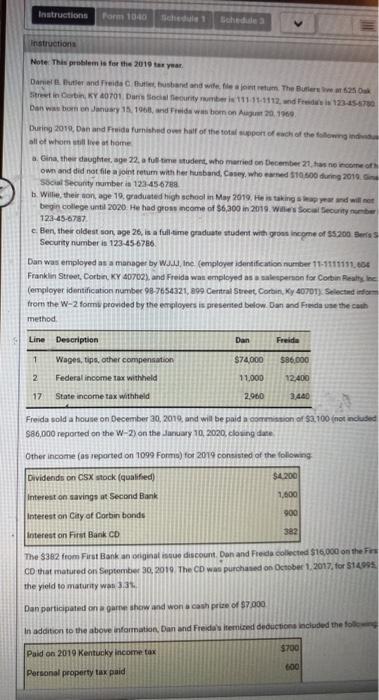

Instructions Porn 1940 Bohedules Instruction Note: This problem is for the 2019 ta year Daniel Butter and Freida Busband and wife retum. The Butler 25 rinn, KY 10701 Dan Social Neurity bei 11111-1112 and Free 123-45-6780 Dan was born on January 15 1901, and Freid was om on August 20, 1960 During 2019, Dan and Fruida furnished half of the total support of each of the foongids all of whom tive of home a. Gina, the daughter, age 22 full time student who married on December 27 has no income own and did not file a joint return with her husband, Casey, who earned 510600 during 2010 cial Security number is 123-456789 b. Willie, their con, age 19. graduated high school in May 2019. He is taking and will not begin college until 2020. He had gross income of $6,300 in 2019. Wie Society 123-45-6787 e. Bentheroldest son age 26, is a full time graduate student with grows income of 55200 Seris Security number is 123-45-6786 Dan was employed as a manager by W.JI, Ine employer identification number 11-1111111.004 Franklin Street, Corbin, KY 4070), and Freida was employed as a salesperson for Cortin Realty Inc (employer identification number 98-7654321, 299 Central Street, CortinKy 4070T. Selected on from the W-2 for provided by the employers is presented below. Dan and Fredase the cash method Line Description Dan Freida 1 $74.000 586.000 Wages, tips, other compensation Federal income tax withheld 2 11.000 12.400 17 State income tax withheld 2.900 340 Freida sold a house on December 30, 2019, and will be paid a commission of 53.100 (not included $86,000 reported on the W-2) on the January 10, 2020, closing date Other income (os reported on 1099 Forma) for 2019 consisted of the following Dividends on CSX stock (qualified) $4,200 1,500 Interest on savings at Second Bank 900 Interest on City of Corbin bonds 382 Interest on First Bank CD The $382 from First Bank an original discount Dan and rede collected $16,000 on the Fes CO that matured on September 30, 2019. The CD was purchased on October 1, 2017 for $14995 the yield to maturity was 3.31 Dan participated on game show and won a cash prize of $7.000 In addition to the above information, Dan and Freida terceed deductions included the to $700 Paid on 2019 Kentucky Income tax 600 Personal property tax paid Instructions Porn 1940 Bohedules Instruction Note: This problem is for the 2019 ta year Daniel Butter and Freida Busband and wife retum. The Butler 25 rinn, KY 10701 Dan Social Neurity bei 11111-1112 and Free 123-45-6780 Dan was born on January 15 1901, and Freid was om on August 20, 1960 During 2019, Dan and Fruida furnished half of the total support of each of the foongids all of whom tive of home a. Gina, the daughter, age 22 full time student who married on December 27 has no income own and did not file a joint return with her husband, Casey, who earned 510600 during 2010 cial Security number is 123-456789 b. Willie, their con, age 19. graduated high school in May 2019. He is taking and will not begin college until 2020. He had gross income of $6,300 in 2019. Wie Society 123-45-6787 e. Bentheroldest son age 26, is a full time graduate student with grows income of 55200 Seris Security number is 123-45-6786 Dan was employed as a manager by W.JI, Ine employer identification number 11-1111111.004 Franklin Street, Corbin, KY 4070), and Freida was employed as a salesperson for Cortin Realty Inc (employer identification number 98-7654321, 299 Central Street, CortinKy 4070T. Selected on from the W-2 for provided by the employers is presented below. Dan and Fredase the cash method Line Description Dan Freida 1 $74.000 586.000 Wages, tips, other compensation Federal income tax withheld 2 11.000 12.400 17 State income tax withheld 2.900 340 Freida sold a house on December 30, 2019, and will be paid a commission of 53.100 (not included $86,000 reported on the W-2) on the January 10, 2020, closing date Other income (os reported on 1099 Forma) for 2019 consisted of the following Dividends on CSX stock (qualified) $4,200 1,500 Interest on savings at Second Bank 900 Interest on City of Corbin bonds 382 Interest on First Bank CD The $382 from First Bank an original discount Dan and rede collected $16,000 on the Fes CO that matured on September 30, 2019. The CD was purchased on October 1, 2017 for $14995 the yield to maturity was 3.31 Dan participated on game show and won a cash prize of $7.000 In addition to the above information, Dan and Freida terceed deductions included the to $700 Paid on 2019 Kentucky Income tax 600 Personal property tax paid