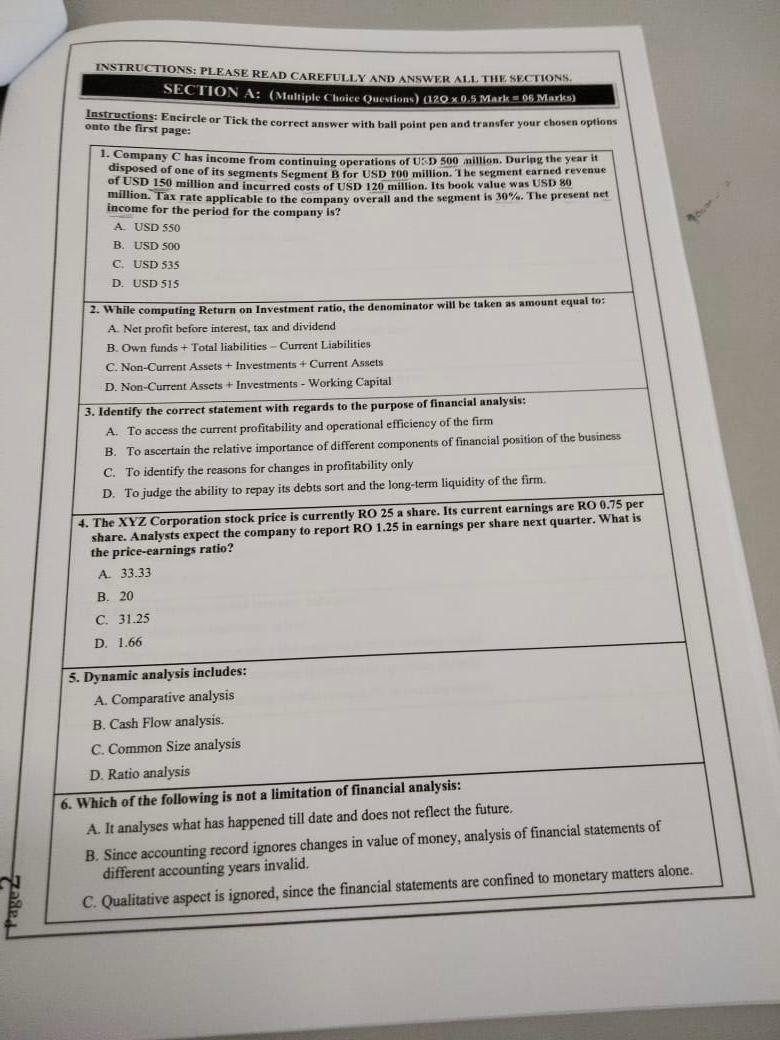

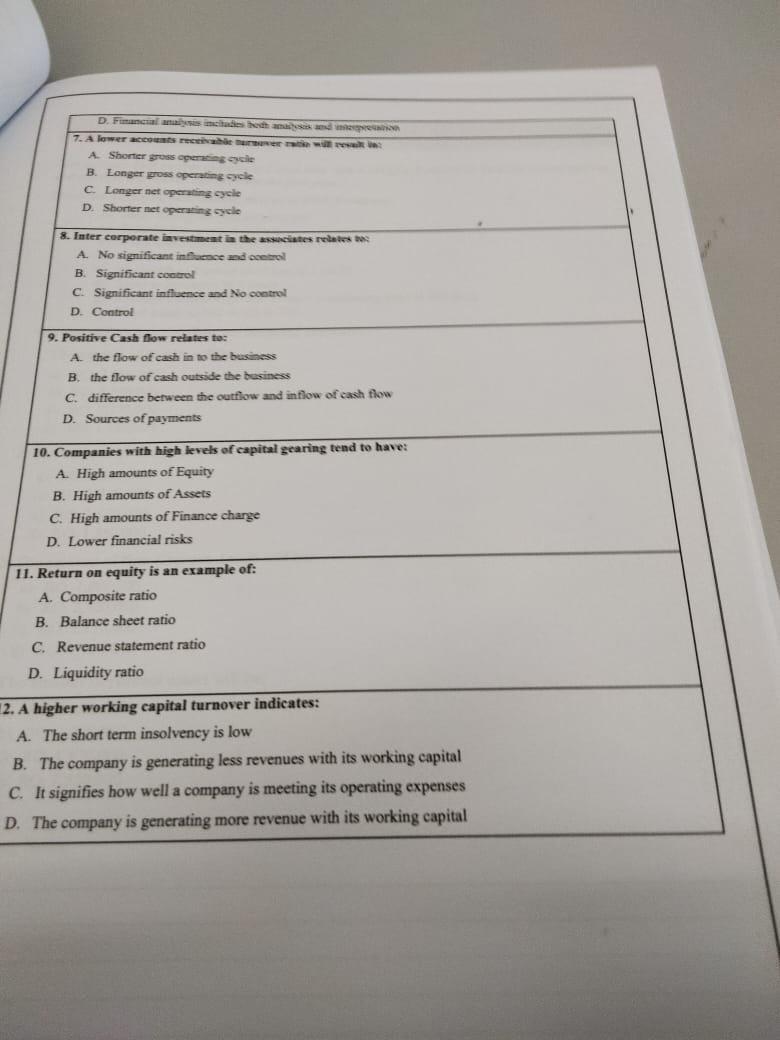

INSTRUCTIONS: PLEASE READ CAREFULLY AND ANSWER AL. THE SECTIONS. SECTION A: (Multiple Choice Questions) (120 x.0.5 Maxk =05Maxks ) Imstructions: Encircle or Tick the correct answer with ball point pen and transfer your chosen options onto the first page: 1. Company C has income from continuing operations of USD disposed of one of its segments Segment B for USD 100 million. The segment earned revenue of USD 150 million and incurred costs of USD 120 million. Its book value was USD 80 million. Tax rate applicable to the company overall and the segment is 30%. The present net income for the period for the company is? A. USD 550 B. USD 500 C. USD 535 D. USD 515 2. While computing Return on Investment ratio, the denominator will be taken as amount equal to: A. Net profit before interest, tax and dividend B. Own funds + Total liabilities - Current Liabilities C. Non-Current Assets + Investments + Current Assets D. Non-Current Assets + Investments - Working Capital 3. Identify the correct statement with regards to the purpose of financial analysis: A. To access the current profitability and operational efficiency of the firm B. To ascertain the relative importance of different components of financial position of the business C. To identify the reasons for changes in profitability only D. To judge the ability to repay its debts sort and the long-term liquidity of the firm. 4. The XYZ Corporation stock price is currently RO25 a share. Its current earnings are RO0.75 per share. Analysts expect the company to report RO 1.25 in earnings per share next