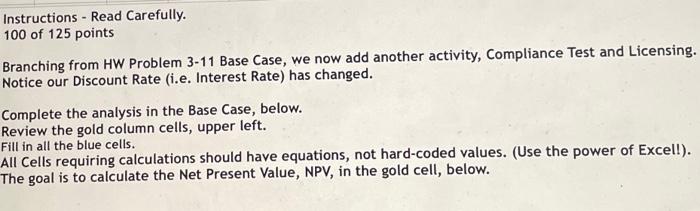

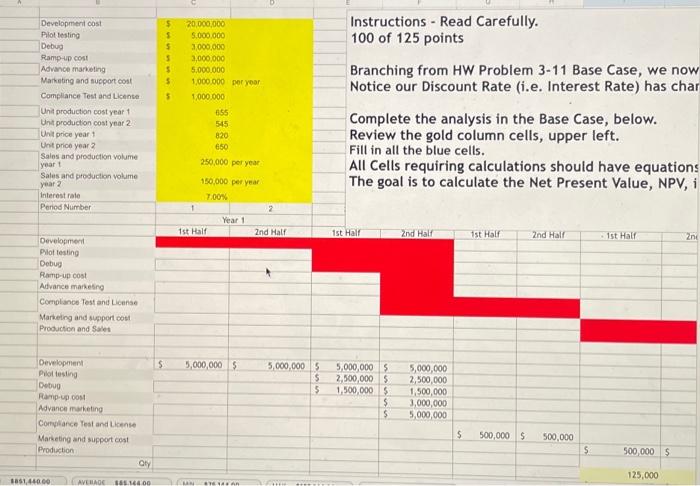

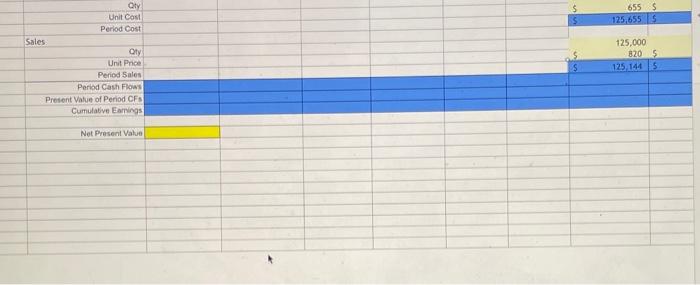

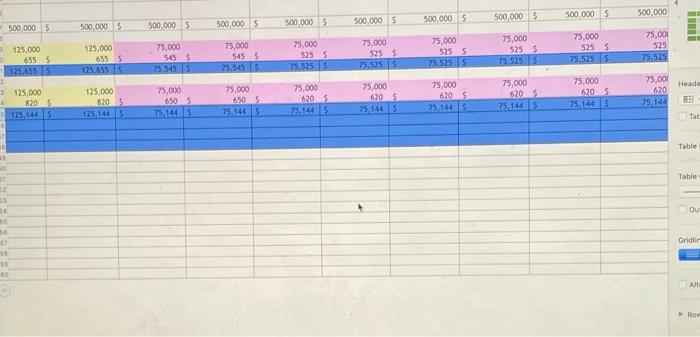

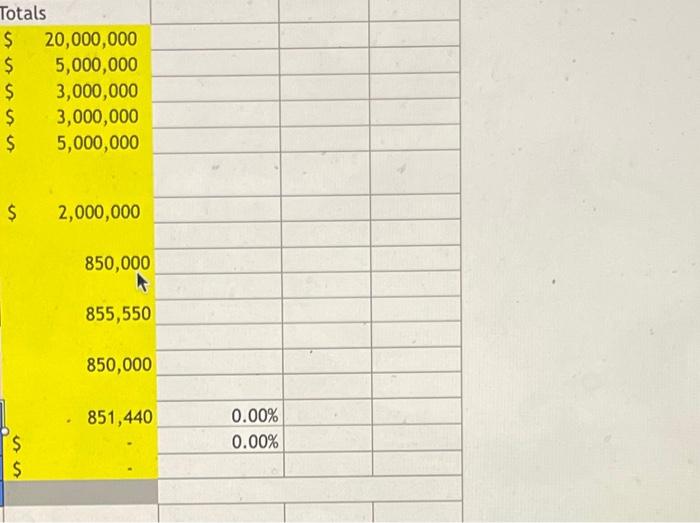

Instructions - Read Carefully. 100 of 125 points Branching from HW Problem 3-11 Base Case, we now add another activity, Compliance Test and Licensing. Notice our Discount Rate (i.e. Interest Rate) has changed. Complete the analysis in the Base Case, below. Review the gold column cells, upper left. Fill in all the blue cells. All Cells requiring calculations should have equations, not hard-coded values. (Use the power of Excell). The goal is to calculate the Net Present Value, NPV, in the gold cell, below. Instructions - Read Carefully. 100 of 125 points $ 5 5 5 $ 5 Development cost Plot testing Debug Ramp-up cost Advance marketing Marketing and support cost Compliance Test and Licente Unit production cost year Unit production cost year 2 Unit price year Unt price year 2 Sales and production volume 20,000,000 5.000.000 3,000,000 3.000.000 5.000.000 1.000.000 per year 1.000.000 655 545 820 650 250,000 per year Branching from HW Problem 3-11 Base Case, we now Notice our Discount Rate (i.e. Interest Rate) has char Complete the analysis in the Base Case, below. Review the gold column cells, upper left. Fill in all the blue cells. All Cells requiring calculations should have equations The goal is to calculate the Net Present Value, NPV, i yeart Salus and production Volume year 2 150,000 per year 7.00% Interest rate Period Number Year 1 1st Half 2nd Hall 1st Hall 2nd Hall 1st Hall 2nd Hall 1st Hall 2nd Development Plot testing Debug Ramp-up cost Advance marketing Compliance Test and License Marketing and support cost Production and Sales $ 5,000,000 5,000,000 $ 5 5,000,000 2,500,000 1,500,000 Development Plot testing Debug Ramp-up cost Advance marketing Comance Test and License Marketing and support cost Production Oly 5,000,000 2,500,000 1.500,000 3,000,000 5,000,000 $ S $ 500,000 $ 500,000 $ 500,000 5 125,000 385140.00 AVELAS BLADO --- 655 $ 125,655 LS Qty Unit Cost Period Cost Sales Oty Unit Price Period Sales Period Cash Flow Present Value of Period CFS Cumulative Earrings 125,000 8205 125 1445 Not Present Value 500,000 500,000 500.0005 500,0005 500,000 $ 500,000 500,000 500,000 $ 500,000 500,000 5 125.000 6555 125.655 125,000 6555 125,6555 75,000 5455 75.5455 75,000 5455 75.545 15 75,000 5255 75,525 15 75,000 525$ 75,5255 75,000 5255 75.5255 75,000 5255 75,5255 75,000 5255 75.525 75,000 525 75,525 Heade 75,000 75.000 125,000 8205 1251445 125,000 8205 125.1445 75,000 620 75 144 75,000 420 S 75 1445 75,000 62025 25.1445 75,000 6205 75.1445 75,000 620 75 1445 75,00 620 75.14 75.1445 75.144 Tac Table 18 Table Ou 54 st 50 Gridir 60 ANE ROY Totals $ 20,000,000 $ 5,000,000 $ 3,000,000 $ 3,000,000 $ $ 5,000,000 $ 2,000,000 850,000 855,550 850,000 851,440 0.00% 0.00% $ $ Instructions - Read Carefully. 