Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions Prepare a statement of activities and a statement of financial position for Nonprofit Trade Association for the fiscal year ended June 30, 2006. On

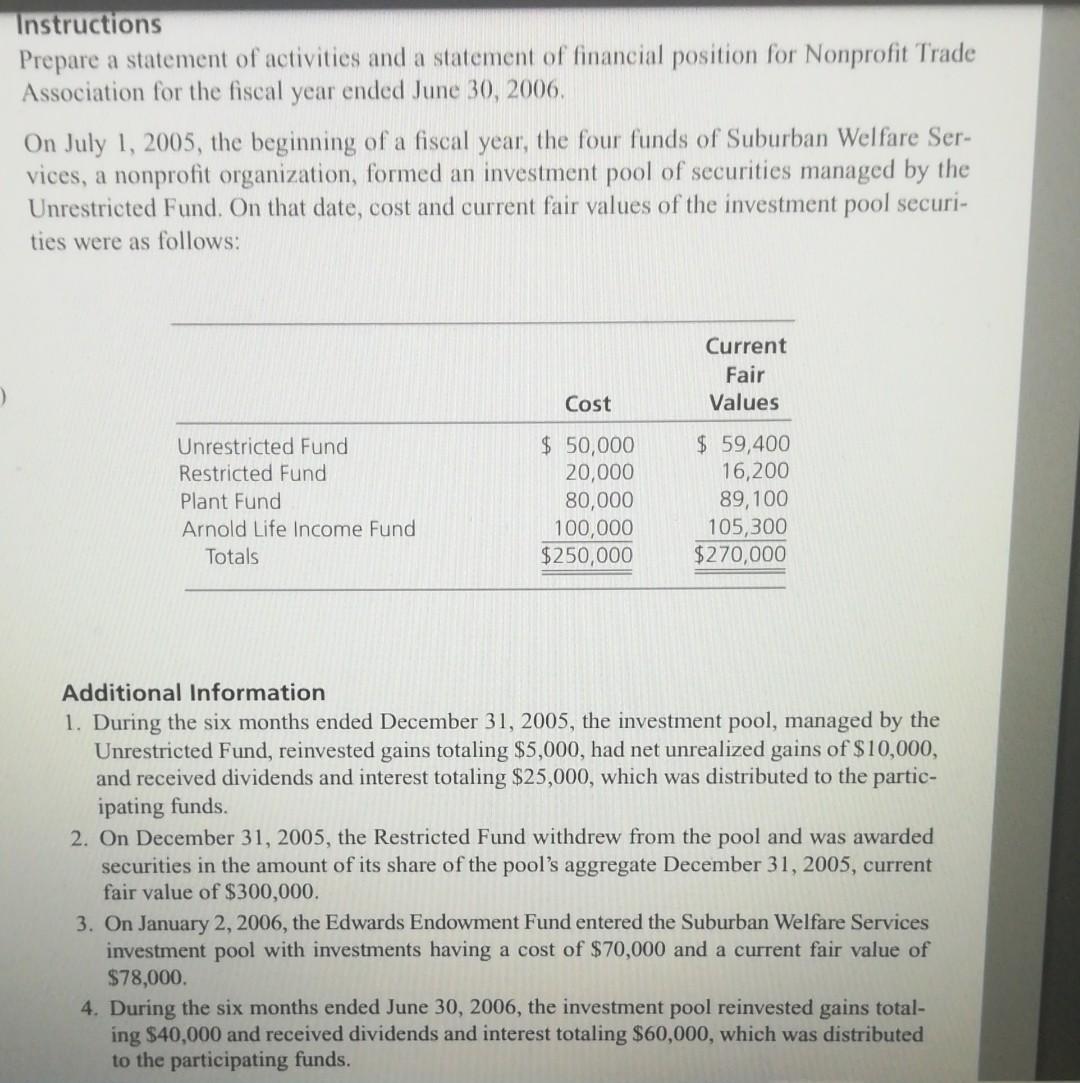

Instructions Prepare a statement of activities and a statement of financial position for Nonprofit Trade Association for the fiscal year ended June 30, 2006. On July 1, 2005, the beginning of a fiscal year, the four funds of Suburban Welfare Services, a nonprofit organization, formed an investment pool of securities managed by the Unrestricted Fund. On that date, cost and current fair values of the investment pool securities were as follows: Additional Information 1. During the six months ended December 31,2005 , the investment pool, managed by the Unrestricted Fund, reinvested gains totaling $5,000, had net unrealized gains of $10,000, and received dividends and interest totaling $25,000, which was distributed to the participating funds. 2. On December 31, 2005, the Restricted Fund withdrew from the pool and was awarded securities in the amount of its share of the pool's aggregate December 31, 2005, current fair value of $300,000. 3. On January 2, 2006, the Edwards Endowment Fund entered the Suburban Welfare Services investment pool with investments having a cost of $70,000 and a current fair value of $78,000. 4. During the six months ended June 30, 2006, the investment pool reinvested gains totaling $40,000 and received dividends and interest totaling $60,000, which was distributed to the participating funds. Additional Information 1. During the six months ended December 31,2005 , the investment pool, managed by the Unrestricted Fund, reinvested gains totaling $5,000, had net unrealized gains of $10,000, and received dividends and interest totaling $25,000, which was distributed to the participating funds. 2. On December 31, 2005, the Restricted Fund withdrew from the pool and was awarded securities in the amount of its share of the pool's aggregate December 31,2005 , current fair value of $300,000. 3. On January 2, 2006, the Edwards Endowment Fund entered the Suburban Welfare Services investment pool with investments having a cost of $70,000 and a current fair value of $78,000. 4. During the six months ended June 30, 2006, the investment pool reinvested gains totaling $40,000 and received dividends and interest totaling $60,000, which was distributed to the participating funds. Instructions a. Prepare a working paper for the Suburban Welfare Services investment pool to compute the following (round all percentages to two decimal places): (1) Original equity percentages, July 1, 2005. (2) Revised equity percentages, January 2, 2006. b. Prepare journal entries to record the operations of the Suburban Welfare Services investment pool in the accounting records of the Unrestricted Fund. Use Payable to Restricted Fund, Payable to Plant