Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Instructions .Read the business s ethical issues in detail. the business scenario below and prepare a 3-5 page paper discussing lI OY araur maper must

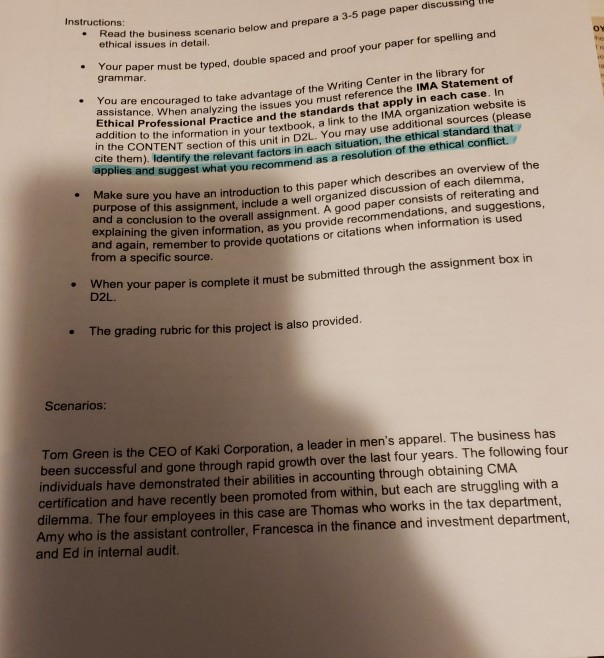

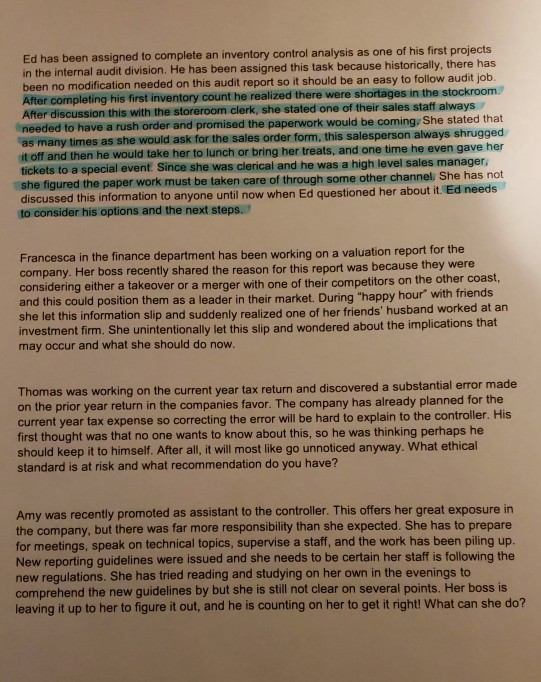

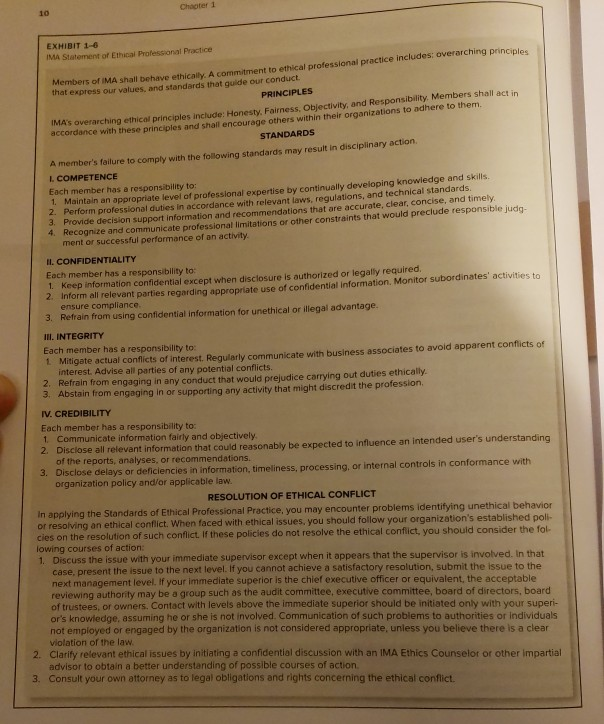

Instructions .Read the business s ethical issues in detail. the business scenario below and prepare a 3-5 page paper discussing lI OY araur maper must be typed, double spaced and proof your paper for spelling and grammar assisre encouraged to take advantage of the Writing Center in the library for rofessional Practice and the standards that apply in each case. In CONTENT section of this unit in D2L. You may use additional sources (please stance. When analyzing the issues you must reference ddition to the information in your textbook, a link to the IMA organization website is e lnem). Identify the relevant factors in each situation, the ethical standard that in the cite them). and suggest what you recommend as a resolution of the ethical conflict. assignment, include a well organized discussion of each dilemma n, remember to provide quotations or citations when information is used ake sure you have an introduction to this paper which describes an overview of the purpose of this . M ing the given information, as you provide recommendations, and suggestions a specific source. and explai a conclusion to the o verall assignment. A good paper consists of reiterating and and again, from . When your paper is complete it must be submitted through the assignment box in D2L. The grading rubric for this project is also provided. . Scenarios: Tom Green is the CEO of Kaki Corporation, a leader in men's apparel. The business has been successful and gone through rapid growth over the last four years. The following four individuals have demonstrated their abilities in accounting through obtaining CMA certification and have recently been promoted from within, but each are struggling with a dilemma. The four employees in this case are Thomas who works in the tax department, Amy who is the assistant controller, Francesca in the finance and investment department, and Ed in internal audit. Ed has been assigned to complete an inventory control analysis as one of his first projects in the internal audit division. He has been assigned this task because historically, there has no modification needed on this audit report so it should be an easy to follow audit job en After completing his first inventory count Aft needed to have a rush order he realized there were shortages in the stockroom. she stated one of their sales staff always er discussion this with the storeroom clerk, and promised the paperwork would be coming/ She stated that as many times as she would ask for the sales order form, this salesperson always shrugged it off and then he would take her to lunch or bring her treats, and one time he even gave her event. Since she was clerical and he was a high level sales manager paper work must be taken care of through some other channel She has not tickets to a special discussed this information to anyone until n to consider his options and the next steps ow when Ed questioned her about it. Ed needs in the finance department has been working on a valuation report for the company. Her boss recently shared the reason for this report was because they were considering either a takeover or a merger with one of their competitors on the other coast and this could position them as a leader in their market. During "happy hour with friends she let this in formation slip and suddenly realized one of her friends' husband worked at an nvestment firm. She unintentionally let this slip and wondered about the implications that may occur and what she should do novw g on the current year tax return and discovered a substantial error made on the prior year return in the companies favor. The company current year tax expense so correcting the error will be hard to explain to the controll first thought was that no one wants to know about this, so he was thinking perhaps he should keep it to himself. After all, it will most like go unnoticed anyway. What ethical standard is at risk and what recommendation do you have? has already planned for the Amy was recently promoted as assistant to the controller. This offers her great exposure in the company, but there was far more responsibility than she expected. She has to prepare for meetings, speak on technical topics, supervise a staff, and the work has been piling up New reporting guidelines were issued and she needs to be certain her staff is following the new regulations. She has tried reading and studying on her own in the evenings to comprehend the new guidelines by but she is still not