100 of 125 points Branching from HW Problem 3-11 Base Case, we now add another activity, Compliance Test and Licensing. Notice our Discount Rate (i.e. Interest Rate) has changed. Complete the analysis in the Base Case, below. Review the gold column cells, upper left. Fill in all the blue cells. All Cells requiring calculations should have equations, not hard-coded values. (Use the power of Excell). The goal is to calculate the Net Present Value, NPV, in the gold cell, below. Instructions - Read Carefully. 100 of 125 points $ 5 5 5 $ 5 Development cost Plot testing Debug Ramp-up cost Advance marketing Marketing and support cost Compliance Test and Licente Unit production cost year Unit production cost year 2 Unit price year Unt price year 2 Sales and production volume 20,000,000 5.000.000 3,000,000 3.000.000 5.000.000 1.000.000 per year 1.000.000 655 545 820 650 250,000 per year Branching from HW Problem 3-11 Base Case, we now Notice our Discount Rate (i.e. Interest Rate) has char Complete the analysis in the Base Case, below. Review the gold column cells, upper left. Fill in all the blue cells. All Cells requiring calculations should have equations The goal is to calculate the Net Present Value, NPV, i yeart Salus and production Volume year 2 150,000 per year 7.00% Interest rate Period Number Year 1 1st Half 2nd Hall 1st Hall 2nd Hall 1st Hall 2nd Hall 1st Hall 2nd Development Plot testing Debug Ramp-up cost Advance marketing Compliance Test and License Marketing and support cost Production and Sales $ 5,000,000 5,000,000 $ 5 5,000,000 2,500,000 1,500,000 Development Plot testing Debug Ramp-up cost Advance marketing Comance Test and License Marketing and support cost Production Oly 5,000,000 2,500,000 1.500,000 3,000,000 5,000,000 $ S $ 500,000 $ 500,000 $ 500,000 5 125,000 385140.00 AVELAS BLADO --- 655 $ 125,655 LS Qty Unit Cost Period Cost Sales Oty Unit Price Period Sales Period Cash Flow Present Value of Period CFS Cumulative Earrings 125,000 8205 125 1445 Not Present Value 500,000 500,000 500.0005 500,0005 500,000 $ 500,000 500,000 500,000 $ 500,000 500,000 5 125.000 6555 125.655 125,000 6555 125,6555 75,000 5455 75.5455 75,000 5455 75.545 15 75,000 5255 75,525 15 75,000 525$ 75,5255 75,000 5255 75.5255 75,000 5255 75,5255 75,000 5255 75.525 75,000 525 75,525 Heade 75,000 75.000 125,000 8205 1251445 125,000 8205 125.1445 75,000 620 75 144 75,000 420 S 75 1445 75,000 62025 25.1445 75,000 6205 75.1445 75,000 620 75 1445 75,00 620 75.14 75.1445 75.144 Tac Table 18 Table Ou 54 st 50 Gridir 60 ANE ROY Totals $ 20,000,000 $ 5,000,000 $ 3,000,000 $ 3,000,000 $ $ 5,000,000 $ 2,000,000 850,000 855,550 850,000 851,440 0.00% 0.00% $ $