Fund, and Payable to Arnold Life Income Fund ledger accounts for amounts payable to other funds. Instructions Prepare a statement of activities and a statement of financial position for Nonprofit Trade Association for the fiscal year ended June 30, 2006. On July 1, 2005, the beginning of a fiscal year, the four funds of Suburban Welfare Services, a nonprofit organization, formed an investment pool of securities managed by the Unrestricted Fund. On that date, cost and current fair values of the investment pool securities were as follows: Additional Information 1. During the six months ended December 31,2005 , the investment pool, managed by the Unrestricted Fund, reinvested gains totaling $5,000, had net unrealized gains of $10,000, and received dividends and interest totaling $25,000, which was distributed to the participating funds. 2. On December 31, 2005, the Restricted Fund withdrew from the pool and was awarded securities in the amount of its share of the pool's aggregate December 31, 2005, current fair value of $300,000. 3. On January 2, 2006, the Edwards Endowment Fund entered the Suburban Welfare Services investment pool with investments having a cost of $70,000 and a current fair value of $78,000. 4. During the six months ended June 30, 2006, the investment pool reinvested gains totaling $40,000 and received dividends and interest totaling $60,000, which was distributed to the participating funds. Additional Information 1. During the six months ended December 31,2005 , the investment pool, managed by the Unrestricted Fund, reinvested gains totaling $5,000, had net unrealized gains of $10,000, and received dividends and interest totaling $25,000, which was distributed to the participating funds. 2. On December 31, 2005, the Restricted Fund withdrew from the pool and was awarded securities in the amount of its share of the pool's aggregate December 31,2005 , current fair value of $300,000. 3. On January 2, 2006, the Edwards Endowment Fund entered the Suburban Welfare Services investment pool with investments having a cost of $70,000 and a current fair value of $78,000. 4. During the six months ended June 30, 2006, the investment pool reinvested gains totaling $40,000 and received dividends and interest totaling $60,000, which was distributed to the participating funds. Instructions a. Prepare a working paper for the Suburban Welfare Services investment pool to compute the following (round all percentages to two decimal places): (1) Original equity percentages, July 1, 2005. (2) Revised equity percentages, January 2, 2006. b. Prepare journal entries to record the operations of the Suburban Welfare Services investment pool in the accounting records of the Unrestricted Fund. Use Payable to Restricted Fund, Payable to Plant Fund, and Payable to Arnold Life Income Fund ledger accounts for amounts payable to other funds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started