INSTRUCTIONS

- Prepare a statement of cash flow for the year ended April 30 2017 on a non-comparative basis from the information provided

- Prepare a reconciliation for the 2017 net loss to cash provided from operations

- Write a memo on why the company is experiencing a cash crunch when the liquidity ratio is acceptable

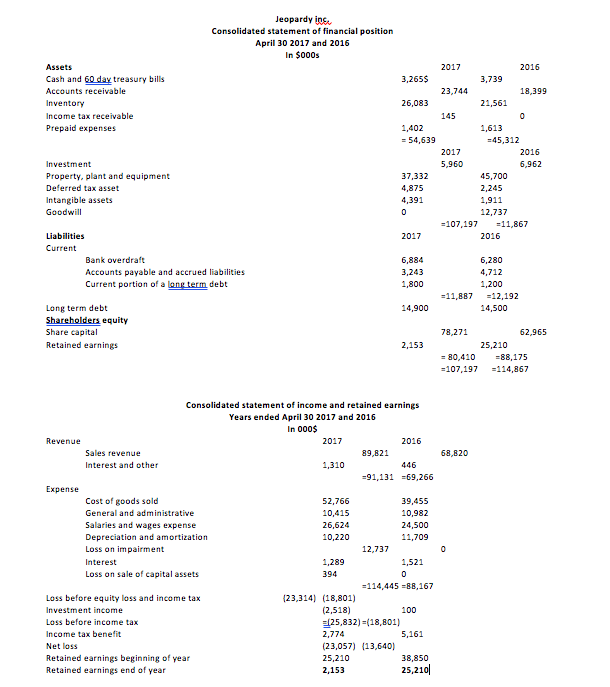

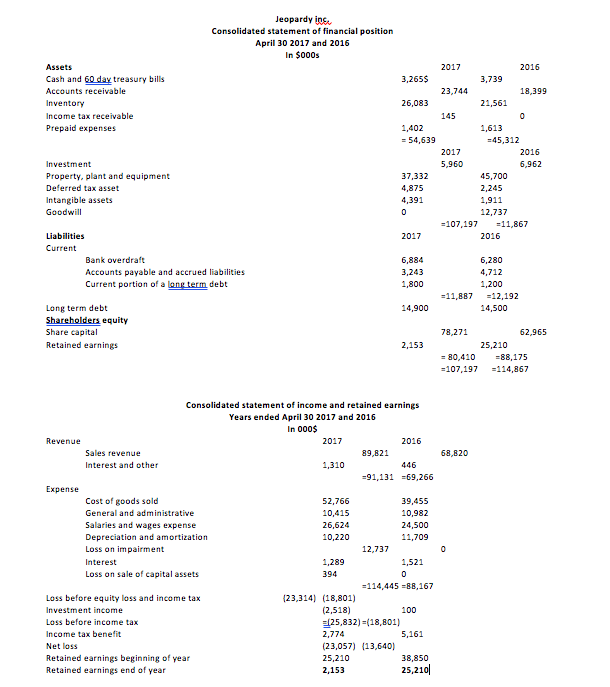

Jeopardy in Consolidated statement of financial position April 30 2017 and 2016 Assets Cash and 60 day treasury bills Accounts receivable 2017 3,265$ 3,739 23,744 18,399 26,083 21,561 Income tax receivable 145 Prepaid expenses 1,402 -54,639 1,613 45,312 2017 5,960 Investment Property, plant and equipment Deferred tax asset Intangible assets Goodwill 6,962 37,332 4,875 4,391 45,700 2,245 1,911 12,737 107,197 :11,867 Liabilities 2017 2016 Current Bank overdraft Accoun Current portion of a long term debt 6,884 3,243 1,800 6,280 4,712 1,200 ts payable and accrued liabilities 11,88712,192 Long term debt Shareholders equity Share capital Retained earnings 14,900 14,500 78,271 52,965 25,210 -80,410 88,175 -107,197 114,867 Consolidated statement of income and retained earning:s Years ended April 30 2017 and 2016 In Revenue 2017 2016 89,821 Sales revenue Interest and other 68,820 1,310 446 91,131-69,266 Cost of goods sold General and administrative Salaries and wages expense Depreciation and amortization Loss on impairment Interest Loss on sale of capital assets 52,766 10,415 26,624 10,220 39,455 10,982 24,500 11,709 12,737 1,289 394 1,521 114,445 88,167 23,314 (18,801) (2,518) Loss before equity loss and income tax Investment income Loss before income tax Income tax benefit Net loss Retained earnings beginning of year Retained earnings end of year 100 25,832)(18,801) 2,774 (23,057) (13,640) 25,210 2,153 5,161 38,850 25,210 Jeopardy in Consolidated statement of financial position April 30 2017 and 2016 Assets Cash and 60 day treasury bills Accounts receivable 2017 3,265$ 3,739 23,744 18,399 26,083 21,561 Income tax receivable 145 Prepaid expenses 1,402 -54,639 1,613 45,312 2017 5,960 Investment Property, plant and equipment Deferred tax asset Intangible assets Goodwill 6,962 37,332 4,875 4,391 45,700 2,245 1,911 12,737 107,197 :11,867 Liabilities 2017 2016 Current Bank overdraft Accoun Current portion of a long term debt 6,884 3,243 1,800 6,280 4,712 1,200 ts payable and accrued liabilities 11,88712,192 Long term debt Shareholders equity Share capital Retained earnings 14,900 14,500 78,271 52,965 25,210 -80,410 88,175 -107,197 114,867 Consolidated statement of income and retained earning:s Years ended April 30 2017 and 2016 In Revenue 2017 2016 89,821 Sales revenue Interest and other 68,820 1,310 446 91,131-69,266 Cost of goods sold General and administrative Salaries and wages expense Depreciation and amortization Loss on impairment Interest Loss on sale of capital assets 52,766 10,415 26,624 10,220 39,455 10,982 24,500 11,709 12,737 1,289 394 1,521 114,445 88,167 23,314 (18,801) (2,518) Loss before equity loss and income tax Investment income Loss before income tax Income tax benefit Net loss Retained earnings beginning of year Retained earnings end of year 100 25,832)(18,801) 2,774 (23,057) (13,640) 25,210 2,153 5,161 38,850 25,210