quarter. What is the price-earnings ratio? A. 33.33 B. 20 C. 31.25 D. 1.66 5. Dynamic analysis includes: A. Comparative analysis B. Cash Flow analysis. C. Common Size analysis D. Ratio analysis 6. Which of the following is not a limitation of financial analysis: A. It analyses what has happened till date and does not reflect the future. B. Since accounting record ignores changes in value of money, analysis of financial statements of different accounting years invalid. C. Qualitative aspect is ignored, since the financial statements are confined to monetary matters alone. A. Shorter gross operatins cysile B. Eonger gross operating cycle C. Longer net operating cycle D. Shorter net operuting oycle 8. Inter corporate investiment lin the aswiciatcs reletes boc A. No significant infferne and ocotrol B. Significant control C. Significant influence and No oontrol D. Control 9. Positive Cash flow relates to: A. the flow of cash in to the business B. the flow of cach outside the business C. difference between the oathow and inflow of eash flow D. Sources of payments 10. Companies with high levels of capital gearing tend to have: A. High amounts of Equity B. High amounts of Assets C. High amounts of Finance charge D. Lower financial risks 11. Return on equity is an example of: A. Composite ratio B. Balance sheet ratio C. Revenue statement ratio D. Liquidity ratio 2. A higher working capital turnover indicates: A. The short term insolvency is low B. The company is generating less revenues with its working capital C. It signifies how well a company is meeting its operating expenses D. The company is generating more revenue with its working capital