clear on several points. Her boss is leaving it up to her to figure it out, and he is counting on her to get it right! What can she do? Instructions .Read the business s ethical issues in detail. the business scenario below and prepare a 3-5 page paper discussing lI OY araur maper must be typed, double spaced and proof your paper for spelling and grammar assisre encouraged to take advantage of the Writing Center in the library for rofessional Practice and the standards that apply in each case. In CONTENT section of this unit in D2L. You may use additional sources (please stance. When analyzing the issues you must reference ddition to the information in your textbook, a link to the IMA organization website is e lnem). Identify the relevant factors in each situation, the ethical standard that in the cite them). and suggest what you recommend as a resolution of the ethical conflict. assignment, include a well organized discussion of each dilemma n, remember to provide quotations or citations when information is used ake sure you have an introduction to this paper which describes an overview of the purpose of this . M ing the given information, as you provide recommendations, and suggestions a specific source. and explai a conclusion to the o verall assignment. A good paper consists of reiterating and and again, from . When your paper is complete it must be submitted through the assignment box in D2L. The grading rubric for this project is also provided. . Scenarios: Tom Green is the CEO of Kaki Corporation, a leader in men's apparel. The business has been successful and gone through rapid growth over the last four years. The following four individuals have demonstrated their abilities in accounting through obtaining CMA certification and have recently been promoted from within, but each are struggling with a dilemma. The four employees in this case are Thomas who works in the tax department, Amy who is the assistant controller, Francesca in the finance and investment department, and Ed in internal audit. Ed has been assigned to complete an inventory control analysis as one of his first projects in the internal audit division. He has been assigned this task because historically, there has no modification needed on this audit report so it should be an easy to follow audit job en After completing his first inventory count Aft needed to have a rush order he realized there were shortages in the stockroom. she stated one of their sales staff always er discussion this with the storeroom clerk, and promised the paperwork would be coming/ She stated that as many times as she would ask for the sales order form, this salesperson always shrugged it off and then he would take her to lunch or bring her treats, and one time he even gave her event. Since she was clerical and he was a high level sales manager paper work must be taken care of through some other channel She has not tickets to a special discussed this information to anyone until n to consider his options and the next steps ow when Ed questioned her about it. Ed needs in the finance department has been working on a valuation report for the company. Her boss recently shared the reason for this report was because they were considering either a takeover or a merger with one of their competitors on the other coast and this could position them as a leader in their market. During "happy hour with friends she let this in formation slip and suddenly realized one of her friends' husband worked at an nvestment firm. She unintentionally let this slip and wondered about the implications that may occur and what she should do novw g on the current year tax return and discovered a substantial error made on the prior year return in the companies favor. The company current year tax expense so correcting the error will be hard to explain to the controll first thought was that no one wants to know about this, so he was thinking perhaps he should keep it to himself. After all, it will most like go unnoticed anyway. What ethical standard is at risk and what recommendation do you have? has already planned for the Amy was recently promoted as assistant to the controller. This offers her great exposure in the company, but there was far more responsibility than she expected. She has to prepare for meetings, speak on technical topics, supervise a staff, and the work has been piling up New reporting guidelines were issued and she needs to be certain her staff is following the new regulations. She has tried reading and studying on her own in the evenings to comprehend the new guidelines by but she is still not clear on several points. Her boss is leaving it up to her to figure it out, and he is counting on her to get it right! What can she do

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started