Question

Instructions: Prepare the bank reconciliation of ABC Company at January 31, 2020. As of January 31, 2020, the bank statement indicates that the January 31

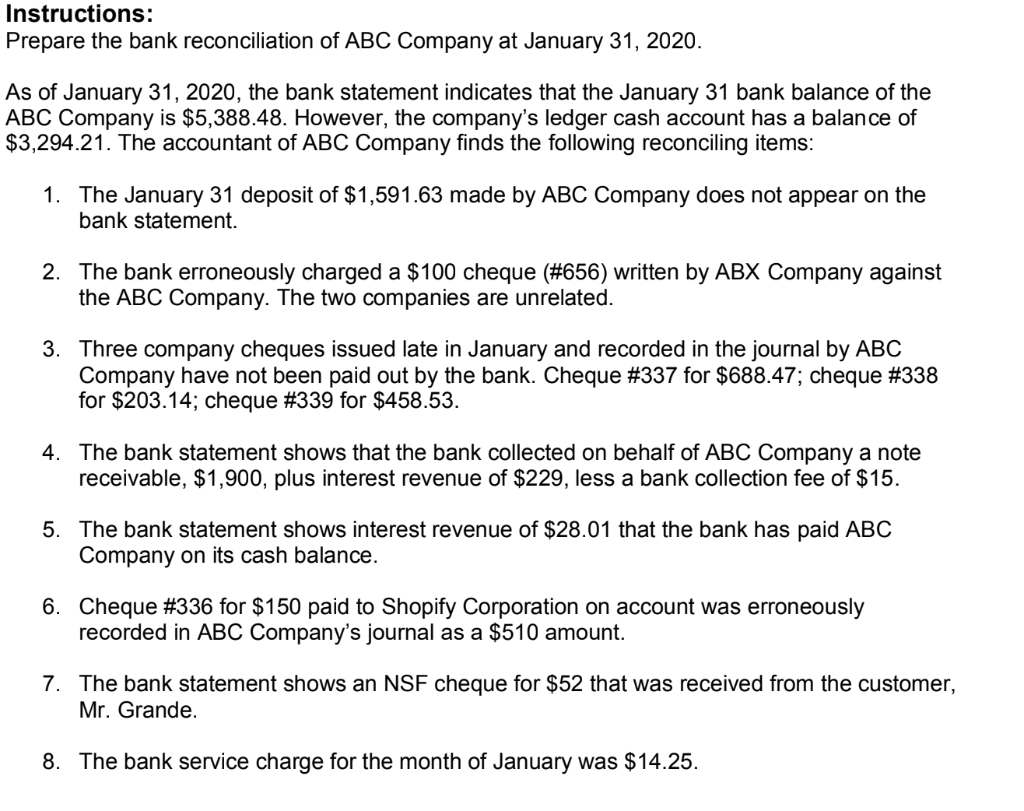

Instructions: Prepare the bank reconciliation of ABC Company at January 31, 2020. As of January 31, 2020, the bank statement indicates that the January 31 bank balance of the ABC Company is $5,388.48. However, the companys ledger cash account has a balance of $3,294.21. The accountant of ABC Company finds the following reconciling items: 1. The January 31 deposit of $1,591.63 made by ABC Company does not appear on the bank statement. 2. The bank erroneously charged a $100 cheque (#656) written by ABX Company against the ABC Company. The two companies are unrelated. 3. Three company cheques issued late in January and recorded in the journal by ABC Company have not been paid out by the bank. Cheque #337 for $688.47; cheque #338 for $203.14; cheque #339 for $458.53. 4. The bank statement shows that the bank collected on behalf of ABC Company a note receivable, $1,900, plus interest revenue of $229, less a bank collection fee of $15. 5. The bank statement shows interest revenue of $28.01 that the bank has paid ABC Company on its cash balance. 6. Cheque #336 for $150 paid to Shopify Corporation on account was erroneously recorded in ABC Companys journal as a $510 amount. 7. The bank statement shows an NSF cheque for $52 that was received from the customer, Mr. Grande. 8. The bank service charge for the month of January was $14.25.

Instructions: Prepare the bank reconciliation of ABC Company at January 31, 2020. As of January 31, 2020, the bank statement indicates that the January 31 bank balance of the ABC Company is $5,388.48. However, the company's ledger cash account has a balance of $3,294.21. The accountant of ABC Company finds the following reconciling items: 1. The January 31 deposit of $1,591.63 made by ABC Company does not appear on the bank statement. 2. The bank erroneously charged a $100 cheque (#656) written by ABX Company against the ABC Company. The two companies are unrelated. 3. Three company cheques issued late in January and recorded in the journal by ABC Company have not been paid out by the bank. Cheque #337 for $688.47; cheque #338 for $203.14; cheque #339 for $458.53. 4. The bank statement shows that the bank collected on behalf of ABC Company a note receivable, $1,900, plus interest revenue of $229, less a bank collection fee of $15. 5. The bank statement shows interest revenue of $28.01 that the bank has paid ABC Company on its cash balance. 6. Cheque #336 for $150 paid to Shopify Corporation on account was erroneously recorded in ABC Company's journal as a $510 amount. 7. The bank statement shows an NSF cheque for $52 that was received from the customer, Mr. Grande. 8. The bank service charge for the month of January was $14.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started